Brief • 3 min Read

According to data from Business Insider, the typical Target shopper is a suburban, Millennial mother with a household income around $80k. You may have picked up on that just from walking through the Target aisles. But this consumer profile gives us a better idea of what Target customers might be looking for, and their pain points.

Want more information on retail trends? Check out our Retail: An Industry Snapshot report for insights and brand data.

The Pain of Higher Prices

In recent years, inflation has stuck as one of consumers’ greatest pain points. Since the COVID-19 pandemic, US inflation has proved to be a serious, and stubborn, problem for American families. While 2024’s inflation rate falls well-below peak levels of inflation, price increases have compounded for the past few years, placing a heavy burden on families’ budgets.

CBS News tracked the change in costs for household goods and housing from 2019 to 2024 to show what these price hikes mean in real numbers. A pound of coffee increased 50% from $4.17 to $6.25. A pound of ground beef increased 44% from $3.81 to $5.47. The price of a dozen eggs jumped 126% from $1.20 to $2.72. When increases hit numerous items in consumers’ shopping carts, Americans feel the squeeze. Consumers are tired of rising prices and shrinking budgets.

Target Relieves Price Pressures

In May, Target announced that it would be reducing prices for 5,000 frequently purchased items. Cuts hit grocery items and household staples (such as paper towels, diapers, and pet food), and impacted many items from Target’s private label brands.

“We know consumers are feeling pressured to make the most of their budget, and Target is here to help them save more. Our teams work hard to deliver great value every day, and these new lower prices across thousands of items will add up to additional big savings for the millions of consumers that shop Target each week for their everyday needs.” – Rick Gomez, Executive Vice President and Chief Commercial Officer at Target

