Brief • 2 min Read

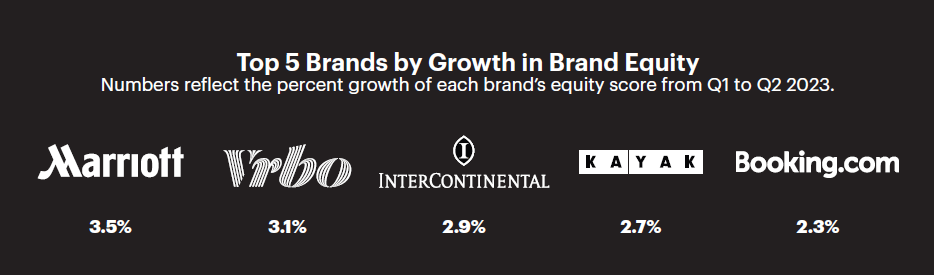

1: Travel: An Industry Snapshot

Our recent report on the state of the travel industry explores consumer sentiment towards trip planning and airline travel. Using QuestBrand data, we rank the leading travel and hospitality brands by brand equity and growth. Here are some key takeaways:

- Only a small number of Americans (16%) prioritize travel more highly now than they did pre-pandemic.

- Americans who take at least one personal trip a year most often consider cost (66%) when selecting a travel destination.

- A quarter (25%) of US adults prefer booking with the same airline each time they fly.

- Of those with a preferred carrier, ticket cost (53%) is the number one reason these travelers favor a specific airline over another.

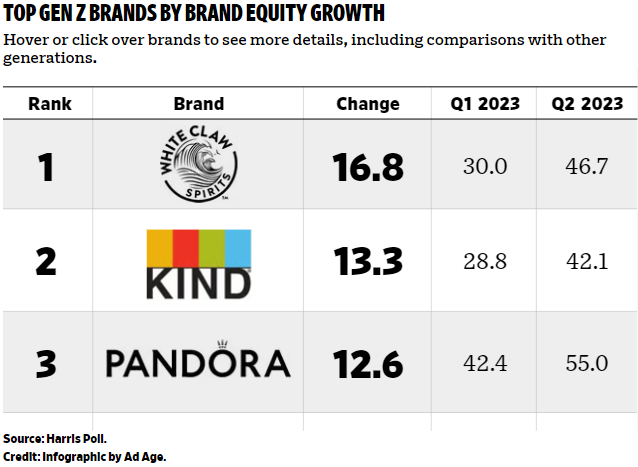

2: 20 Brands Catching Gen Z’s Attention Right Now – AdAge

The latest AdAge-Harris Poll Gen Z brand tracker ranked the top 20 brands gaining steam among Gen Z adults (ages 18-24). This quarterly tracker used QuestBrand data to determine the top brands by brand equity growth from Q1 to Q2 2023. Here’s a sneak peak of this quarter’s top brands:

- Popular hard seltzer brand White Claw topped the list with a +16.8 change in brand equity.

- “White Claw Hard Seltzer’s new line of vodkas and canned cocktails have been well-timed to capitalize on summer beverage consumption, but the brand is doing more to link their products with summertime. White Claw’s recent sponsorship of live events has potentially tied their brand identity with festival season and summer fun in the minds of consumers,” explained Harris Poll co-CEO Will Johnson.

Check out this quarter’s full rankings to see what other popular brands made the list.

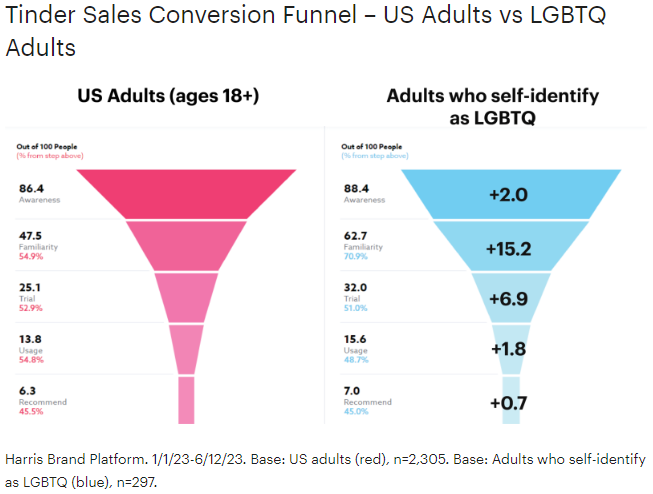

3: LGBTQ Community Finds Connection Through Dating Apps – Brand Story

Dating apps have revolutionized how we date. As the largest dating app, Tinder boasts 75+ million active monthly users. While app users come from all walks of life, a 2020 survey found that LGBTQ adults are almost twice as likely as heterosexual adults to have used online dating apps.

- Approximately 7.2% of Americans identify as LGBTQ. As a minority group, dating apps make it easier for LGBTQ individuals to find and build community.

- Using QuestBrand data, we compared Tinder’s sales conversion funnel between the general population of US adults to adults who self-identify as LGBTQ.

- From the chart below, we see that Tinder’s sales funnel among LGBTQ adults (blue) is wider across each phase of the conversion process than Tinder’s funnel among overall US adults (red).

- LGBTQ individuals especially outpace the general population in familiarity (+15.2) with Tinder and trial (+6.9) of the app.

What to learn more? Read the whole brand story here. Or, check out our LGBTQIA+ Inclusive Insight reports now.

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Related Content