Brief • 3 min Read

While already in use before the pandemic, COVID-19 helped P2P payment systems gain popularity across a wider spectrum of US adults. As Americans tried to avoid spreading germs, consumers eschewed cash in favor of contactless payment options. After two-plus years of living with pandemic-era practices, P2P payment systems are here to stay…and they haven’t peaked in popularity yet.

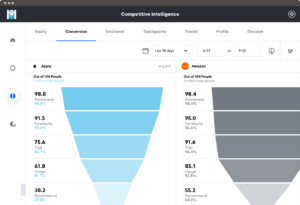

Based on QuestBrand data, P2P payment systems scored highly in both of this reports’ brand equity rankings. PayPal ranked second in the list of the top 10 financial services brands by brand equity score in Q3. P2P payment systems – Venmo and Cash App – also topped the list for brand equity growth from Q2 to Q3 2022.

Want to read more about trends in the financial services industry? Check out our Financial Services: An Industry Snapshot report for insights and brand rankings.

Brand equity values reflect the overall value consumers see in a brand at a particular moment in time. It is an average of four distinct components: consumer familiarity with the brand, perceived brand quality, purchase consideration, and perceived brand momentum.

Venmo and Cash App experienced similar patterns in their quarter over quarter growth. Both realized their highest increases in consideration, signaling that more consumers were considering using the payment systems in Q3 than in Q2, a positive sign for growth. Consumers also reported greater familiarity with each P2P brand, reflecting a greater understanding of and comfort with these payment methods as they become increasingly used across society.

PayPal’s second highest brand equity ranking (just behind Visa) is not a huge surprise. They are the most downloaded P2P payment app in the world. They received 56.6 million downloads in the first half of 2021. In comparison, CashApp received 27.2 million and Venmo received 15.1 million downloads. While popular in the US, Venmo is only the seventh most downloaded P2P payment app worldwide, but it is also only available for download in the United States.

These numbers reflect changing payment habits in America and across the world at large. Carrying wads of cash has long been on its way out, and the pandemic helped further this trend, pushing consumers to use P2P systems over cash, debit, and credit cards. Time will tell if these systems continue to gain new users or if a new payment system will disrupt P2P’s charge to the top.

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Related Content