Brief • 3 min Read

Brands in heritage industries like watches and jewelry are deploying marketing strategies that revive their brand among younger and more diverse consumer segments. More recently, Tiffany & Co. has focused on revitalizing its perception among young shoppers with its controversial “Not Your Mother’s Tiffany” campaign, which launched in July. Understanding perceptions of the broader industry can explain why Tiffany dared to market itself as a more unconventional brand.

Old Faithful

Luxury brands, especially in the watches and jewelry industry, have often focused on older consumers. This makes sense given the higher disposable incomes such consumers often have. However, concentration on an older customer set has created a reliable and client-focused industry persona among consumers aged 40 and under. Such a persona may help build long-term loyalty, but for young shoppers looking to be impressed, it does little to draw new customers to luxury brands.

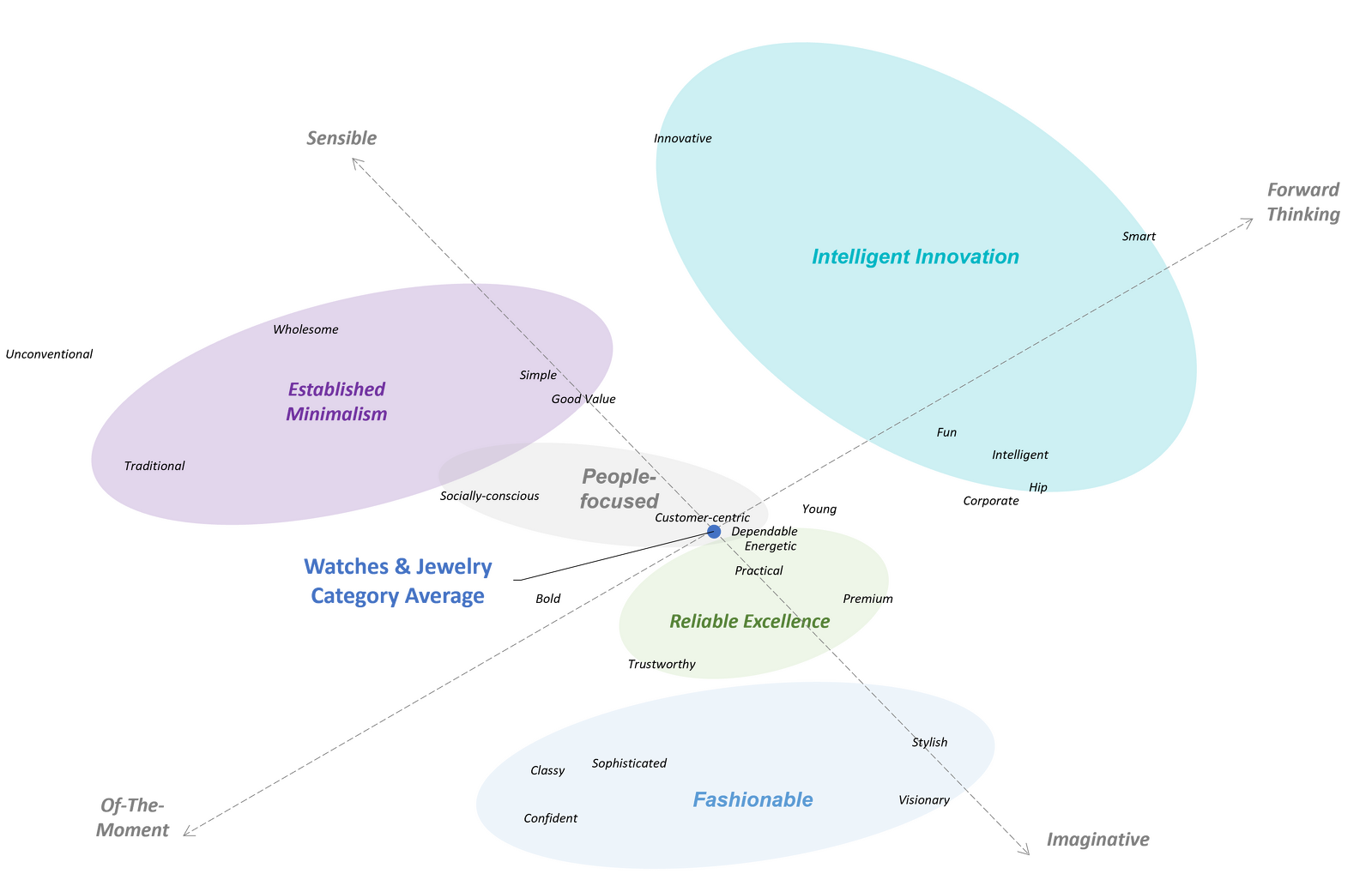

QuestBrand measured the positioning of luxury watches and jewelry brands in the months leading up to Tiffany’s new campaign in July.* The perceptual map below reveals that on average, Millennials and Gen Z saw the category as customer-centric, dependable, and practical. They also associated the category with being energetic – perhaps reflecting the perceived moves brands are taking to revitalize their image among young adults – but on average, the category remained far from the fun, hip, bold, and visionary perceptions with which more youth-focused brands are associated.

It’s not surprising, then, that Tiffany would seek to stand out from the industry’s positioning.

On average, Millennials and Gen Z viewed the luxury watches and jewelry category as customer-centric, dependable, and practical before the launch of Tiffany’s controversial campaign. Perceptual map of emotional attributes for the luxury watches and jewelry category among U.S. adults aged 18-40 from April 15, 2021, to June 30, 2021.

A Rebrand in Action

Overall, three in five (61%) consumers claim to be at least somewhat familiar with Tiffany & Co. (i.e., they know at least some information about the brand beyond having just heard its name). Unsurprisingly, this level of familiarity is higher among those with household incomes over $100,000 (67%).

With the new Tiffany campaigns geared towards younger and more diverse consumers, it’s unsurprising that familiarity was also slightly higher among African Americans (66%), Asian Americans (67%)**, and Millennials (72%). That being said, the brand still has a long way to go with boosting familiarity among young people and people of color. One in five Gen Z (23%) and Millennials (20%) say they’ve only heard the brand name and know nothing more about Tiffany & Co. The same can be said for African Americans (26%), Hispanics (26%)**, and Asian Americans (21%).

