Brief • 3 min Read

Goldman Sachs has been a trusted name in banking for more than 150 years. Known for helping high-asset clients protect and grow their wealth, they typically target investors with more than $10 million in assets.

In 2016, Goldman Sachs radically expanded their target demographic to include everyday investors with the launch of Marcus by Goldman Sachs. Marcus is a digital collection of banking products and services, including high-yield savings accounts, personal loans, and more.

Since Marcus’ release, Goldman has continued to add to users’ banking capabilities. In February 2021, they released Marcus Invest, a digital investment platform. Marcus Invest allows consumers to quickly setup and personalize their investment strategy based on their stated financial goals and risk tolerance. The Marcus Invest platform automatically purchases stocks and bonds in accordance with the investor’s long-term goals. As the financial markets change, the platform accordingly rebalances the holder’s investments.

In stark contrast to Goldman Sachs’ history of representing clients with $10+ million in assets, Marcus Invest initially only required a $1,000 minimum account balance, and charged fees of 0.35%. This is well below private wealth advisors’ typical advisory fees at Goldman which can exceed 1% of smaller accounts.

As of June 29, 2022, Marcus became even more accessible to everyday investors. They lowered their minimum account balance to $0, and portfolio management fees to 0.25%. This made it easier than ever before for consumers to benefit from Goldman Sachs’ investing prowess.

Want to read more about trends in the financial services industry? Check out our Financial Services: An Industry Snapshot report for insights and brand rankings.

“It is about making every step of the experience better than it used to be. It’s about creating more value for the consumer. It’s actually understanding their need and solving for those needs, working to an end where our financial expertise is available at all customer touch points.” – Swati Bhatia, Head of Marcus and Co-CEO GreenSky

Brand equity soars with the launch of Marcus Invest

Brand equity measures the value that consumers see in a brand at a particular moment in time. It is an average of four distinct components: consumer familiarity with the brand, perceived brand quality, purchase consideration, and perceived momentum.

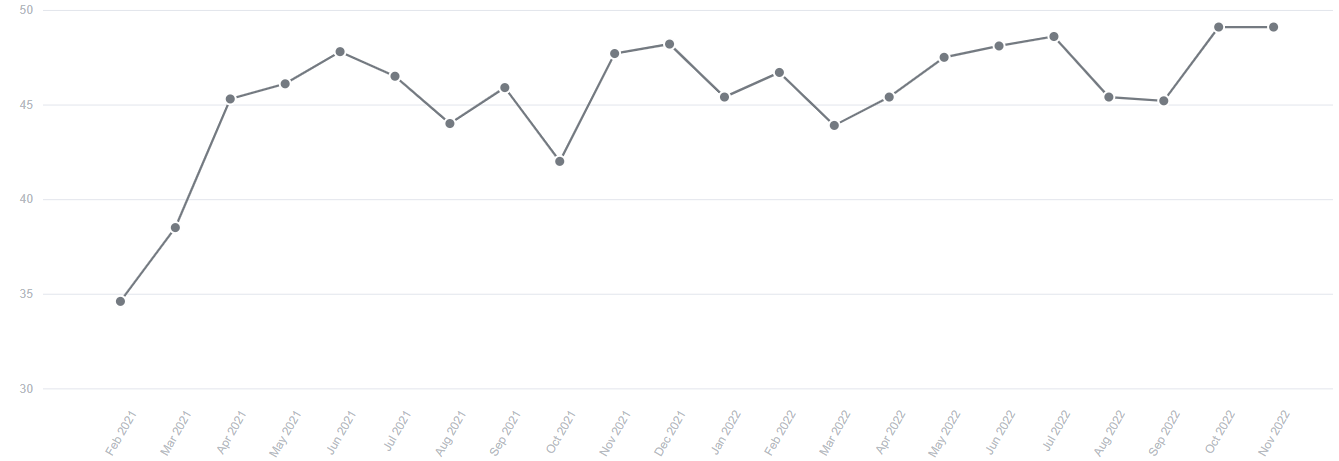

Looking at Marcus by Goldman Sachs’ QuestBrand data, we see a significant uptick in brand equity starting with the launch of Marcus Invest in February 2021.

Marcus’ brand equity experienced normal fluctuations after the period of extreme growth (Feb – June 2021), but their overall brand equity still remains significantly elevated above Feb 2021 levels more than a year later.

Marcus Brand Equity Feb 2021 – Nov 2022

QuestBrand. Base: US adults familiar with the Marcus by Goldman Sachs brand. n=5,591. 2/1/21-11/30/22.

