Brief • 2 min Read

1: Retail & Ecommerce: An Industry Snapshot

Our recent report on the state of the retail industry explores consumers’ thoughts about customer loyalty programs and subscription-based services. Using QuestBrand data, we rank the leading retail and ecommerce brands by brand equity and growth. Here are some key takeaways:

- Eight in 10 (83%) loyalty program members agree that they are more likely to shop at a store when they are a member of its customer loyalty program.

- More than half (56%) of loyalty program members agree that they have spent more at a business than they normally would to earn rewards through the membership program.

- Less than half (40%) of US adults do not subscribe to any form of subscription company (e.g., Stitch Fix, Hello Fresh, Bark Box).

- Three-quarters (73%) of US adults with a subscription agree that receiving items or services through a subscription is more convenient than traditional shopping methods.

- Six in 10 (61%) subscribers agree that they often buy items or services from brands that they initially found out about through online subscription companies.

2: Consumers Embrace Livestream Shopping – Case Study

The online social marketplace, Poshmark, serves as a platform for shopping enthusiasts to sell and purchase clothing, accessories, home goods, electronics, and other merchandise. In April 2023, Poshmark launched Posh Shows, a new livestream shopping feature.

- Posh Shows quickly gained popularity after their spring debut. Poshmark now hosts more than 100,000 Posh Shows every month.

- Posh Shows are highly dynamic auction-style events during which sellers interact with their online audience, respond to comments, and answer questions about the products.

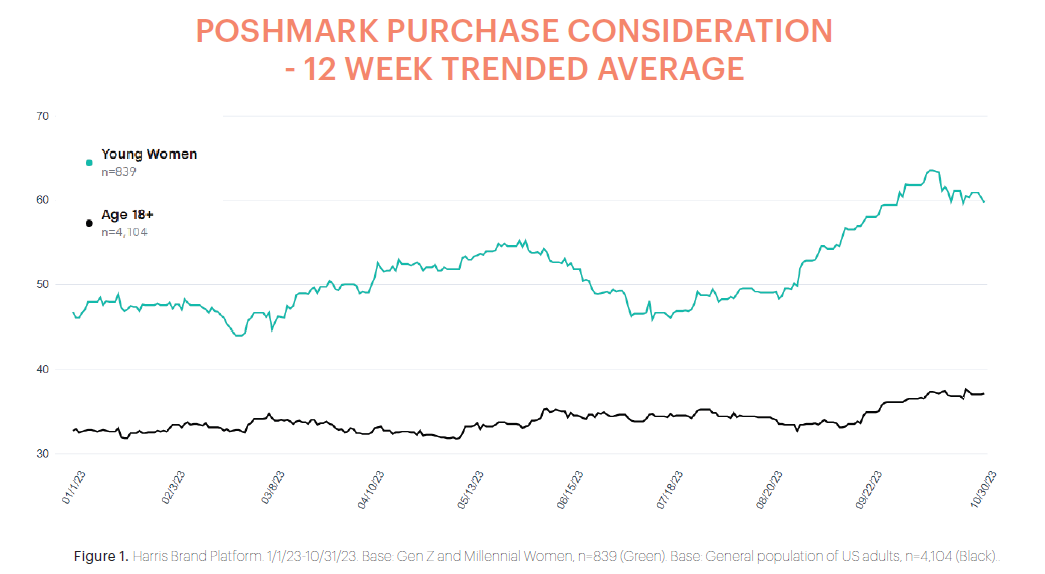

- According to QuestBrand data, Poshmark experienced significant brand equity gains after their spring launch of Posh Shows. This is especially apparent among young adult women (Gen Z and Millennials).

- The graph below tracks consumers’ purchase consideration from the start of 2023 through the end of October. From this data, we can see that young women were significantly more likely (+14.3) to consider purchasing from Poshmark at the end of October (61.0) than they had been at the beginning of January (46.7).

