Brief • 2 min Read

1. Coinbase Gains Trust Despite Crypto Turbulence – Case Study

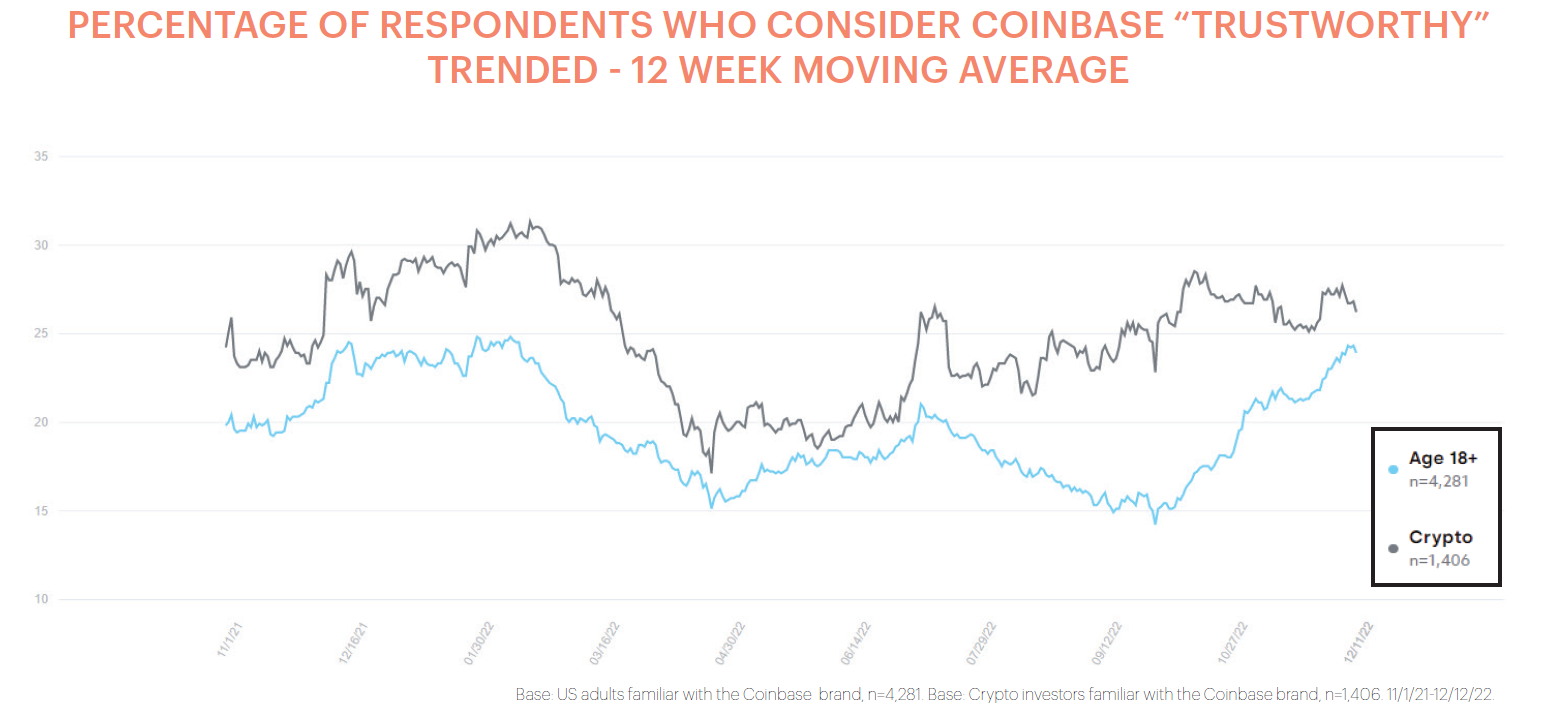

2022 was a tough year for crypto. Cryptocurrencies crashed, values plummeted, and FTX unexpectedly filed for bankruptcy. Using QuestBrand data, we explored how US adults, and more specifically crypto investors, felt about Coinbase throughout this turbulent year:

- In response to crypto’s volatility, investors became wary of engaging in trades. By May, Coinbase’s stock price had dropped 85% from its all-time high in Nov 2021.

- Brand Platform data shows Coinbase’s brand equity fall throughout the first half of 2022 as cryptocurrency values and consumer confidence plunged.

- In the second half of 2022, Coinbase reversed their downward slide, with several promising announcements that helped rebuild consumer trust.

Download our case study to see how Coinbase effectively earned consumers’ trust despite industry-wide uncertainty.

2. Embarking on a Dry January? You Aren’t Alone.

A recent Harris Poll study on behalf of Go Brewing found that 79% of US adults who drink alcohol said that they could be persuaded to participate in Dry January this year. In case you haven’t heard of Dry January, it’s a month abstaining from alcohol to give your body and mind a break. Respondents were interested in participating to:

- Improve their health (52%)

- Lose weight (35%)

- Increase focus on their goals (33%)

Takeaway: Let this be the motivation you need to resist cocktail-sized temptations this month. Take heart in the fact that you are not alone on your sober quest.

3. Marcus by Goldman Sachs Breaks Down Barriers to Investing – Brand Spotlight

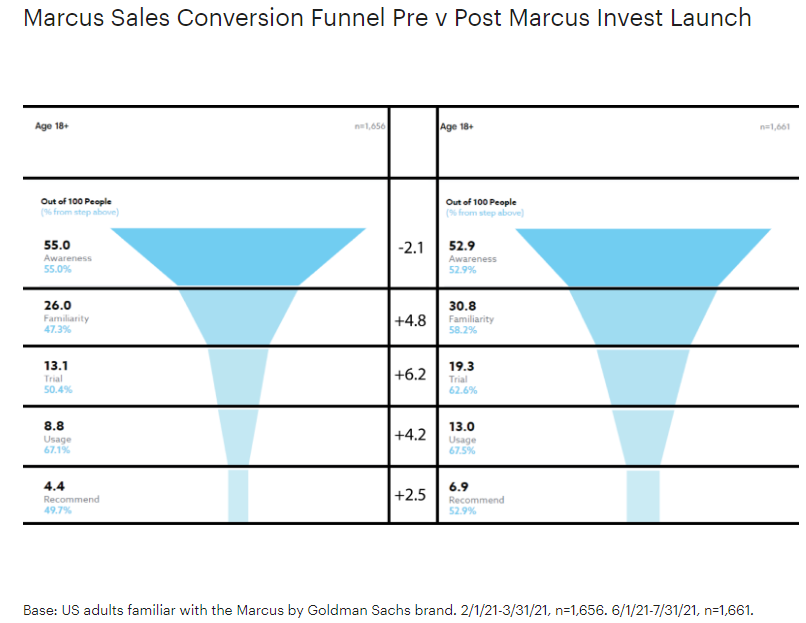

Goldman Sachs has typically represented high-asset clients who hold $10+ million in assets. This target demographic greatly widened with the launch of Marcus by Goldman Sachs in 2016, which initially only required a $1,000 minimum account balance to invest. In February 2021, the additional launch of Marcus Invest further increased consumers’ interest in the platform:

- With the launch of Marcus Invest, account balance minimums were eliminated, and management fees were reduced.

- According to QuestBrand data, all four measures of brand equity (+10.8) increased after the launch, but their steep increase in perceived quality (+20.1) is especially striking.

- Additionally, Marcus’ sales conversion funnel significantly widened as Marcus Invest opened the door to more everyday investors.

See how the launch of Marcus Invest greatly expanded the number of consumers who rely on the Goldman Sachs name for investing.

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Related Content