Brief • 3 min Read

Skechers took its first steps as a footwear company in 1992. Thirty-one years later, and the Skechers brand is still running hot!

In recent years, Skechers’ combined promise of high comfort and affordable pricing has successfully drawn casual footwear customers away from competitor brands, such as Adidas and Nike.

Skechers’ value proposition has especially resonated with consumers during this period of high inflation. The footwear brand has even started attracting more affluent consumers (those making over $100,000).

Want to read more about emerging apparel industry trends? Check out our Apparel & Fashion: An Industry Snapshot report for insights and brand rankings.

Historically, Skechers has been popular among older consumers (Baby Boomers and the Silent Generation), but the shoe brand is actively trying to boost its appeal with younger shoppers. Skechers has done this through strategic partnerships with popular celebrities like Doja Cat, Kim Kardashian, Demi Lovato, and Snoop Dogg.

The brand also recently launched a retro line of shoes featuring the Rolling Stones’ iconic tongue and lips logo. However, it is taking time to shake off consumers’ perception of Skechers as “old people shoes.”

Skechers’ Quarterly Sales Hit a New High

2023 has been a strong year for Skechers. Q1 marked the first time the company hit over $2 billion in quarterly sales. This was a 10% increase from Q1 sales in 2022.

By the end of 2023, Skechers predicts reaching $8 billion in sales, and they continue to see growth on the horizon. By 2026, the popular shoe brand hopes to see $10 billion in annual sales.

Skechers’ efforts are paying off. In June, Skechers made the Fortune 500 list for the first time. It is one of only four apparel brands that are ranked.

“It’s an incredible achievement for Skechers to make the Fortune 500 and be included on an elite list that features the top businesses in every industry. This is yet another milestone in our journey which validates our business model of delivering products that offer comfort, innovation, style and quality at a reasonable price. This first appearance illustrates the strength, dedication and contributions of the entire Skechers family worldwide, and we look forward to climbing up the list in the years to come.” – Michael Greenberg, President at Skechers

Momentum Soars in Q2

According to QuestBrand data, Skechers continued to gain momentum throughout Q2 after their strong first quarter. Momentum is a component of brand equity, and it reflects a brand’s market position and its ability to beat out competitors.

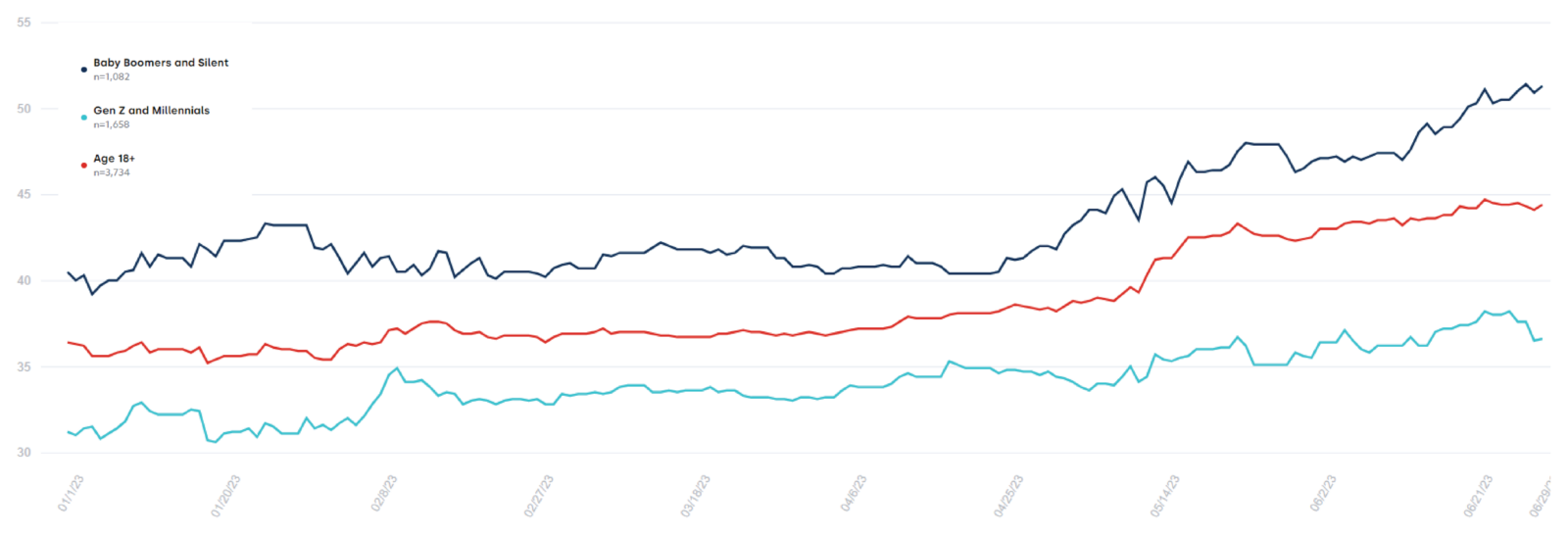

The graph below illustrates Skechers’ momentum throughout the first half of 2023 – broken out by the age of respondents.

