Brief • 3 min Read

White Claw is the top hard seltzer brand by sales volume with 45% market share. Its closest competitor, Truly, holds 17.4% market share. Despite its lead, White Claw works hard to remain top of mind with consumers. Often, White Claw relies on in-person event marketing to engage with fans through the White Claw Shore Club.

“As a brand born in culture, White Claw looks for these key cultural touchpoints as a way to further connect with fans, placing emphasis on music, design, and fashion.” – Kevin Hurd, Senior Manager – National Partnerships for White Claw Hard Seltzer

By the end of 2023, the popular seltzer brand will have attended more than 200 events – music festivals, movie festivals, and other popular events. In the first half of the year, this included SXSW, the Sundance Film Festival, and the Kentucky Derby.

White Claw generated buzz for the White Claw Shore Club through its website and social media accounts – like this Instagram post from White Claw’s Derby activation.

Want to read more about emerging food and beverage industry trends? Check out our Food & Beverage: An Industry Snapshot report for insights and brand rankings.

White Claw’s Purchase Consideration and Momentum Climbs

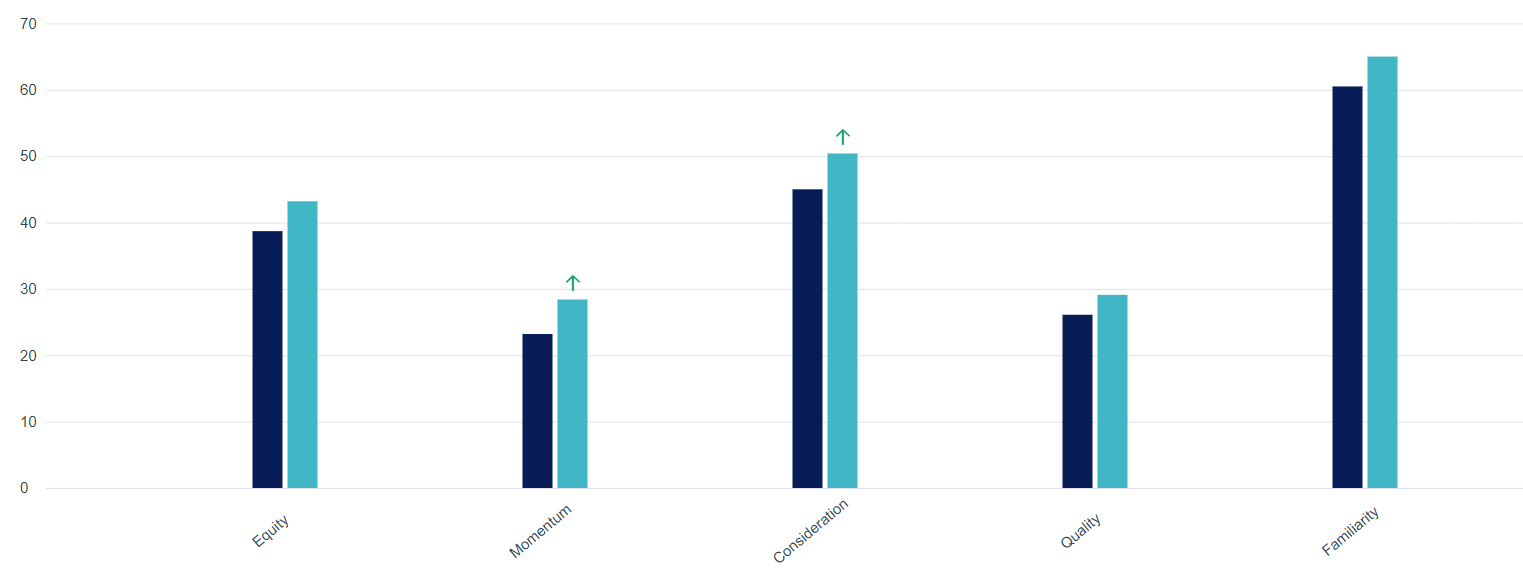

Using QuestBrand data, we tracked White Claw’s brand equity and sales conversion funnel data through the first half of 2023.

Brand equity measures the value consumers see in a brand at a particular moment of time. It is an average of four components: brand familiarity, perceived quality, purchase consideration, and perceived momentum.

The graph below compares White Claw’s brand equity data among active alcohol consumers (US adults who report consuming wine, beer, or spirits within the last 30 days) from Q1 to Q2 2023.

White Claw Brand Equity Among Active Alcohol Consumers – Q1 v Q2 2023

QuestBrand. Base: US adults who have consumed wine, beer, or spirits in the past 30 days (active alcohol consumers). Pre: 1/1/23-3/31/23, n=766. Post: 4/1/23-6/30/23, n=845.

