Brief • 4 min Read

In The Harris Poll Tracker (Week 77) fielded August 13th to 15th, 2021 among 2,043 U.S. adults, we look at raising health insurance premiums for the unvaccinated, NFL viewership for the upcoming season, financial literacy in America, the importance of broadband equity, and brands going for gold during the Olympics.

As a public service, our team has curated key insights to help leaders navigate COVID-19. Full survey results, tables, and weekly summaries can be accessed for free at The Harris Poll COVID-19 Portal. We will continue to actively field on a regular cadence to track the shifts in sentiment and behaviors as the news and guidelines evolve.

The Potential Cost of Being Unvaccinated

Premiums for health insurance coverage has long been a divisive topic in America, and COVID has added a new layer of complexity; should unvaccinated employees be charged more for their health insurance coverage? Is it discriminatory, or is it justified? We took the pulse in this week’s survey to see where Americans stand:

- Overall, Americans are split: (51%) say they oppose employers charging unvaccinated employees more for their health insurance premiums to cover potential associated medical costs from contracting COVID while (49%) support the idea. As for vaccinated Americans, (61%) are in favor (vs. 27% unvaccinated) and (39%) oppose (vs. 73% unvaccinated).

- Driving the debate: Three quarters (76%) of unvaccinated Americans say that getting vaccinated is a personal choice and therefore should not lead to penalization (vs. 44% vaccinated), while just (24%) agree that employers are justified to charge a higher insurance premium because the surcharge would be less than the potential hospital bills (vs. 56% vaccinated).

- Two-thirds (65%) agree that if insurance companies can’t charge more for pre-existing conditions, then employers shouldn’t be able to charge more based on vaccination status and another (61%) say doing so would be discriminatory.

- The big question facing the unvaccinated now is “how much would this cost me?” CBS News writes more about the potential financial impact.

Takeaway: With roughly 30% of Americans still not having received at least one dose of the vaccine, this issue will soon be another COVID-related work policy that will likely be a sensitive subject – employers will need to think critically about how to communicate with their employees effectively and clearly about where they stand on the issue.

NFL Viewership May Dip In 2021 As Americans Avoid In-Person Games And Crowded Bars: Ad Age-Harris Poll

With the 2021 NFL pre-season in full swing and the official kick off in less than a month, we conducted a survey in partnership with Ad Age on planned watch patterns and found a slight dip in the share of Americans who plan to tune in this season compared to last year. Here’s what else we found:

- Who’s watching: Two-thirds (65%) of Americans reported watching NFL games last season, but only (60%) have plans to tune in for the 2021 season — a potential loss of tens of millions in viewers.

- Americans aren’t exactly clamoring to attend games in-person: only about 1 in 4 (27%) are likely to attend an event and only (12%) very likely to and most Americans (69%) and NFL fans (73%) agree it’s not safe for kids to attend major sporting events in person.

- Cheering from home: (40%) said they’d watch a game at a bar or restaurant that wasn’t at all crowded (at less than 25% occupancy), while only 25% said they’d stick around if the venue was very crowded (at more than 76% occupancy).

- There is some good news for the NFL and advertisers, however: of those planning to watch this season, one-third (33%) plan to watch more games this season compared to last, which could translate into higher ratings and stronger engagement.

Takeaway: It is critical for brands to deliver ads that viewers want to see to keep viewers from channel surfing, and according to our survey that means ads that are funny (57%) and uplifting (52%) and not the saturated nostalgic ones (34%).

The Financial Literacy and Investing Gap: USA Today-Harris Poll

In our latest survey, shared exclusively with USA Today, we look at the differences among Americans when it comes to financial literacy and knowledge surrounding one of the hottest financial topics – cryptocurrencies. Here’s what we found:

- Roughly two-thirds of Americans say they understand investing, but only one in five (20%) say they understand investing very well, with a trend in higher income leading to higher literacy with (40%) of high income Americans being very literate compared to just (21%) of low income Americans.

- What about crypto?: Americans’ struggle with general financial knowledge transcends to the specifics as well, with nearly (60%) of adults saying they are not very or not at all familiar with cryptocurrency.