Skechers Momentum Q1-Q2 2023 – Trended 12 Week Moving Average

QuestBrand. 1/1-23-6/30/23. Base: Baby Boomers + Silent Generation (dark blue), n=1,082. Base: Gen Z and Millennials (light blue), n=1,658.

You can see older consumers’ preference for Skechers reflected in the QuestBrand data. The top line (dark blue) captures older consumers’ perceived momentum of the Skechers brand (Baby Boomers and the Silent Generation), while the bottom line (light blue) shows responses from younger consumers (Gen Z adults and Millennials). The middle line (red) captures data from all US adults (ages 18+).

Across all three age groups, Skechers’ momentum significantly picks up in April 2023, and continues to rise throughout the end of June.

Significant Gains in Consumer Ad Recall

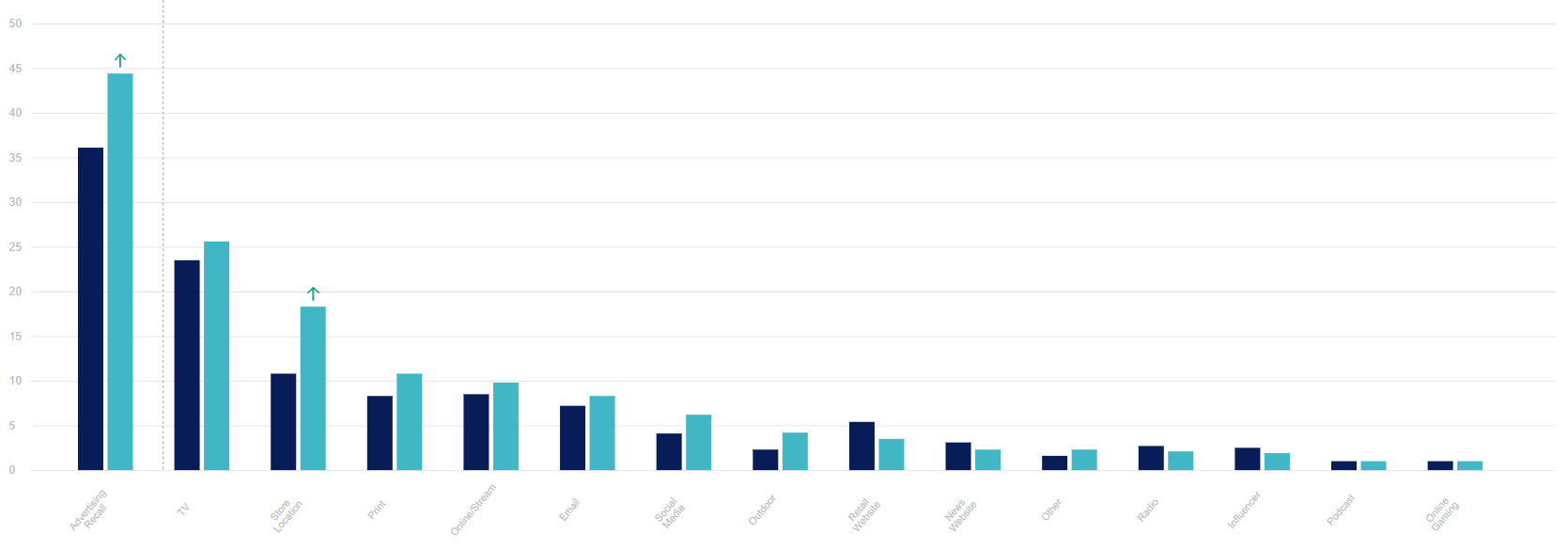

Skechers’ rise in momentum may have been positively impacted by the company’s strong marketing efforts in Q2. Among older consumers, we see ad recall jump (+8.3) from Q1 (36.1) to Q2 (44.4). Ad recall captures the percentage of consumers who remember interacting with a brand’s ad in the prior 30 days.

Skechers aims to keep their brand top of mind with memorable advertising. They employ an omni-channel marketing approach that targets shoppers across many advertising mediums, including the use of print, TV, radio, and digital advertising, influencers and celebrities.

Skechers partners with a diverse team of celebrities – including Martha Stewart, Mr. T, and Doja Cat – ensuring that their marketing appeals to a variety of consumers.

Skechers Advertising Recall Q1 v Q2 Among Older Consumers

QuestBrand. Base: Baby Boomers + Silent Generation. 1/1-23-3/31/23, n=707. 4/1/23-6/30/23, n=375.

If Skechers continues to grow in popularity with Gen Z adults and Millennials, we can expect their sales numbers to rise. We are excited to see how Skechers evolves in the years ahead, and we will hopefully watch them rise in rank on the Fortune 500 list.

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Related Content