Among this group, purchase consideration (+5.4) and brand momentum (+5.2) significantly rose from Q1 to Q2. This indicates that adults who typically consume alcoholic beverages were more likely to consider purchasing White Claw hard seltzer in Q2 than they had been during the first quarter of the year.

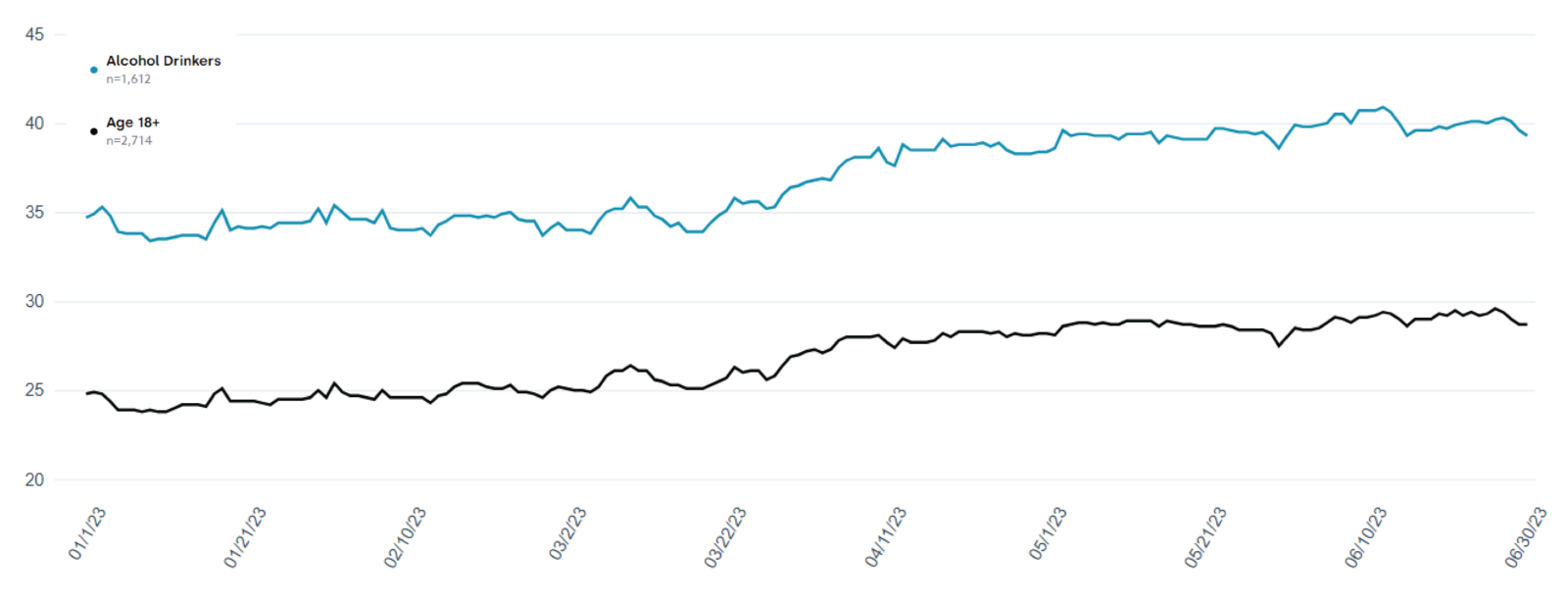

This trend holds true when we evaluate consumers’ self-reported White Claw usage (consumption) throughout the first half of 2023. The trendline below breaks out reported White Claw usage between overall US adults (black), and active alcohol drinkers (blue) in the first six months of the year.

White Claw Usage Jan-June 2023 – 12 Week Moving Average

QuestBrand. 1/1/23-6/30/23. Base: General population of US adults (black), n=2,714. Base: US adults who have consumed wine, beer, or spirits in the past 30 days (active alcohol drinkers – blue), n=1,612.

QuestBrand. 1/1/23-6/30/23. Base: General population of US adults (black), n=2,714. Base: US adults who have consumed wine, beer, or spirits in the past 30 days (active alcohol drinkers – blue), n=1,612.

While reported usage climbs throughout Q1 and Q2 for both groups of consumers, reported usage among active alcohol drinkers is predictably higher. Active alcohol consumers’ reported White Claw usage stood at 34.7 at the beginning of January. This number rose (+6.2) and peaked in June at 40.9.

The QuestBrand data reflects that consumers’ White Claw consumption increased as festival season kicked into full gear. While seasonality plays a part in the increased seltzer consumption, White Claw has been on a mission to become the “festival drink of choice.”

By attending over 200 live events this year, the brand has actively pursued this goal. They are continually interacting with their target consumers in a fun and playful atmosphere. White Claw’s steady increase in reported usage suggests that this marketing approach may be paying off.

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Related Content