Takeaway: “We saw a huge gap in live commerce in the U.S., and the need for a platform that could help anyone be successful with live selling by making it incredibly simple and fun. The community reception has blown us away, and I’m excited for what’s ahead as we make Poshmark the number one place to shop and sell live.” – Tracy Sun, Poshmark Cofounder and SVP Seller Experience

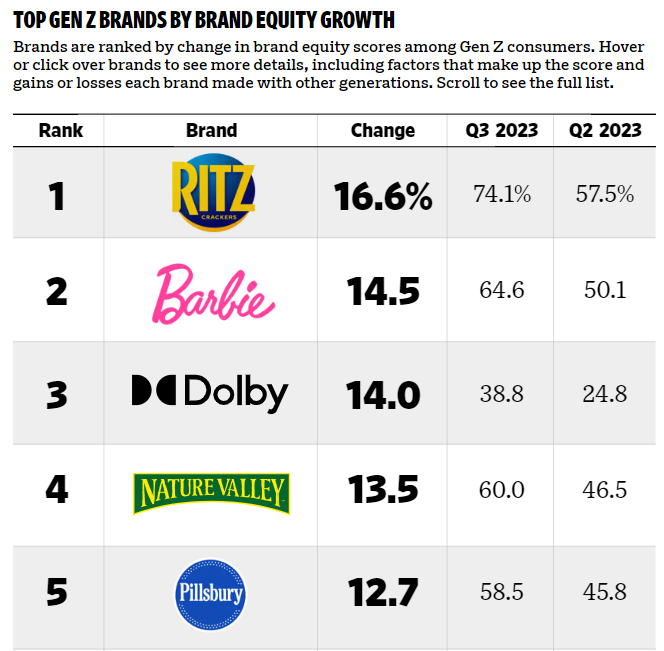

3: 20 Brands Catching Gen Z’s Attention – AdAge-Harris Poll

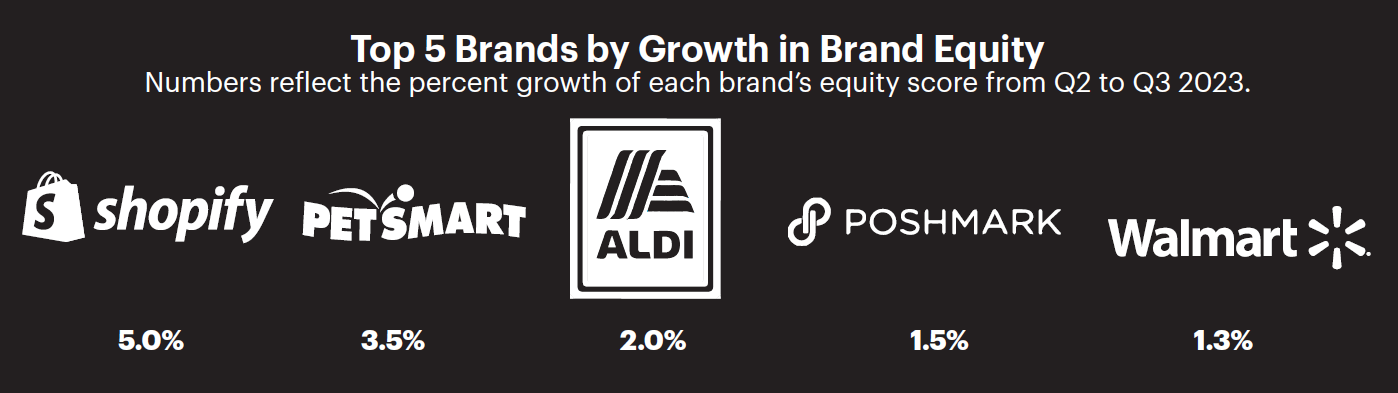

A recent AdAge-Harris Poll uses QuestBrand data to rank the top 20 brands by quarter-over-quarter brand equity growth among Gen Z adults. The top five growth brands from Q2 to Q3 2023 are listed below.

“While Ritz Crackers and Barbie are both already ubiquitous as brands in the United States, both enjoyed massive increases in brand momentum this past quarter—amid the Barbie movie craze and Ritz’s summer ad campaigns. Ritz’s relative jump in both familiarity and quality in the eyes of Gen Z are what earned it the top spot in this quarter’s rankings.” – Harris Poll Co-CEO Will Johnson

Click here to check out all top 20 brands, and for a look at how these brands have successfully connected with Gen Z.

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Related Content