Brief • 3 min Read

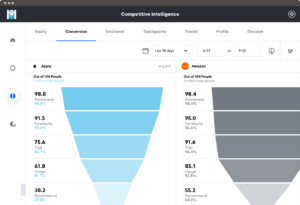

According to QuestBrand data, Chinese fast fashion startup SHEIN was the top apparel brand by brand equity growth from Q1 to Q2 2022. Their brand equity spike is hardly surprising. SHEIN already holds the largest share (28%) of the fast fashion market in the United States. In April 2022, SHEIN was valued at a whopping $100 billion dollars. This is the third highest valuation for any private company, only falling behind SpaceX and Byte-Dance. SHEIN’s valuation dwarfs the combined values of fast fashion rivals H&M and Zara, an impressive feat for a brand that was basically unknown to US consumers five years ago.

SHEIN’s growth stems from their unorthodox approaches to marketing and production. SHEIN focuses on promoting its brand through mid-tier social media influencers. To increase brand recognition and hype, the online-only apparel brand sends select influencers free hauls of SHEIN clothes to show off on Instagram, TikTok, and YouTube. This low-cost marketing tactic has made SHEIN the most talked about brand across social media.

Want to read more about emerging apparel industry trends? Check out our Apparel & Fashion: An Industry Snapshot report for insights and brand rankings.

To ensure that they do not waste money manufacturing styles that do not sell, SHEIN tests new items’ popularity with small batch production. They may only create a few hundred units of a new item to determine whether the item is worth mass-producing. On average, SHEIN adds 6,000 new styles to the website every day. This adds up. Over a 12-month span, SHEIN added 1.3 million items to its website. In contrast, competitor H&M added 25,000.

SHEIN’s product and marketing approaches seem to be paying off with younger consumers, many of whom appreciate the seemingly endless styles at budget-friendly prices. From Q1 to Q2 2022, SHEIN’s overall brand equity score (representing the overall value that consumers see in a brand) rose by 2.9. Notably, consumers thought more highly of the brand quality (+3.1) and were more willing to consider purchasing (+4.1) from SHEIN in the second quarter of the year.

Despite the brand’s growing popularity, SHEIN is not immune to controversy. They have faced negative press surrounding their environmental impact, employee working conditions, and intellectual property violations.

SHEIN’s long-term popularity remains uncertain. While they appear unstoppable, consumers report values that are at-odds with SHEIN’s brand proposition. Two-thirds (74%) of US adults report that they are willing to pay more for fashion items (clothing, accessories) if they last a long time, the antithesis of fast fashion items. Seventeen percent of overall consumers, but 27% of younger consumers (ages 18-34) report that they consider sustainability when they decide where to shop for fashion items. Unfortunately, fast fashion is known for its high environmental cost. While these value clashes have clearly not stopped SHEIN’s rise to the top of fast fashion, we will have to see if their brand equity growth continues in the years to come.

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Related Content