Brief • 2 min Read

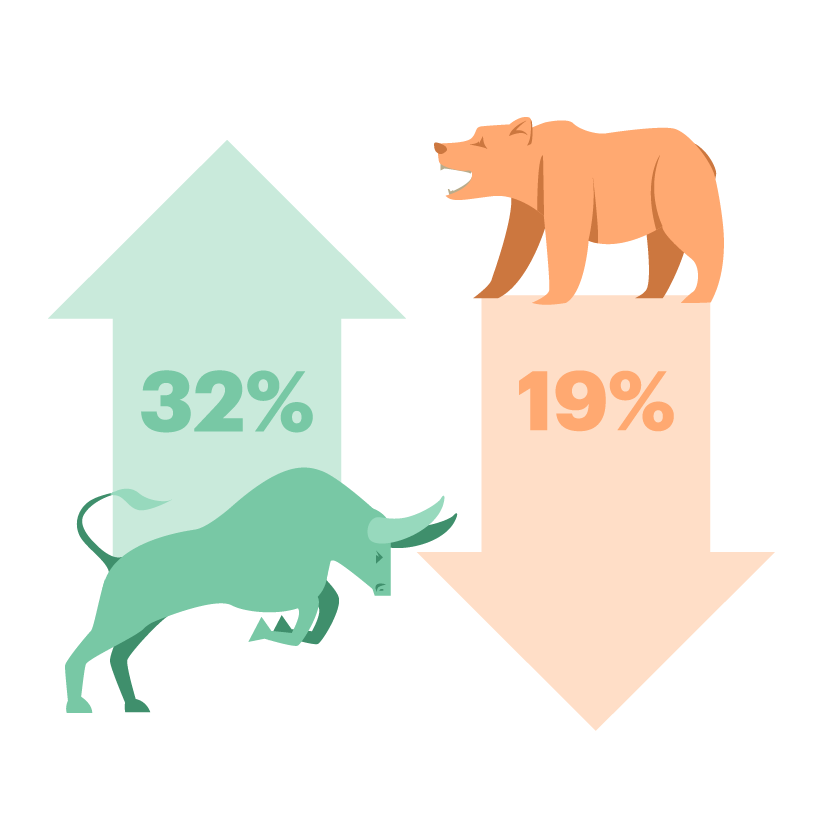

Although there is a lack of confidence in returns over the next 5 years, data shows that people are still feeling aggressive in investing in the stock market right now. 32% of people feel bullish saying that it is a good time to increase investments in the stock market (41% of men feel this way vs. 21% of women), whereas only 19% of people feel bearish saying that it is a good time to decrease investment in the stock market.

Age seems to play a factor here as middle-aged people seem to be the most aggressive with investments in the stock market right now. 67% of people between the ages of 35-44 agree that it is a good time to invest, while only 9% of people between 35-44 believe it is a bad time to invest. This trails off quite a bit with the next most aggressive age group (18-34 year-olds). Only 37% of this younger generation say it is a good time to invest, while 32% of them believe it is a good time to decrease investments.

In addition to being more bullish on the market, men seem to be more aggressive with investing than women across the board. A vast majority of men (92%) have individual equity investments as compared to only 67% of women. On the flip side, 82% of women have general checking or saving accounts as compared to only 69% of men. This falls right in line with men feeling much more confident in achieving their investment goals as compared to women. 32% of men are very confident they will achieve their investment goals, whereas only 4% of women are very confident in achieving these goals.

Risk-taking has long been a characterization of younger generations, and this holds true when it comes to being willing to take on more financial risk. 92% of these 18-34 year-olds have individual equity investments, but less than half (42%) have general checking or savings accounts.

Despite this, there is a general lack of confidence in returns on equity investments right now. Just over 4 in 10 of those with equity investments (41%) believe that their expected annual returns over the next 5 years will be negative, and just over half of those with equity investments (51%) believe returns will be <5%.

Methodology

This survey was fielded online from June 17 – 18, 2020, among a nationally representative sample of 200 U.S adults with financial assets or Investments in any of the following: Equity stocks, Individual bonds, commodity stocks, Mutual funds, ETFs, Fixed or Variable Annuities or IRA. The data was weighted to ensure results are projectable to appropriate U.S. populations.

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Download the Data

Get the full data tabs for this survey conducted online within the United States by The Harris Poll on behalf of Yahoo Finance between June 17 – 18, 2020, among a nationally representative sample of 200 U.S adults.

Download

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Download the Data

Get the full data tabs for this survey conducted online within the United States by The Harris Poll on behalf of Yahoo Finance between June 17 – 18, 2020, among a nationally representative sample of 200 U.S adults.

DownloadRelated Content