Consumer Brand Perception Shifts

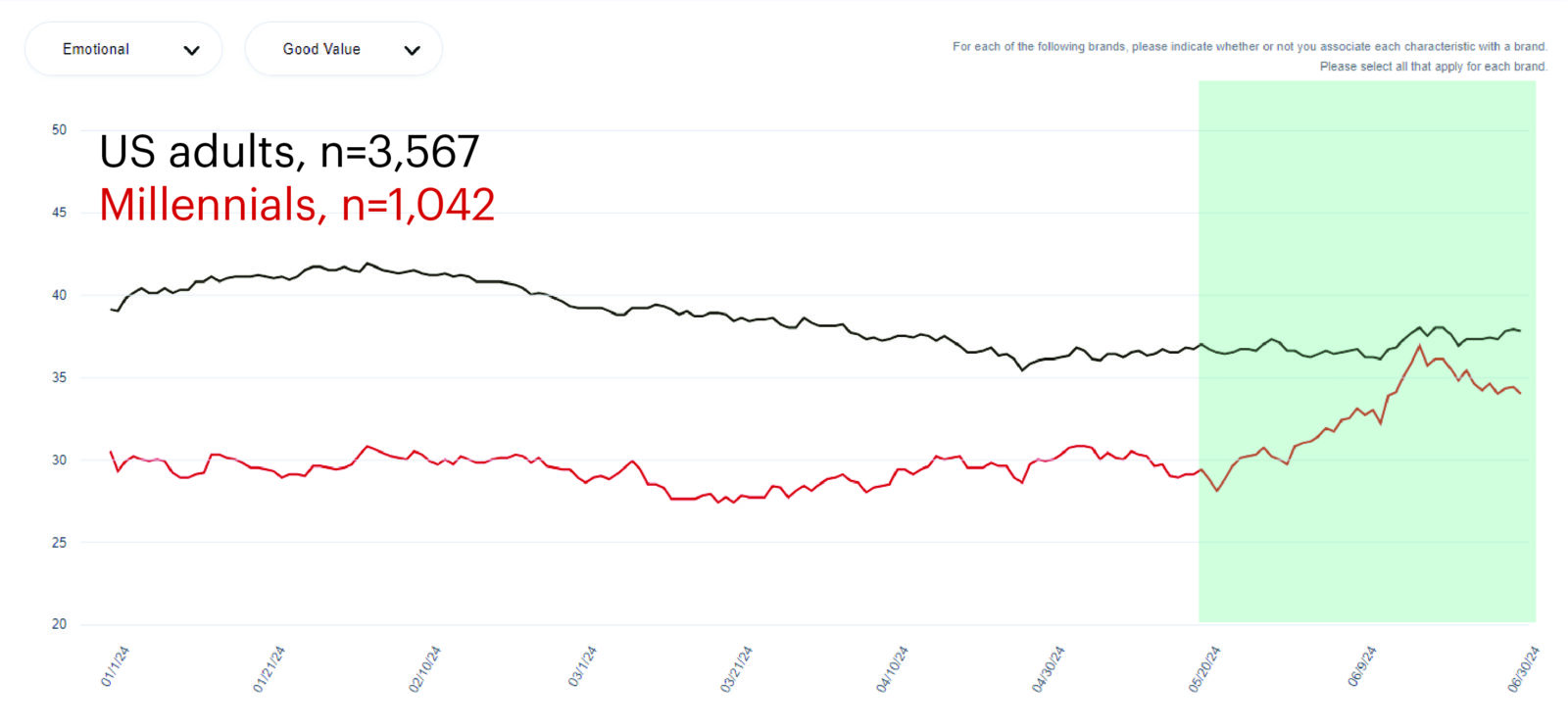

Using data from QuestBrand by The Harris Poll, we can see how consumer brand perceptions shifted in the wake of Target’s mass price decreases. The percentage of Millennials who described Target as a “good value” increased from 28.8 at the end of May to peak at 35.7 in June.

Millennials Who Describe Target as “Good Value” – 12 Week Trended Average

QuestBrand. 1/1/24-6/30/24. Base: General population of US adults, n=3,567. Base: Millennials, n=1,042.

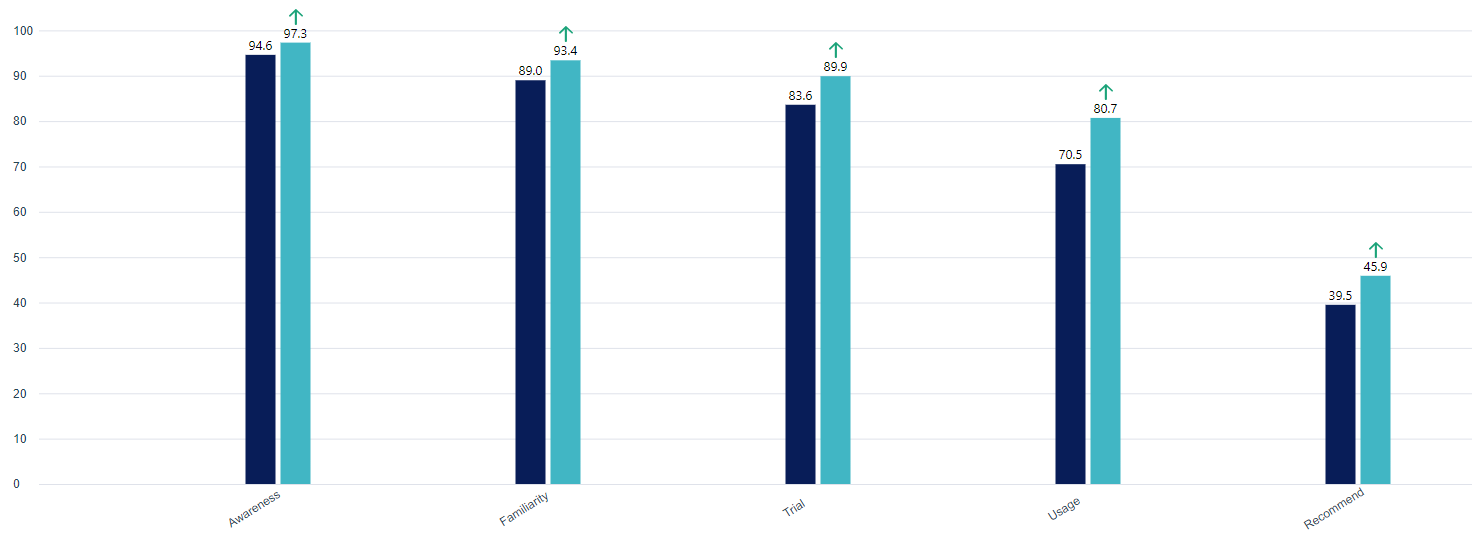

In addition to a change in the way Millennial consumers describe the Target brand, Millennials’ sales conversion funnel significantly shifted from Q1 to Q2 2024.

A sales conversion funnel tracks customers’ journey through the buying process, from initial brand awareness through to product purchase and recommending the product to others. A widening funnel signals a growing consumer base.

Target’s Sales Conversion Funnel Among Millennials – Q1 vs Q2 2024

QuestBrand. Base: Millennials. Pre: 1/1/24-3/31/24, n=643. Post: 4/1/24-6/30/24, n=398.

All five stages of Target’s conversion funnel saw significant increases from the first to the second quarter among Millennials: awareness (+2.7), familiarity (+4.4), trial (+6.3), usage (+10.2), and recommend (+6.4).

Target’s quarter-over-quarter conversion funnel growth is a positive sign for the retailer. Their Q1 earnings were a dissapointment, coming in 3% lower than 2023 as shoppers pulled back on discretionary spending. Target’s Q2 price reductions appear to have gone a long way in re-engaging budget-conscious Millennials. Let’s hope that more brands follow suit and similarly drop their prices.

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Related Content