Brief • 3 min Read

Close your eyes and picture the average Goldfish consumer. What do they look like? Are they about three feet tall, 45 pounds…and five years old?

While primarily considered a children’s snack, households with children only make up half of Goldfish consumers. Adults without children make up the other half of regular Goldfish buyers.

Pepperidge Farm Goldfish crackers were first launched in the United States in 1962 as a bar snack for adults. It was not until the 1990s that Goldfish were marketed as a children’s snack. After a few decades of targeting households with children, Goldfish realized that they were ignoring the other half of their consumer base – childless adults.

Over the past two years, the brand has effectively engaged young adult consumers, launching new flavors and marketing campaigns that appeal to Gen Z and Millennial adults.

They seem to be doing something right. Goldfish consumption was up 8% for the quarter ending May 2022 from the previous year, and up an impressive 18% from the same quarter three-years prior.

Want to read more about food and beverage trends? Check out our Food & Beverage: An Industry Snapshot report for insights and brand rankings.

Nostalgic Snacks with Elevated Flavor

“Nostalgia has and continues to be huge with snacking and providing a sense of comfort, especially the past two years” – Janda Lukin, Chief Marketing Officer at Campbell Snacks (parent company of Goldfish).

To entice their adult consumers, Goldfish released new products and flavors that appeased consumers’ nostalgia for their favorite childhood snack while simultaneously appealing to a more mature palate.

In May 2022, Pepperidge Farm released Goldfish Mega Bites, a larger fish cracker in two bold flavors: Sharp Cheddar and Cheddar Jalapeño. They have also released a series of limited-time spicy flavors, including Frank’s RedHot (released May 2021), Jalapeño Popper (September 2021), and Old Bay (May 2022).

The Old Bay flavor garnered more than 1 billion impressions within the first 48 hours of launch, and sold out on Shop McCormick within just 9 hours. When Goldfish launched their Jalapeño Popper flavor, they partnered with clothing brand JNCO who released a Jalapeño Popper/90s-inspired retro jean. This heavily appealed to both Millennials’ nostalgia for the fashion of their youth, and Gen Z’s infatuation with 90s-style clothing.

Taking it to Social Media

Returning to their bar snack roots, Goldfish geared social media content to young adults with alcoholic beverage and Goldfish pairings. In December, 2021, they suggested enjoying Vanilla Cupcake Goldfish with an espresso martini, or Parmesan Goldfish with an IPA beer.

The fish-shaped cracker also embraced popular social media platform TikTok to reach young adults where they spend their free time. In 2021, they created #GoForTheHandful challenge that encouraged consumers to see how many Goldfish they could hold in a single hand. Goldfish partnered with NBA stars for the campaign, including Dallas Mavericks center Boban Marjanović, who can palm an astonishing 301 crackers. Marjanović’s video received more than 31 million views, and the #GoForTheHandful challenge generated more than 9 billion views on TikTok.

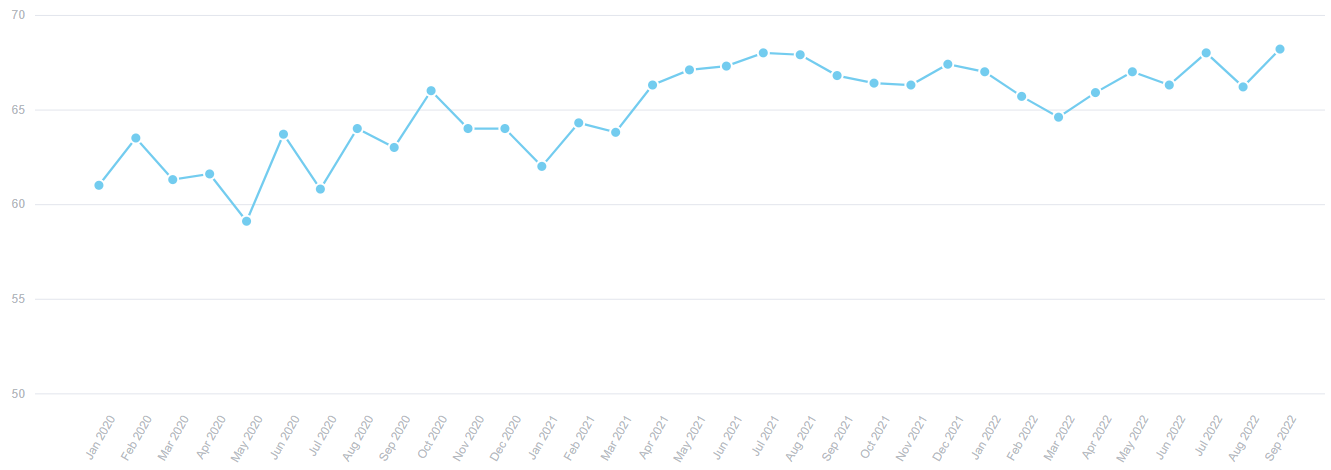

When we look at the trajectory of Goldfish’s QuestBrand brand equity data (among US adults familiar with the Goldfish brand) from early 2020 through September 2022, we see that the #GoForTheHandful challenge made a significant impact. Goldfish’s brand equity begins to rise in May 2021 when the challenge launched, and remains elevated even after the campaign ended.

Goldfish Brand Equity Jan 2020 – Sept 2022

QuestBrand. Base: US adults familiar with the Goldfish brand. 1/1/20-9/30/22, n=25,341.

Strengthening Young Adults’ Perception of the Goldfish Brand

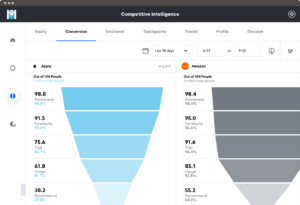

When we compare Goldfish’s brand equity (the overall value that consumers see in a brand) among Gen Z adults and Millennials from 2020 to 2022, we see some notable upticks among its four components (familiarity, quality, consideration, and momentum).

Goldfish Brand Equity 2020 vs. 2022, Among Gen Z and Millennial Adults

QuestBrand. Base: Gen Z and Millennial adults familiar with the Goldfish brand. 1/1/20-12/31/20, n=3,469. 1/1/22-9/30/22, n=2,615.

While consumer familiarity with the brand remained relatively constant (+0.7), Goldfish experienced a significant lift in consumers’ perception of the brand quality (+5.4). Consumers may perceive a higher product quality due to Goldfish’s creative flavor expansion, and their more established social media presence that caters to young adults.

Goldfish crackers also saw an increase in purchase consideration (+2.1) and perceived brand momentum (+2.6) among young adults. This signals consumer enthusiasm for the direction Goldfish is heading, and foreshadows that Goldfish could continue to see strong sales from this demographic in the upcoming quarter.

By finally turning their marketing focus on Gen Z and Millennials, Goldfish has ignited enthusiasm among this consumer base and strengthened consumer sentiment towards this classic snack brand.

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Related Content