This helps explain the new range of brand ambassadors Tiffany has introduced over the past month, including Tracee Ellis Ross, Anya Taylor-Joy, Eileen Gu, and – most notably – Beyoncé and JAY-Z.

A Strategic Success

Beyoncé appears to be a wise choice among those familiar with the megastar and Tiffany. Within this group, 80% consider Beyoncé to be a good fit for the brand.*** She was perceived as a good fit even more often among African Americans (91%), Hispanics (98%), Gen Z (97%)**, and Millennials (82%).

When asked why, consumers who consider Beyoncé a good fit often mention her widespread popularity, glamor, wealth, and status as both a style icon and role model as assets that will help boost Tiffany’s sales. “Everyone knows Beyoncé and would be more likely to pay attention to what she is advertising or talking about,” a 45-year old woman elaborates.

Her down-to-earth personality especially resonates with younger consumers. One 32-year-old man describes her as “rich and relatable” while an 18-year-old woman says, “She seems like a genuinely nice person, and nowadays personality means everything.”

They realize her broad market reach, too. “Beyoncé would bring lots of attention to the brand and bring in a different type buyer,” a 53-year-old woman notes. A 19-year-old woman is even more specific, emphasizing the star’s specific impact on diverse consumers, “Beyoncé is a very empowering woman of color that I admire, and I think [Tiffany] would look great on her and empower other women of color to purchase if they can. I see far too many white women marketing the brand.” This and similar remarks from other young adults reveal that brand ambassadors who contradict the typical idea of luxury can be effective at grabbing the attention of younger, racially diverse audiences who demand greater representation and authenticity from companies.

Strong Supporting Acts

However, despite drawing attention by going against the grain, a celebrity’s perceived alignment with a brand is still important. Compared to his wife, JAY-Z is not as strongly associated with Tiffany. Only 43% of all consumers familiar with him and with Tiffany think he is a good fit for the brand. He has a slightly higher positive association among African Americans (58%), Millennials (48%), and Gen X (48%).

Although other recently added brand ambassadors don’t have the same level of positive association among all consumers, they do perform well among segments of interest. Tracee Ellis Ross is viewed as a good fit for Tiffany by 43% of all consumers familiar with her and the brand, but the level of brand association jumps among African Americans (92%), Millennials (54%), and Gen X (50%).

Another example, actress Anya Taylor-Joy did especially well in brand associations among Hispanics (57%), Millennials (52%), and Gen Z (47%) versus all consumers aware of both her and Tiffany (31%). Additionally, teenage skier Eileen Gu had higher “good fit” perceptions among Millennials (32%) and Gen Z (27%) than among all consumers aware of both her and Tiffany (22%).

