Brief • 1 min Read

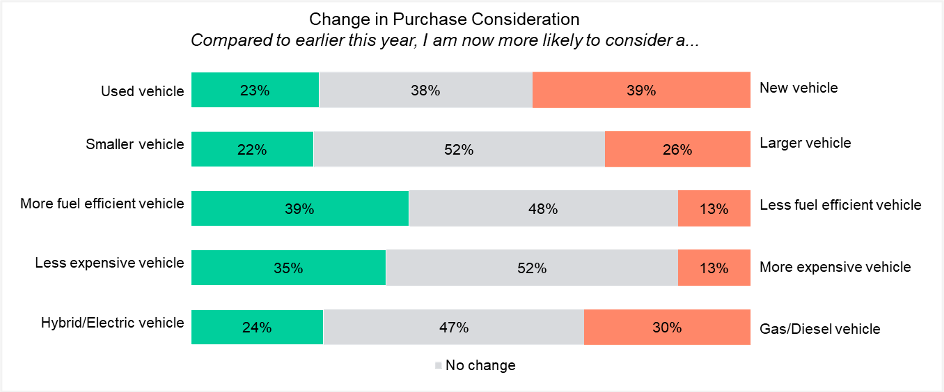

Vehicle shoppers who were considering a vehicle (new or used) before the pandemic are rethinking the type of vehicle they plan to purchase. At least a third of vehicle shoppers are now more likely to purchase a less expensive vehicle (35%) and close to two in five are more likely be shopping for a fuel-efficient vehicle (39%). About half of them say they have not changed the amount they plan to spend on a vehicle (52%) or the level of fuel efficiency (48%) they seek. Helping customers feel comfortable with the amount they’re spending on a vehicle at purchase and over the vehicle ownership lifecycle will be crucial for manufacturers.

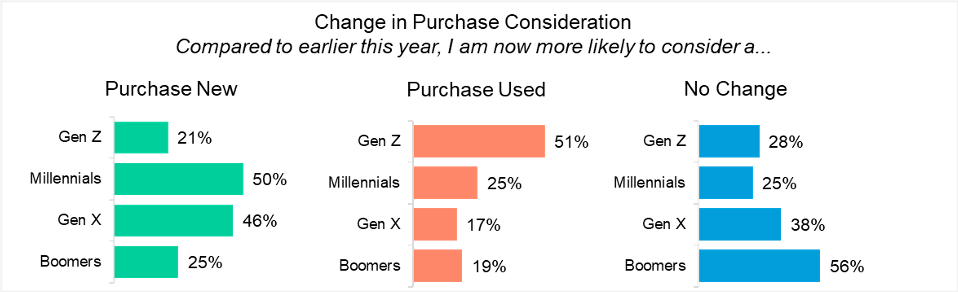

Two in five vehicle shoppers are now more likely to be considering a new vehicle (39%) than they were before the pandemic. This is good news for manufacturers who have seen sales decline sharply as a result of the pandemic. Sales are most likely to be led by Millennials (50%) and Gen X (45%) who are showing the most interest in new vehicles. Conversely, Gen Z shoppers (51%) are more likely to consider used vehicles while the majority of Baby Boomers (56%) have not changed the type of vehicle they’re considering.

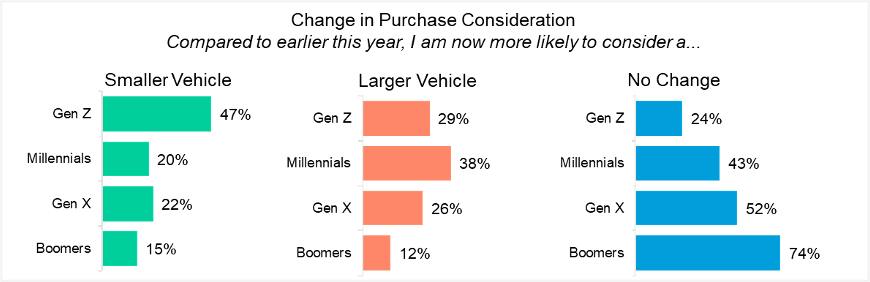

When it comes to vehicle size, one-half of vehicle shoppers haven’t altered their consideration (52%). This is especially true for older shoppers. Young shoppers, however, are reconsidering their vehicle size. Gen Z shoppers are now more likely to consider a smaller vehicle (47%) compared to Millennials who are more likely to consider a larger vehicle (38%).

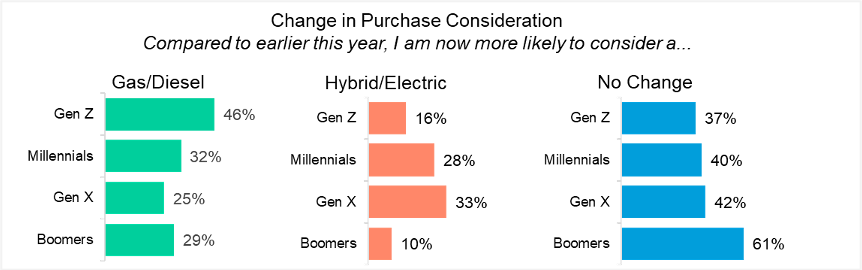

Powertrain consideration is unwavering for 47% of vehicle shoppers still in-market. A slightly higher percentage of shoppers are now more likely to consider a gas/diesel engine (30%) as they are to now consider a hybrid electric vehicle (24%). Gen X shoppers show more interest in hybrid electric vehicles (33%). Conversely, Baby Boomers show the least new consideration for hybrid electrics vehicles (10%). The majority of Baby Boomers have not shifted their powertrain consideration (61%). The big implication for automakers is that demand continues to exist for alternative powertrains, particularly among younger shoppers, but this must be measured against small demand among Baby Boomers.

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Related Content