Brief • 4 min Read

In The Harris Poll Tracker (Week 122) fielded June 24th to 26th, 2022 among 2,041 U.S. adults, we find that Americans are overwhelmingly concerned about the economy (87%) and nearly two-thirds (62%) can’t shake the worry over the pandemic.

Check out our America This Week: From The Harris Poll podcast on Spotify and Apple Podcasts for data-driven discussions between our CEO John Gerzema and CSO Libby Rodney on this week’s data and more.

As a public service, our team has curated key insights to help leaders navigate COVID-19. Full survey results, tables, and weekly summaries can be accessed for free at The Harris Poll COVID-19 Portal. We will continue to actively field on a regular cadence to track the shifts in sentiment and behaviors as the news and guidelines evolve.

First It Was The Pandemic, Now It’s Inflation Shocking Budgets: Personal Capital-Empower-Harris Poll

In our latest survey with Personal Capital and Empower, as featured in Fortune’s CFO Newsletter, we find that American consumers are concerned about their financial stability in face of rising inflation.

- (85%) of Americans are concerned about rising inflation and (74%) about a potential recession impacting their financial stability – over half of Americans (56%) say their standard of living is already declining.

- Beyond general cutting back on daily expenses (71%), (56%) are paying off debt more aggressively than would have otherwise, (58%) are putting away more to their short-term savings and retirement savings (58%), and (37%) are exploring alternative housing options.

- (69%) think their income isn’t keeping up with inflation, but less than half (41%) are asking for a raise at work.

Takeaway: Employers need to be cognizant of how inflation is impacting both consumers and their own employees as we’ve previously found in partnership with Bloomberg that (19%) of employees have quit a job when they didn’t receive a requested raise and (64%) would be likely to quit their job if offered a role from a different company.

Pay Me Now So I Can Get To Work: DailyPay-Funding Our Future-Harris Poll

The effects of inflation and high gas prices are hitting hourly workers especially hard according to our latest survey with DailyPay and Funding Our Future, as covered by Yahoo! Money.

- Three-quarters (75%) of hourly workers have struggled to pay expenses this year: Groceries (49%), gas (48%), utilities (40%), and rent/mortgage (34%) topped the list.

- Over a fifth (22%) say they have taken out a payday loan this year, including (31%) of those aged 18 to 34.

- Stagnant wages: (35%) of all hourly workers report receiving no pay increase over the past year – increasing to (49%) for those in households making under $50K a year.

Takeaway: Employers should be thinking about new ways to help hourly employees make ends so they don’t have to choose between paying for gas or taking a shift at work. One example an increasing number of employers are offering is on-demand pay to help their workers avoid payday loans, as a financial wellness benefit.

All Roads Lead To The Midwest: Crain’s Chicago Business-Harris Poll

In our latest research, as covered by Crain’s Chicago Business, 6 in 10 Americans worry about the impact of climate change on their region.

- When asked who should take the lead on issues related to the environment, the majority (69%) of Great Lakes residents (Illinois, Indiana, Michigan, Ohio, and Wisconsin) cited some form of government – however, there is little consensus as to which level: federal (26%), state (22%), or local (21%).

- In comparison, (31%) of Great Lakes residents want either individuals or non-government entities like businesses to take the lead (21% and 10%, respectively).

- Half would move, half would stay: Just over half (54%) say they would move if their area was being negatively affected by climate change, while 6 in 10 don’t want more people moving into their area.

Takeaway: According to Harris Poll Co-CEO, Will Johnson, areas such as the Great Lakes must dramatically improve their infrastructure if they will successfully absorb a population surge driven by climate refugees.

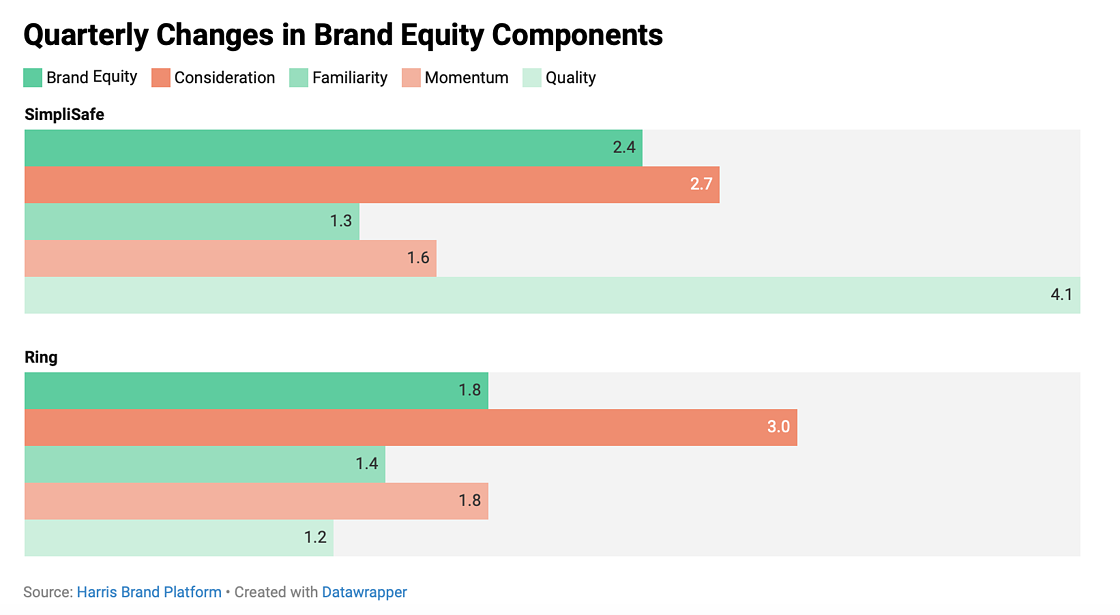

Taking Control During Uncertainty: Harris Brand Platform Security System Case Study

The last two years have been anything but predictable, yet, many Americans have turned to DIY security systems to reclaim feelings of safety according to our latest Harris Brand Platform data.

- Two DIY home security systems, SimpliSafe (+2.4) and Ring (+1.8), made our list of the top five electronics growth brands from Q4 2021 to Q1 2022 by brand equity growth.

- Portable security systems have also allowed renters to enter the home security market, with renters composing (36%) of US households – a significant number of new potential customers.

- The home security market currently stands at $56.9 billion, but it is expected to keep growing. By 2027, projections show the home security market reaching $84.4 billion.

Takeaway: At a time when the world has been feeling increasingly out of control, American consumers are looking for new ways to keep their loved ones secure. If the predicted trends hold, DIY home security systems may continue to grow in popularity, and brand equity, in the months ahead.

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Download the Data

This survey was conducted online within the U.S. by The Harris Poll from June 24th to 26th, among a nationally representative sample of 2,041 U.S. adults.

Download

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Download the Data

This survey was conducted online within the U.S. by The Harris Poll from June 24th to 26th, among a nationally representative sample of 2,041 U.S. adults.

DownloadRelated Content