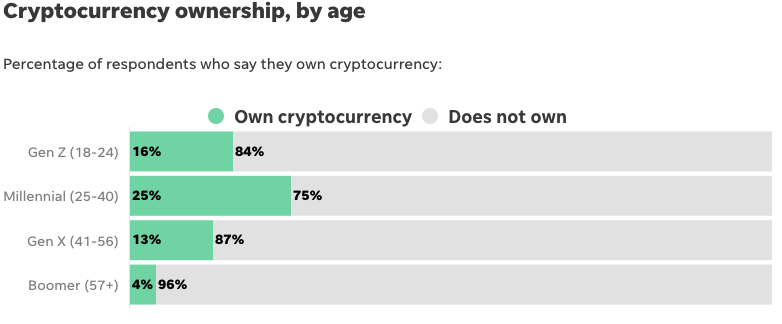

- Younger Americans are more likely to say they are very or somewhat familiar with cryptocurrency: Six in 10 (61%) of Millennials are, followed by (53%) of Gen Zers, (42%) of Gen Xers, and just (19%) of Boomers.

- And that leads to young investors: One in four (25%) of Millennials and (16%) of Gen Zers are crypto owners, compared to (13%) of Gen Xers and only (4%) of Boomers.

Takeaway: “When it comes to investing, Americans say they’re sufficient, but not proficient by any stretch,” says John Gerzema, CEO of The Harris Poll. “They acknowledge they’re OK at it, but they haven’t mastered it.”

Building Investment in Broadband for All—A Basic Human Right: National 4-H Council-Harris Poll

