Brief • 3 min Read

The PGA Tour has remained the gold standard of professional golf tours since the early 1900s, boasting the best players and the largest tournament purses. Their dominance was challenged in October 2021 with the launch of LIV Golf. This Saudi-backed upstart rocked the golf world as it enticed top talent away from the Tour with unrivaled compensation offers. It looked like LIV could split the golf world, taking players and fans with them.

PGA Tour Commissioner Jay Monahan has accused LIV of trying to “buy the game.” Phil Mickelson was promised $200 million just to join LIV. The total 2023 LIV tour pot stands at an astounding $405 million. In response, the PGA Tour raised their own tournament purses. They also barred any golfers who participate in LIV events from PGA Tour tournaments.

Want to read more about entertainment industry trends? Check out our Entertainment: An Industry Snapshot report for insights and brand rankings.

Same game, different rules

While both the PGA Tour and LIV vie for the same talent, there are some key differences between PGA Tour and LIV play. LIV’s updates are designed to increase the speed of play, to attract athletes, and to build a younger fan base.

- Team Play: The Tour players compete as individuals. In LIV, there are 12 team captains who draft three players to their team per tournament.

- Start Style: In contrast to the Tour’s traditional tee times, LIV tournaments use a shotgun start. This reduces the time it takes all players to complete the course.

- Number of Rounds: PGA tournaments are comprised of four rounds. Tour players with the highest scores are cut after the second round. LIV has three rounds, and players complete in all rounds of the tournament.

- Player Payment: LIV golfers receive a paycheck after every tournament they play in. In contrast, only the leading competitors make money in any single PGA Tour tournament.

- Atmosphere: LIV tournaments feature background music throughout the course, and have a more laid-back atmosphere than the more buttoned-up PGA Tour events.

Survey says…

The first LIV event was held on June 9, 2022. LIV’s launch generated a significant stir in the golf world; however, viewership failed to take off in its first year. This may have partially stemmed from LIV’s lack of a TV broadcast deal. Instead, tournament play is streamed through their website, YouTube, or Facebook. LIV’s third tournament attracted approximately 74,000 concurrent streamers. In contrast, the PGA Tour’s Rocket Mortgage Classic had 2.5 million viewers on the same day.

While the PGA Tour was understandably concerned that LIV Golf could siphon interest from their own brand, QuestBrand data shows that the launch of LIV Golf did not significantly damage consumer perception of the PGA Tour brand.

When we compare the Tour’s brand equity pre LIV Golf (Jan – May 2022) to post launch (June – December 2022), the PGA Tour’s overall brand equity dropped by less than 4 points. And, several components of their brand equity actually rose. We predominantly focused our attention on the reactions of PGA Tour fans since this demographic would have been the most aware of and interested in the launch of a rival golf tour.

PGA Tour Brand Equity Among PGA Tour Fans Pre v Post LIV Launch

QuestBrand. Base: US adults familiar with, and fans of, the PGA Tour brand. 1/1/22-5/31/22, n=597. 6/9/22-12/31/22, n=487.

Brand equity measures the value that consumers see in a brand. It is made up of four distinct components: consumer familiarity with the brand, perceived brand quality, purchase consideration, and perceived brand momentum.

Perceived brand momentum (-12.4) experienced the most significant drop among PGA Tour fans. This could reflect fans’ concern that the Tour could lose its dominance (and relevance) with the rise of a new, cutting-edge golf tour. However, fans’ (engagement) consideration (+1.6) and perceived quality of the brand (+2.2) actually increased over this same time span.

The drop in perceived momentum is even less pronounced when you look at responses across all US adults, not just PGA Tour fans. The drop in momentum decreased by just -2.7. Similarly, consideration (+1.2) and perceived quality (+2.1) also increased across US adults.

Despite fans’ impression that the Tour’s momentum had waned, the PGA Tour boasted strong viewership throughout 2022. The Canadian Open had its highest viewership since 2000. Likewise, British Open viewership was up 16% from 2021 and 27% from 2019. The FedEx Cup playoff was the most watched postseason opener since 2017 with 2.97 million viewers.

