Brief • 2 min Read

1. Food & Beverage: An Industry Snapshot

Our recent report on the state of the food and beverage industry explores consumer sentiment towards CBD-infused products, plant-based alternatives, and popular vodka brands. Using QuestBrand data, we rank the leading food and beverage brands by brand equity and growth. Here are some key takeaways:

- More than half of US adults think CBD products are safe to use (66%) and that there are too many restrictions placed on CBD (53%).

- Millennials have tried CBD-infused candies (44%), snacks (27%), prepared foods (22%), alcoholic drinks (14%), and non-alcoholic drinks (12%).

- Only 15% of US adults follow a plant-based diet, but 47% have tried a plant-based meat alternative.

- More than one-third (36%) of US adults who have tried a plant-based alternative have done so because they think it is healthier than the animal product.

Download our report for a closer look at how US consumers feel about CBD products, plant-based alternatives, and more. Understanding consumer sentiment is essential to developing and effectively marketing food and beverage products.

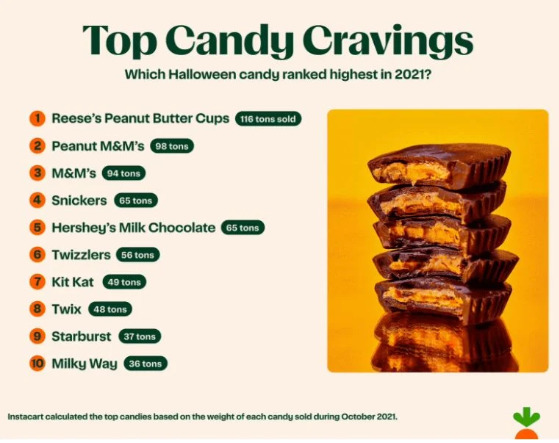

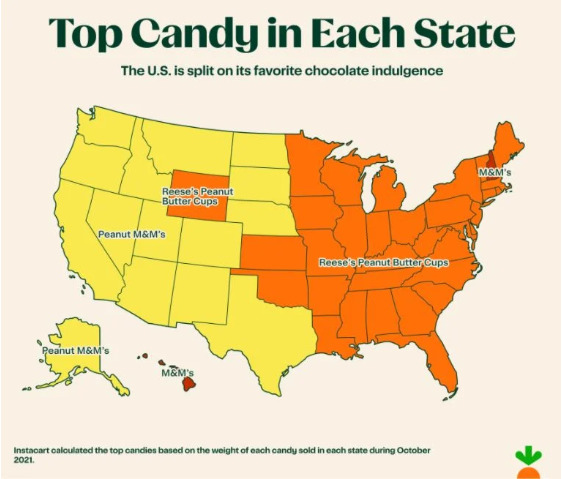

2. Trick Or Treat! What Sugary Treats will Appear on Candy’s Biggest Night?

In a spooktacular Harris Poll study on behalf of Instacart, we measured Americans’ Halloween candy habits and preferences ahead of this year’s nationwide sugar coma:

- Eight in ten (82%) Americans purchase Halloween candy, with Reese’s Peanut Butter Cups ranking as the top candy sold in 2021.

- Location, location, location…determines a candy’s popularity. The West goes crazy for Peanut M&Ms, while East coasters can’t say no to Reece’s Peanut Butter Cups.

- While most consumers (at least somewhat) think of the costumed kids, 27% report that they are more likely to take their own candy preferences into account when purchasing Halloween candy.

- Keep riding that sugar high: 62% of Americans purchase post-Halloween sale candy.

Want more sweet insights? Discover the most valuable Halloween candy (according to children) and what they are willing to trade to acquire their favorites in our Candy Index report.

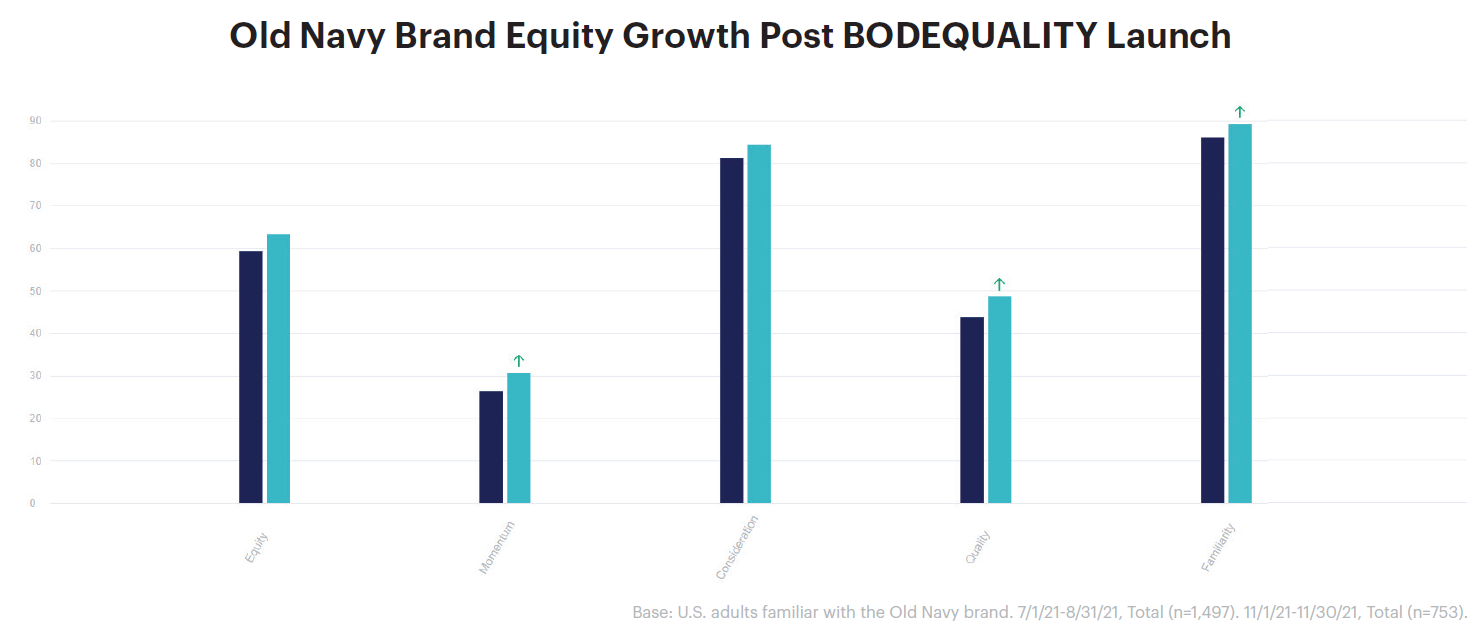

3. A Size-Inclusive Rollout Shrinks Earnings, but Not Brand Equity

In August 2021, Old Navy launched BODEQUALITY, a campaign that expanded their clothing line to serve women sizes 00-30. Inventory mismanagement resulted in financial losses; however, QuestBrand data shows that this “failure” comes with a silver lining:

- BODEQUALITY departed from the traditional women’s clothing market, with apparel specifically designed for curvy women and a strategy focused on size inclusivity.

- The right idea…Consumers familiar with the Old Navy brand appreciated BODEQUALITY’s mission, and the retailer’s brand equity hit a November high.

- …The wrong execution: Inventory mismanagement, and supply chain issues, resulted in stores overwhelmed with surpluses of the largest and smallest sizes, and a lack of their most popular mid-range sizes.

Download our case study to discover how consumers responded to Old Navy’s BODEQUALITY campaign, and how this “failure” also did the brand some good.

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Related Content