Boosting Brand Imagery and Purchase Intent

Despite the controversy around the messaging and imagery of Tiffany’s recent rebrand, Harris Poll research shows the tactic may have successfully boosted purchase intent. Accompanying brand ambassador selection has likely played a role, too. Overall, one in five consumers at least somewhat familiar with Tiffany plans to buy something from the brand in the next 12 months. This was notably higher for target markets including those with household incomes over $100,000 (30%), African Americans (42%)**, and Millennials (46%).

Maintaining brand ambassador lists with a mix of widely known celebrities alongside stars targeted to specific groups (e.g., Gen Z) may help Tiffany and its competitors appeal to new, key audiences – namely, young people and people of color – while still maintaining their current shopper base.

Having asked about brand fit for hypothetical brand ambassadors, too, Harris Poll research shows the likely success of such a strategy. Broadly known and admired, two-thirds (67%) of consumers familiar with actor George Clooney felt he would be a good fit for Tiffany. Such sentiment was even higher among Americans over 40 (69% for Gen X and 72% for Baby Boomers). Three in five (59%) consumers familiar with Will Smith – another well-known star – felt he would be a good fit for the brand. Such sentiment was higher among markets closely aligned with the actor-musician, such as African Americans (68%) and Gen X (64%).

Especially popular with young adults, celebrities Kim Kardashian and Timothee Chalamet were considered good fits for Tiffany more frequently among Gen Z than the among all adults (81% vs. 64% and 47% vs. 29%, respectively). Again, they show that although a celebrity may not always have mass appeal, they can be useful in attracting a new generation of buyers.

Other real-life partnerships in the industry show the success of such strategies. Citizen Watches currently uses tennis star Naomi Osaka as one of its brand ambassadors. QuestBrand brand equity data also prove the influence such partnerships can have on a brand’s perception among key audiences. Among Gen Z and Millennials, Citizen has steadily improved in its perception as a fun, hip, and bold brand while declining slightly in its perception as a “corporate” brand.

Brand revitalizations inherently come with risks of alienating current customer bases and failing to resonate with new target segments. Although Tiffany’s new campaign has garnered some resentment among its most loyal fans, the brand has caught the attention of younger consumers while generating tremendous buzz. Ultimately, Tiffany’s tactics to rebrand with controversial marketing and diverse brand ambassadors are a valuable case study for other watches and jewelry brands looking to adapt to an evolving, luxury consumer base.

Research Notes

*For this report, the luxury watches & jewelry category is defined as Omega, Citizen, Frederique Constant, Bulova, Movado, Tissot, TAG Heuer, and Apple Watch.

**The unweighted sample size for this group was less than 100 respondents but greater than 30 respondents for some or all questions surveyed in this study. While data is still statistically significant and valid for this group, to comply with The Harris Poll’s public release guidelines, this group’s responses for this insight are only reported as a directionally indicative.

***A celebrity is considered a “good fit” if a respondent reported they thought the celebrity was “an okay fit,” “a good fit,” or “an excellent fit” as a brand ambassador for Tiffany & Co.

Methodology

Consumer sentiment data on Tiffany & Co. was conducted online within the United States during August 20-23, 2021, among 1,053 adults (aged 18 and over) in the United States by The Harris Poll. Brand equity data for brands in the watches & jewelry category was collected during April 15 – June 30, 2021, among adults aged 18-40 in the United States by QuestBrand. Brand equity data for Citizen Watches was collected during March 1 – September 13, 2021, among adults aged 18-40 in the United States by QuestBrand. Figures for age, sex, race/ethnicity, education, region, and household income were weighted where necessary to bring them into line with their actual proportions in the population. Propensity score weighting was used to adjust for respondents’ propensity to be online.

All sample surveys and polls, whether they use probability sampling, are subject to multiple sources of error which are most often not possible to quantify or estimate, including sampling error, coverage error, error associated with nonresponse, error associated with question wording and response options, and post-survey weighting and adjustments. Therefore, the words “margin of error” are avoided as they are misleading. All that can be calculated are different possible sampling errors with different probabilities for pure, unweighted, random samples with 100% response rates. These are only theoretical because no published polls come close to this ideal.

Respondents for this survey were selected from among those who have agreed to participate in our surveys. The data have been weighted to reflect the composition of the adult U.S. population. Because the sample is based on those who agreed to participate in the online panel, no estimates of theoretical sampling error can be calculated. For more information on methodology or full data tables, please contact Dami Rosanwo or Madelyn Franz.

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Related Content