Brief • 2 min Read

Concerts, comedy acts, and other in-person events transitioned to virtual platforms as the world shut down due to the COVID-19 pandemic. Instead of packing into event halls, Americans streamed events from the comfort of their couches.

While 76% of US adults feel that they get more out of in-person rather than virtual events, recent findings from a Harris Poll survey found some significant benefits of the virtual experience that could outlive the pandemic. Once safety is no longer an issue, would Americans still want the option of virtual attendance?

Virtual options expand event access

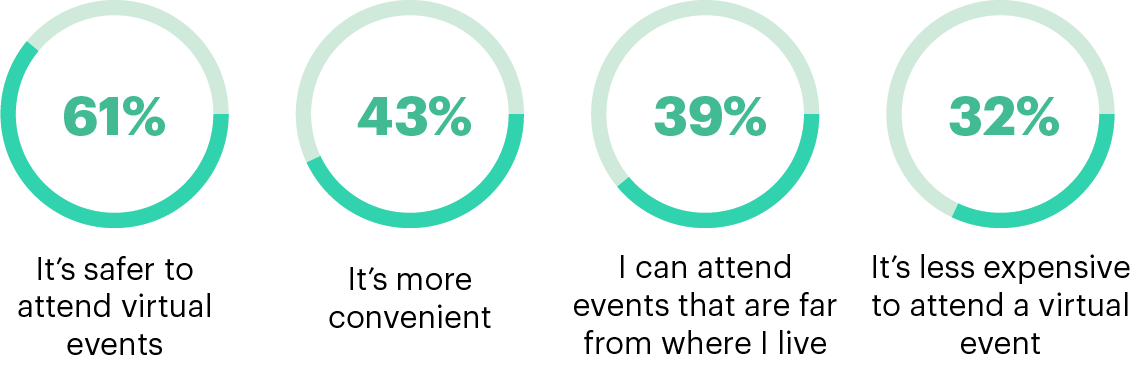

When asked why they would rather attend a virtual event, most respondents (61%) pointed to safety concerns. However, attendees also appreciated the accessibility of virtual events. Forty-three percent enjoyed the convenience, and 39% welcomed the ability to attend events taking place far from home. Almost a third (32%) of people who said that they would rather attend a virtual event cited the reduced expense.

Continuing to provide virtual event options post-COVID could expand attendance to untapped audiences. Virtual events allow rural and suburban communities the opportunity to access the cultural aspects of city life, without the burden of travelling to the nearest big city. Lower event costs also allow budget-conscious Americans the chance to attend events that they might otherwise have been unable to afford.

Why Would You Prefer to Attend a Virtual Event?

Base: U.S. adults that would rather attend a virtual event than an in-person one now. (n=562)

Despite the benefits of virtual, interest in live events remains healthy

While attendees appreciate some of the benefits of virtual events, virtual options do not threaten to overtake in-person entertainment. Even with the threat of COVID, more adults (52%) attended at least one in-person event in the last three months than attended a virtual public event (38%). This occurred even though more than half of US adults (54%) say they do not think that it is currently safe to attend in-person events.

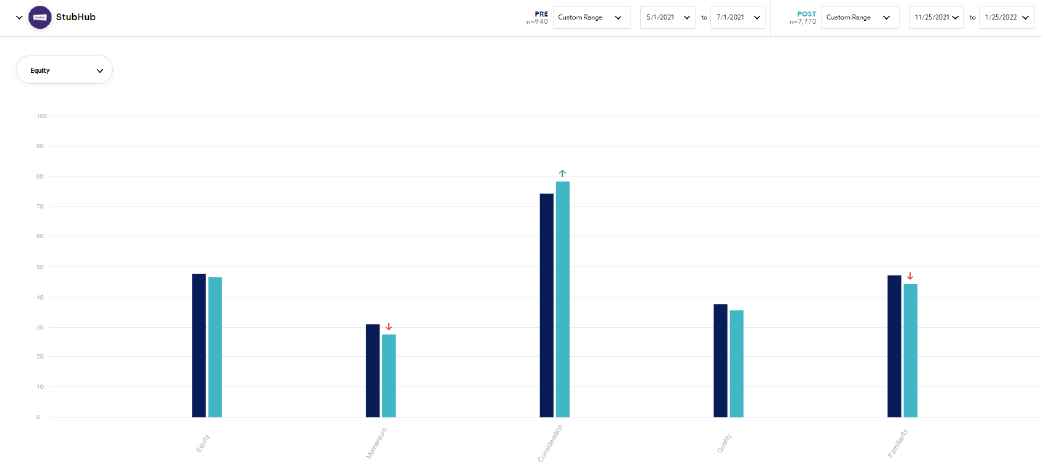

The brand health of live event ticket companies has also remained strong, despite spiking COVID fears during the Omicron variant surge. Using brand equity data taken from QuestBrand, we compared the brand equity scores of live event ticket exchange company StubHub from pre-Omicron surge (May 1, 2021 – July 1, 2021) to mid-Omicron surge (Nov 25, 2021 – Jan 25, 2022) to examine whether the fear of attending live events negatively impacted consumer brand perception.