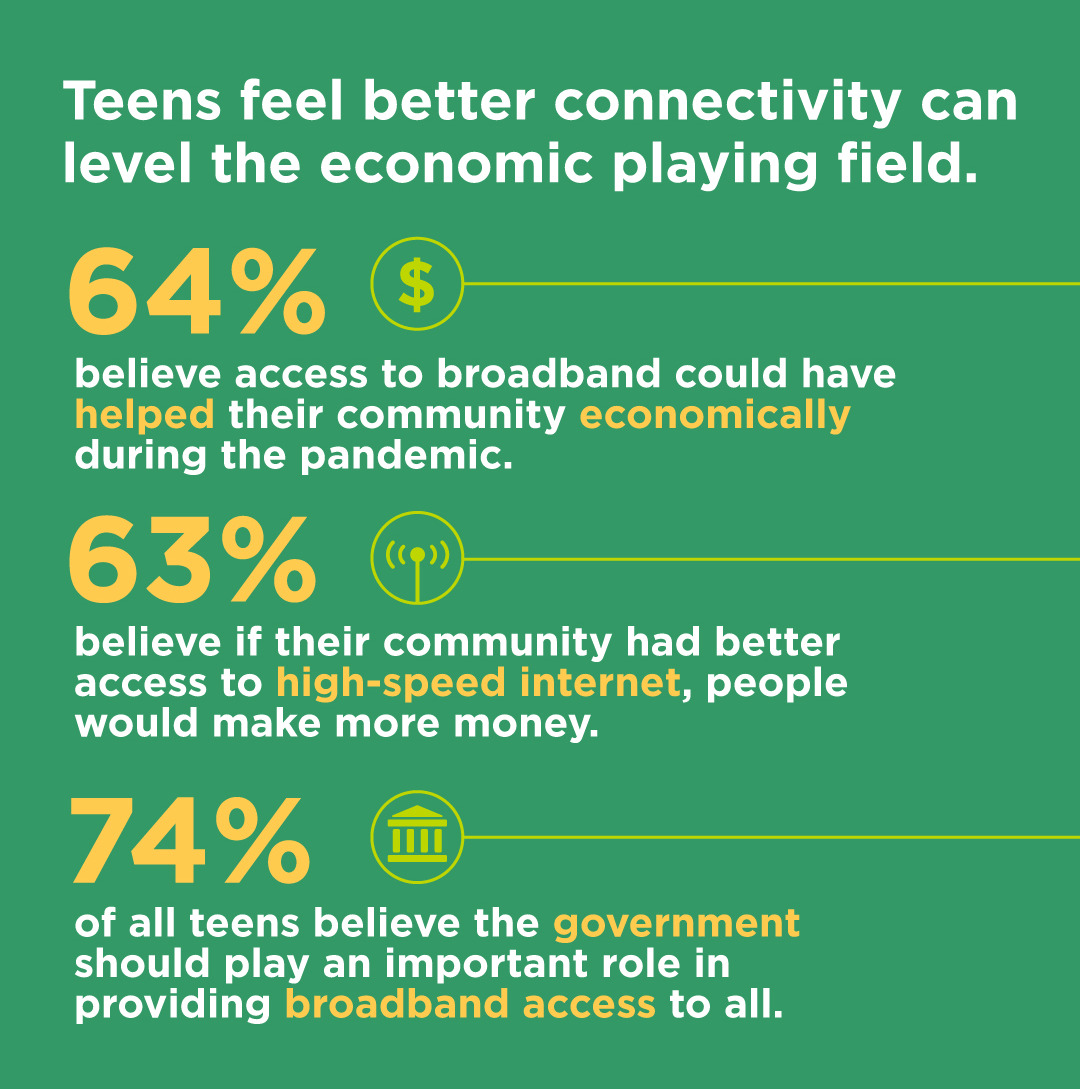

Our recent work with the National 4-H Council highlights the growing digital divide among teens and its impact on social mobility. Teens are calling for broadband equity, an issue that will continue to be critical to a world in flux. Here’s more from our findings:

- Better connectivity levels the playing field: Nearly two-thirds (64%) of teens believe access to broadband could have helped their community economically during the pandemic, and (74%) say the government should play an important role in providing broadband access to all.

- Digital Divide: Three quarters (73%) of teens agree that “digital skills will likely be the key to getting the best jobs for my generation.” Teens who have access to high-speed internet are also more confident in their ability to have a successful career (88%) and financial success (85%) vs. those that do not (81%, 80%).

- Economic Implications: A majority (63%) of teens agree that “if my community had better access to high-speed internet, people here would make more money.”

Takeaway: Last week, the Senate approved of the infrastructure bill which includes a focus on broadband access and initiatives – a significant step in the right direction to provide equal opportunities for social mobility among all, but especially for America’s youth and the next generation of leaders.

Brands Going for Gold: Measuring Sponsorships and Creative at the 2020 Tokyo Olympic Games

The Olympic Games are a major advertising event — but with over 120 advertisers, partners, and sponsors vying for attention over a 2-week time period, how can brands ensure they hit the mark? Harris Brand Platform’s research report on the 2020 Tokyo Olympics, “Brands Going for Gold,” reveals the relative impact of major brands’ sponsorships, partnerships and advertisements on consumer perception and behavior following the games. Here are the highlights:

- Why did viewers tune in? While many viewers (35%) were motivated to watch Olympic Games coverage by their sense of patriotism, viewers were largely interested in the Olympic sporting events themselves (47%) – with Americans most interested in gymnastics (63%) followed by track & field (55%).

- Peacock, the go-to platform for streaming the games, won the Olympics in terms of brand equity lift – with an increase of 6.0 points – closely followed by Nike and Omega.

- Do viewers remember brands? Among viewers of this year’s Olympic Games, 51% of U.S. adults recalled seeing an ad from a specific brand during the Games (unaided). That said, more viewers (78%) were able to identify brands that advertised (aided).

- Not every brand that topped the advertiser list was an official sponsor, such as McDonalds, but all saw a very high percentage of viewers who recalled ads from their brand during Olympics coverage. The top 5 include: Coca-Cola, Nike, Toyota, McDonald’s, and Visa:

Takeaway: The full report includes extensive analysis on consumers’ watch plans ahead of the event vs. their actual watch behavior; measures the brand lift of major brand sponsors and partners; and assesses the impact of these brands’ creative campaigns on U.S. consumers.

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Download the Data

This survey was conducted online within the U.S. by The Harris Poll from August 13 to 15, among a nationally representative sample of 2,043 U.S. adults.

Download

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Download the Data

This survey was conducted online within the U.S. by The Harris Poll from August 13 to 15, among a nationally representative sample of 2,043 U.S. adults.

DownloadRelated Content