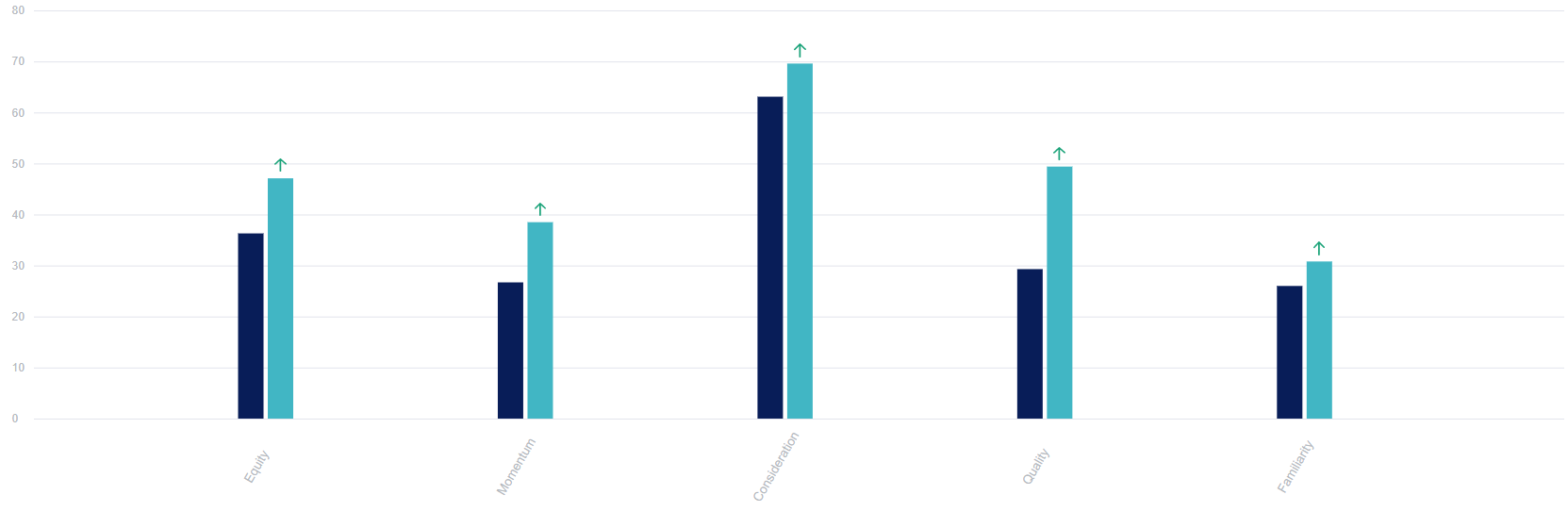

All four measures of brand equity (+10.8) experienced significant growth after the February launch of Marcus Invest: familiarity (+4.8), quality (+20.1), consideration (+6.5), and momentum (+11.8).

Marcus’ steep increase in perceived quality (+20.1) is especially striking. This reflects the value that consumers think Marcus Invest brought to the overall brand, and consumers’ high trust in Goldman’s automated investing technology.

Brand momentum also took off after the Marcus Invest launch, showing that consumers thought that this platform would continue to gain in use and popularity.

Marcus Brand Equity Growth Pre v Post Marcus Invest Launch

QuestBrand. Base: US adults familiar with the Marcus by Goldman Sachs brand. 2/1/21-3/31/21, n=431. 6/1/21-7/31/21, n=512.