Comparing StubHub’s brand equity scores pre- and mid-surge, we see a slight drop in the brand’s momentum (from 31 to 27.6). However, StubHub still saw a four-point increase in consumer consideration (from 74.3 to 78.3). The brand’s lift in consideration signals that consumers still find StubHub’s services relevant and capable of meeting their needs, despite consumers’ recent hesitancy of attending large public events.

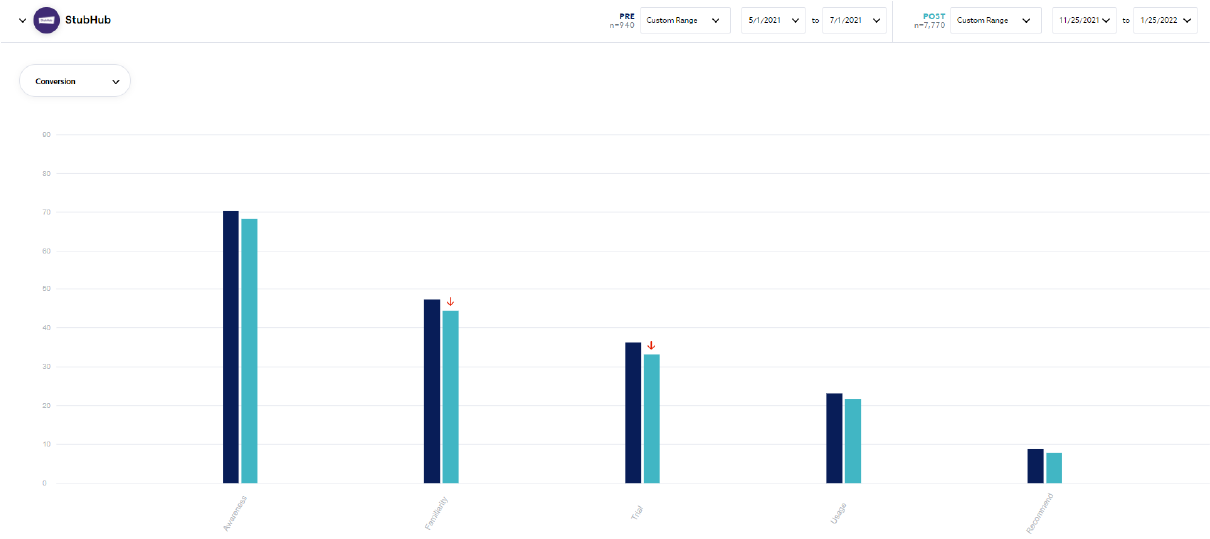

Examining StubHub’s sales conversion funnel pre- and mid- Omicron surge, we see a dip in their familiarity (47.2 to 44.3) and trial (36.2 to 33.1) scores. These decreases could reflect consumers’ disinterest in researching and pursuing in-person events at the current time. As the Omicron surge dies down, we may see StubHub’s momentum, familiarity, and trial scores tick back upwards as consumers regain enthusiasm for in-person events and spend more time researching their ticket options.

Where does this leave virtual event options?

While more Americans prefer the in-person experience, virtual events could still play an important role in the future of the entertainment industry. Companies hosting live events may want to consider capturing an expanded audience by offering both live and virtual ticket options. Attendees could choose to attend in-person or virtually based on their location, desire for convenience, and price sensitivity, increasing event engagement and revenue potential in the process.

Methodology

This survey was conducted online within the United States by The Harris Poll during January 14-19, 2022, among 1,060 US adults ages 18 and older. This online survey is not based on a probability sample and therefore no estimate of theoretical sampling error can be calculated. Figures for age, sex, race/ethnicity, education, region, and household income were weighted where necessary to bring them into line with their actual proportions in the population. Propensity score weighting was used to adjust for respondents’ propensity to be online. For more information, please contact Madelyn Franz or Andrew Laningham.

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Download the Data

Get the full data tabs for this survey conducted online within the United States by The Harris Poll between January 14-19, 2022, among 1,060 U.S. adults ages 18 and older.

Download

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Download the Data

Get the full data tabs for this survey conducted online within the United States by The Harris Poll between January 14-19, 2022, among 1,060 U.S. adults ages 18 and older.

DownloadRelated Content