Brief • 3 min Read

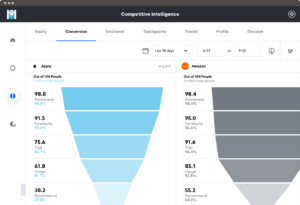

Using data from QuestBrand, we’re comparing four prominent grocery brands — Kroger, Trader Joe’s, Whole Foods Market, Instacart — across US adults. Brand equity captures the overall value consumers see in a brand and is comprised of four components: consumer familiarity with the brand, perceived brand quality, purchase consideration, and perceived brand momentum. Tracking brand equity is essential for companies to monitor brand health and how consumers react to their on-going business decisions.

Grocery Brands: Brand Equity Comparison

QuestBrand. Base: Familiar with the brand. 1/1/22-9/30/22.

Want to read more about retail trends? Check out our Retail, Grocery & Ecommerce: An Industry Snapshot report for insights and brand rankings.

Kroger claims the highest familiarity score (74.7), an earned distinction as the largest US supermarket chain. In 2021, Kroger’s sales totaled over $141 billion. A traditional, and trusted, supermarket brand, Kroger holds the highest purchase consideration (86.8) across US adults.

Trader Joe’s secured the highest quality score (57.7), and second highest momentum score (45.9). Their popularity is hardly surprising. Trader Joe’s ranked first in our 2022 Axios Harris Poll 100 corporate reputation rankings, reflecting strong trust in the brand. Consumers’ enthusiasm stems from the brand’s uniquely friendly culture, strong customer service, low prices, and popular private-label products. About 80% of Trader Joe’s products are store brands that cannot be found elsewhere.

While nearly on-par with Kroger in purchase consideration, Whole Foods has a higher perceived quality score (56.2). Whole Foods has long been known for carrying high-quality specialty items that are difficult to source elsewhere. Whole Foods also ranked as the highest growth retail/grocery brand by brand equity (+5.4%) from Q2 to Q3. This could be partially due to the chain’s recent technology-forward announcements, including smart carts and palm-reading payment options that propel this grocery store into the future.

While Instacart lags in familiarity (51.7), it shines in momentum (49.1) showing consumer optimism for this brand’s future. Founded in 2012, Instacart gained strength during the COVID-19 pandemic when many preferred online to in-store shopping. Sales increased a whopping 330% in 2020 from 2019, and an additional 15% in 2021. As we move further from the pandemic, it may be difficult for Instacart to maintain these levels of growth, but Instacart CEO Fidji Simo maintains that “Grocery delivery…adds real value to people’s families, and so I believe that that is very much here to stay.”

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Related Content