Brief • 3 min Read

On January 10, 2024, the United States Securities and Exchange Commission (SEC) approved the listing and trading of spot bitcoin exchange traded funds (ETFs). This allowed regulated exchanges, such as the New York Stock Exchange and Nasdaq, to facilitate the trade of investment funds that are tied to the current price of bitcoin. At the time of launch, 11 asset managers had been cleared to launch spot bitcoin ETFs.

Just like buying and selling more traditional stocks or mutual funds, this system allows investors to buy and sell bitcoin ETFs quickly and easily. Up to this point, cryptocurrency exchanges had served as the primary trading ground for all things bitcoin. Bitcoin ETFs offer investors an easier entry into the world of crypto. Investors can remain on the traditional exchanges, and trade more familiar products, while dipping a toe into the cryptocurrency space.

Lee Reiners, a fellow at the Duke Financial Economics Center, described the SEC approval this way to NPR: “You basically are creating an interstate freeway that’s connecting the crypto economy with the traditional financial system.” Even anticipation of the SEC’s approval had driven up the price of bitcoin to its highest level in two years – exceeding $45,000.

Want more information on trends within the crypto scace? Check out our Cryptocurrency: An Industry Snapshot report for insights and brand data.

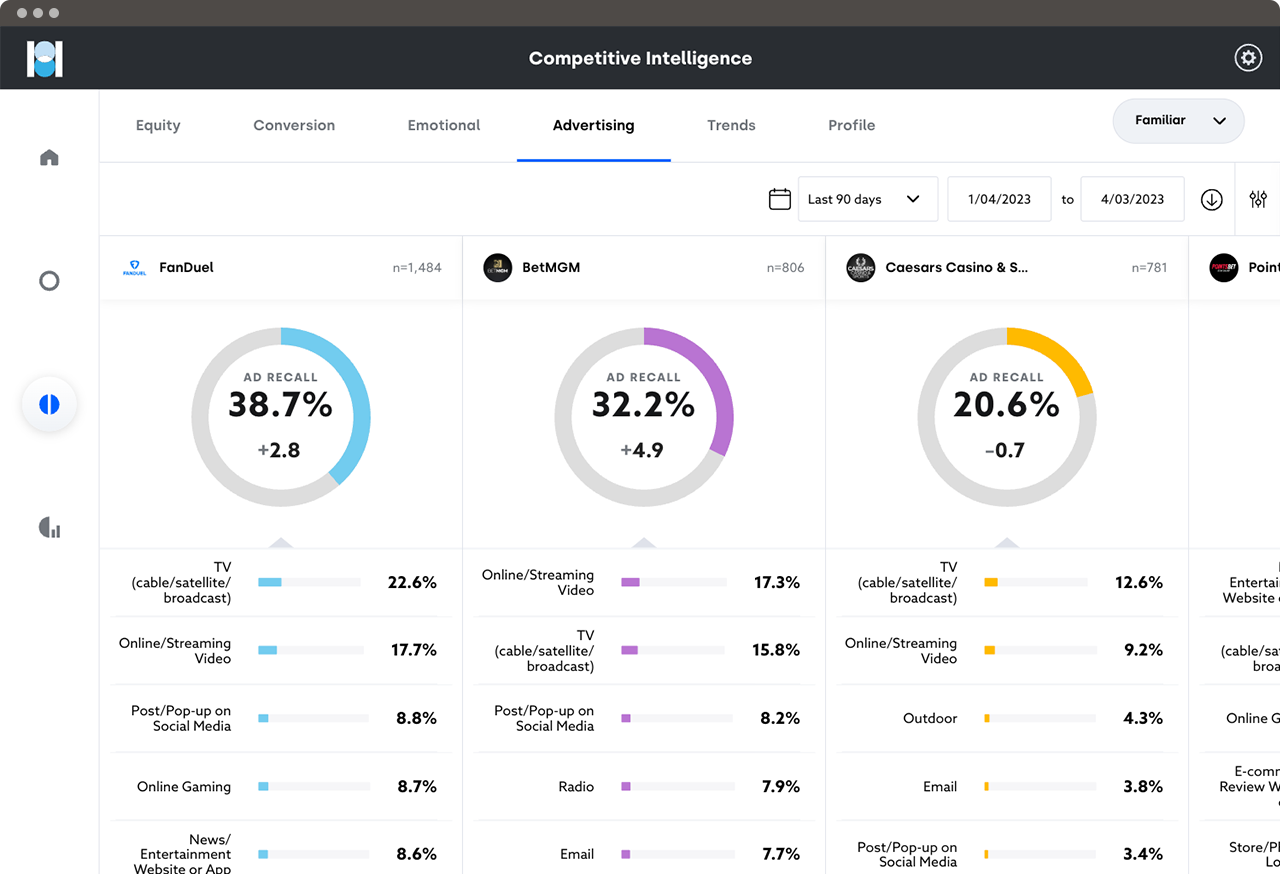

Using data from QuestBrand by The Harris Poll, we can see how the SEC’s approval of bitcoin ETFs impacted American’s overall trust in bitcoin. The percentage of US adults who describe bitcoin as “trustworthy” significantly increased (+4.9) from pre- (5.3) to post- (10.2) SEC announcement.

Consumers’ boost in trust is an important step up for crypto, which remains distrusted by a large segment of the population. While the SEC was careful to not endorse bitcoin when approving the trade of spot bitcoin EFTs, allowing bitcoin ETFs to trade on regulated exchanges seems to have still increased Americans’ trust in the cryptocurrency.

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Related Content