Brief • 2 min Read

1: Food & Beverage: An Industry Snapshot

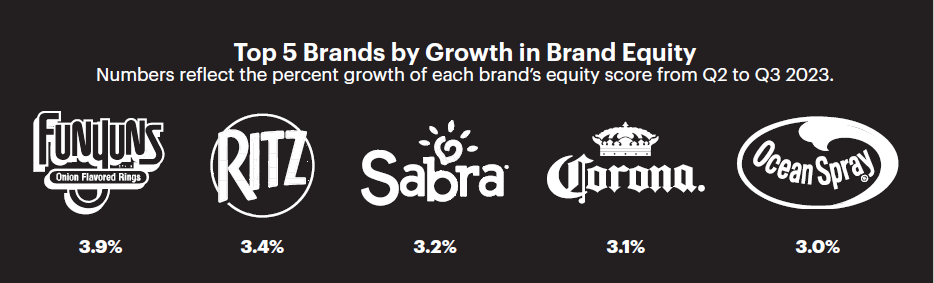

Our recent report on the state of the food and beverage industry explores consumers’ thoughts about mock-alcoholic beverages and caffeine consumption. Using QuestBrand data, we rank the leading food and beverage brands by brand equity and growth. Here are some key takeaways:

- More than half (55%) of young adults (ages 21-34) enjoy an alcoholic beverage at least once a week, but only 16% of young adults (ages 18-34) enjoy a mock-alcoholic beverage over this same period.

- More than half (57%) of young adults have decreased their alcohol consumption in the last year.

- Three in ten (27%) young adults who drink mock-alcoholic beverages are trying to limit their alcohol consumption. A quarter (25%) drink mock-alcoholic beverages due to nutritional considerations (e.g., sugar content, calories).

- The majority (58%) of US adults agree that they need caffeine to make it through the day.

- Four in 10 (41%) US adults think caffeine is bad for your health, and half (58%) try to limit their caffeine intake.

2: The Twitter Rebrand: 3 Demographic Trends Marketers Should Know – AdAge Op-Ed

In a recent op-ed for AdAge, Harris Poll co-CEO Will Johnson explores consumer sentiment towards Twitter’s recent rebrand to X and the launch of its competitor Threads. Here are a few key points from the survey:

- A failing grade: Less than a quarter (23%) of US adults aware of Twitter’s rebrand to X liked the rebrand.

- Will ‘X’ catch on? Seven in 10 (69%) platform account holders still call the platform Twitter rather than X.

- Millennials’ interest is peaked: Millennials are the only generation whose self-reported Twitter usage increased after the platform’s rebrand.

- Friendly competition: Threads users have a more favorable view of Twitter than the general public – 42% of Threads users like the Twitter rebrand.

- Battle of the sexes: Almost a third (28%) of men, but only 17% of women, approve of Twitter’s rebrand.

Takeaway: “Twitter’s future is still uncertain, though it so far seems clear that neither Threads nor the rebrand to X will kill it at this time. Twitter remains largely what it always has been in the eyes of its users: positive in some ways and negative in others. Can advertisers find value in that? Probably.” – Will Johnson

3: White Claw Gains Momentum Throughout Festival Season – Brand Story

White Claw is the top hard seltzer brand by sales volume with 45% market share. Despite its lead, White Claw embraces in-person event marketing to remain top of mind with consumers.

By the end of 2023, the popular seltzer brand will have attended more than 200 live events, including movie and music festivals. Using QuestBrand data, we tracked how consumers’ White Claw purchase consideration and usage increased as festival season kicked into full gear.

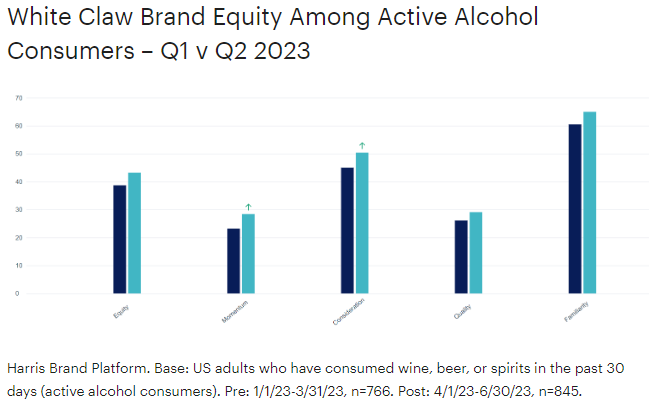

- The graph below compares White Claw’s brand equity data among active alcohol consumers (US adults who report consuming wine, beer, or spirits within the last 30 days) from Q1 to Q2 2023.

- Among this group, purchase consideration (+5.4) and brand momentum (+5.2) significantly rose from Q1 to Q2.

- This trend holds true when we evaluate consumers’ self-reported White Claw usage (consumption) throughout the first half of 2023.

- Active alcohol consumers’ reported White Claw usage stood at 34.7 at the beginning of January. This number rose (+6.2) and peaked in June at 40.9.

Want to know more about White Claw’s successful engagement strategy? Read the full brand story now.

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Related Content