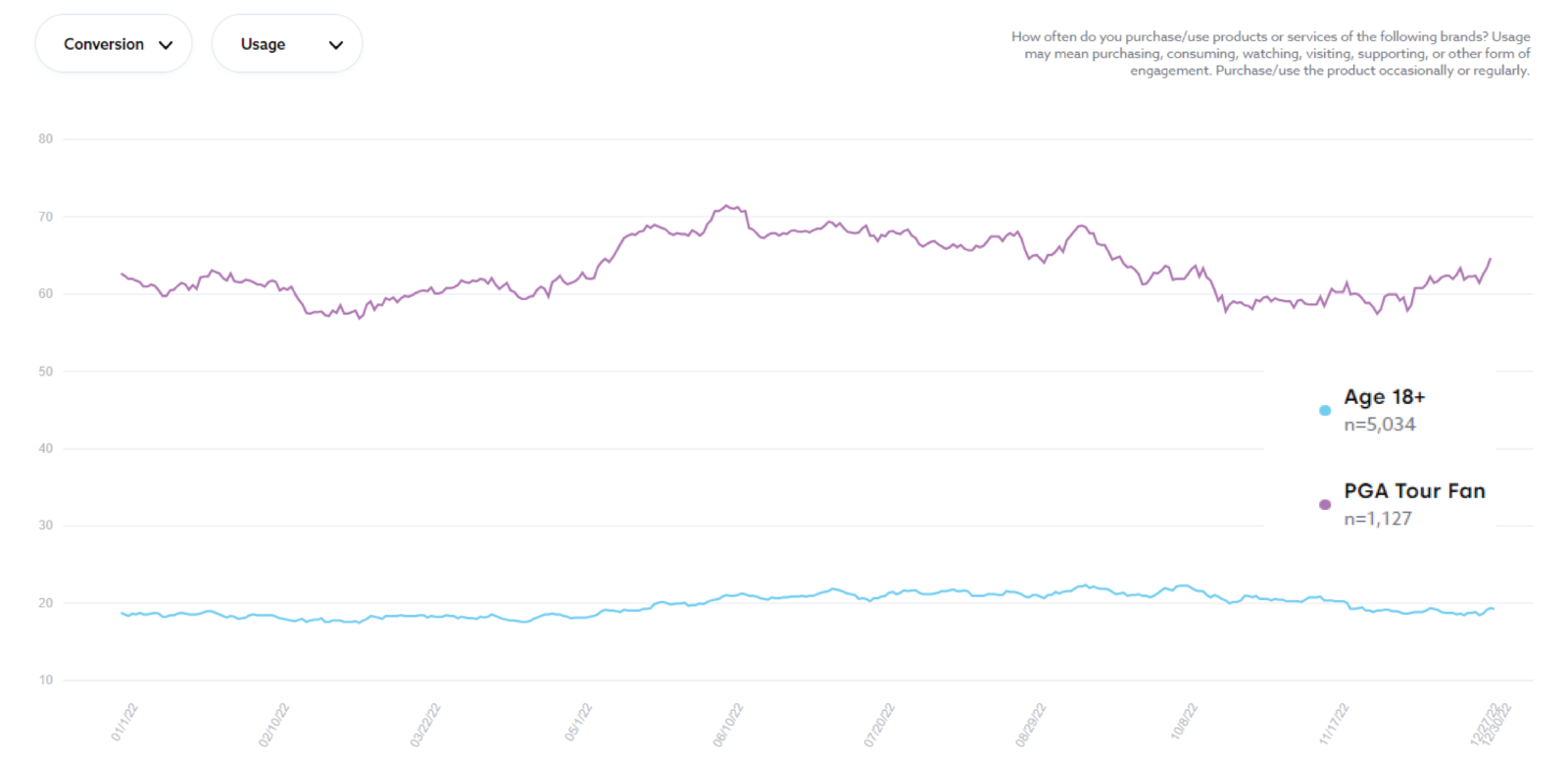

PGA Tour “Usage” (Active Viewership) Among US Adults and PGA Tour Fans Throughout 2022 – 12 Week Moving Average

QuestBrand. Base: US adults familiar with the PGA Tour brand (Blue), 1/1/22-12/31/22, n=5,034. Base: PGA Tour fans (Purple), 1/1/22-12/31/22, n=1,127.

Looking at the Tour’s QuestBrand sales conversion funnel, reported “usage” of the PGA Tour brand remained relatively steady throughout the year with a slight drop in November and December. This dip could also reflect the season since the PGA breaks from major tournament play at the end of the year.

While 2022 was a stressful year for PGA Tour leadership, both viewership and QuestBrand numbers positively signal towards the league’s ongoing success.

LIV’s changes to game play were designed to appeal to a new, and younger, audience. However, the Tour’s fans are typically older, and more affluent, than the rest of the population. Unlike other sports that rely on young viewers to remain relevant, the Tour does well standing by their existing audience. LIV’s changes have yet to turn their heads from the gold standard of professional golf. We will have to watch what 2023 brings for these two rival leagues.

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Related Content