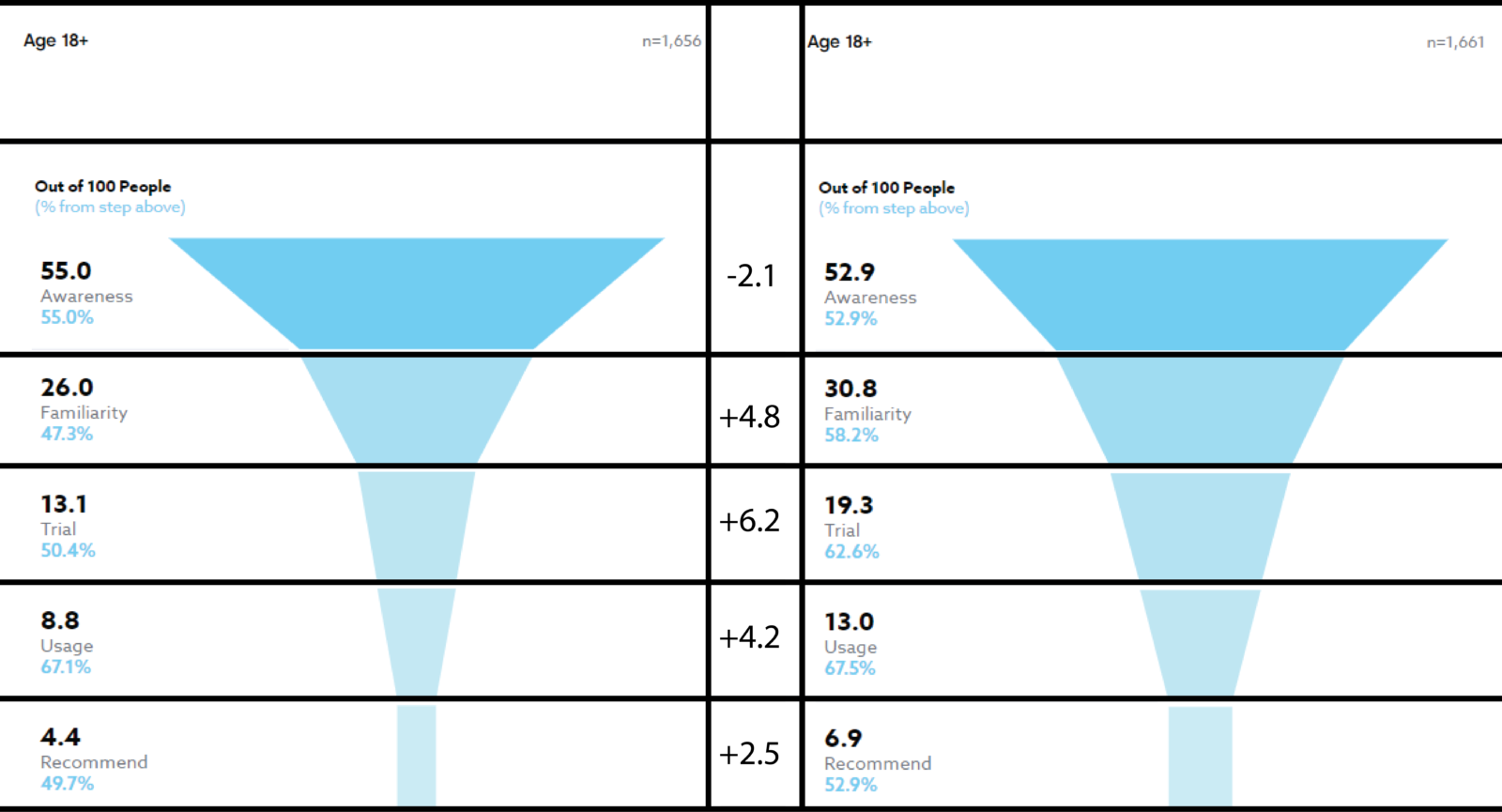

Marcus’ sales conversion funnel noticeably widens

When we look at the change in Marcus’ sales conversion funnel over this same time period, consumer awareness (-2.1) of the brand dropped, but all other phases of the consumer sales funnel increased: familiarity (+4.8), trial (+6.2), usage (+4.2), and recommend (+2.5).

These increases show that US adults were more likely to try, use, and recommend Marcus by Goldman Sachs to other consumers after the Marcus Invest launch.

Marcus Sales Conversion Funnel Pre v Post Marcus Invest Launch

QuestBrand. Base: US adults familiar with the Marcus by Goldman Sachs brand. 2/1/21-3/31/21, n=1,656. 6/1/21-7/31/21, n=1,661.

Continuing to push for their account holders

“Over the past five years at Marcus, through seamless digital experiences, we’ve brought multiple products together, such as lending, savings, credit cards, and soon, checking! We aim to be the primary digital consumer banking platform for millions of consumers and are excited to continue to help those millions of customers achieve their financial goals.” – Swati Bhatia

Marcus Invest was not the last of Goldman’s innovations. The Marcus team has continued to pursue new ideas that make it easier for account holders to use Marcus for their primary bank.

Goldman Sachs employees are currently in the process of piloting a digital no-fee checking account which will later be expanded to Marcus users. In September 2022, Goldman announced the acquisition of GreenSky to expand their direct-to-consumer lending abilities, allowing Marcus account holders to pursue home improvement loans. They expect that this acquisition will generate an additional one million Marcus customers a year.

As Marcus by Goldman Sachs continues to add new functionalities, we will see if their brand equity continues on its current upward trajectory, as the brand strives to become “the leading global digital consumer bank,” – Denis Coleman, Goldman Sachs Chief Financial Officer.

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Related Content