Brief • 3 min Read

Launched in 2011, SoFi is an online bank and personal finance company that is widely known for its student loan refinancing services. While the online bank remains unprofitable (as of Q3 2023), 2023 has proven to be a year of significant growth.

In Q2, SoFi added more than 584,000 new customers. In Q3, they added an additional 717,000 customers. While SoFi has many strong product offerings, the larger economic environment has made these products even more appealing to customers and helped spur this growth.

Want more information on trends within the financial services industry? Check out our Financial Services: An Industry Snapshot report for insights and brand rankings.

SoFi’s brand equity grows throughout 2023.

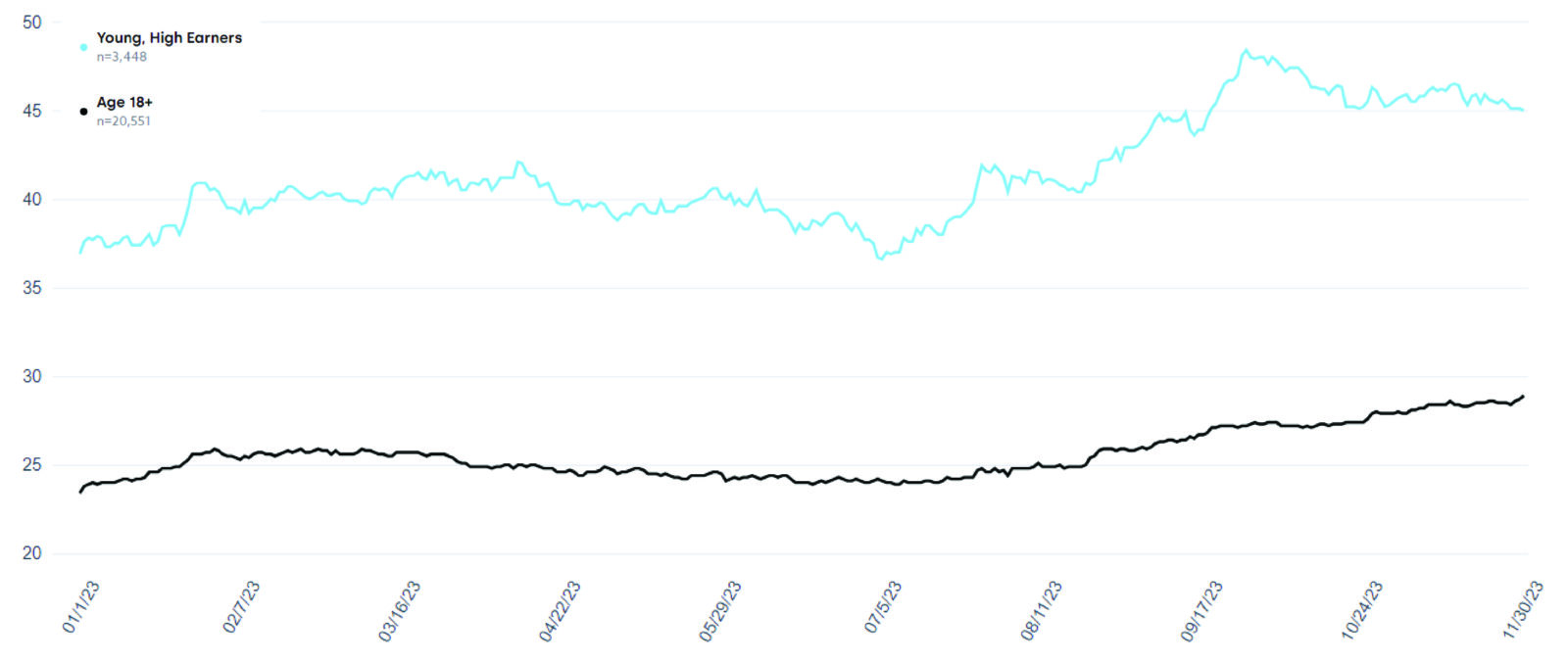

According to QuestBrand data, SoFi’s brand equity steadily rose among US adults throughout 2023. However, brand equity gains were most significant among SoFi’s target customer – high earning, young adults, with the largest jump in brand equity during Q3 (see graph below).

Throughout this post, “young, high earners” are defined as Millennials and Gen Z adults with an income of $100,000+. Among this demographic, SoFi started July with a brand equity score of 37.7. By the end of the third quarter, brand equity had increased to 48.0 (+9.3).

Brand equity measures the value consumers see in a brand at a particular moment of time. It is an average of four components: brand familiarity, perceived quality, purchase consideration, and perceived momentum.

SoFi Brand Equity – Jan-Nov 2023 – 12 Week Moving Average

QuestBrand. 1/1/23-11/30/23. Base: US adults ages 18+ (black), n=20,551. Base: Millennials + Gen Z adults, Income $100,000+ (Young, High Earners – blue), n=3,448.

What has made SoFi so attractive to young, high earners?

Recently, Americans have been hit with several economic hurdles – high inflation, interest rate hikes, and restarting student loan payments. SoFi’s offerings have appealed to consumers looking to navigate these turbulent financial waters.

SoFi offers some of the most favorable student loan refinancing options on the market. After several years of paused Federal student loan payments, interest started accumulating at the start of September, and payments resumed at the beginning of October. This decision could have contributed to SoFi’s Q3 jump in popularity as Americans look for new ways to manage their student debt.

“If you have a student loan, you want to lower your monthly payment, you’re able to do that either via a lower rate or extending the term. There are always trade-offs with those decisions, but we’re giving people that opportunity to get their money right through a variety of different vehicles, and that’s very appealing to them.” – Anthony Noto, SoFi CEO

Additionally, in the wake of multiple interest rate hikes and years of high inflation, customers appreciate SoFi’s high yield savings accounts. While the national average savings account rate stands at 0.61% APY, SoFi offers up to 4.6% APY.

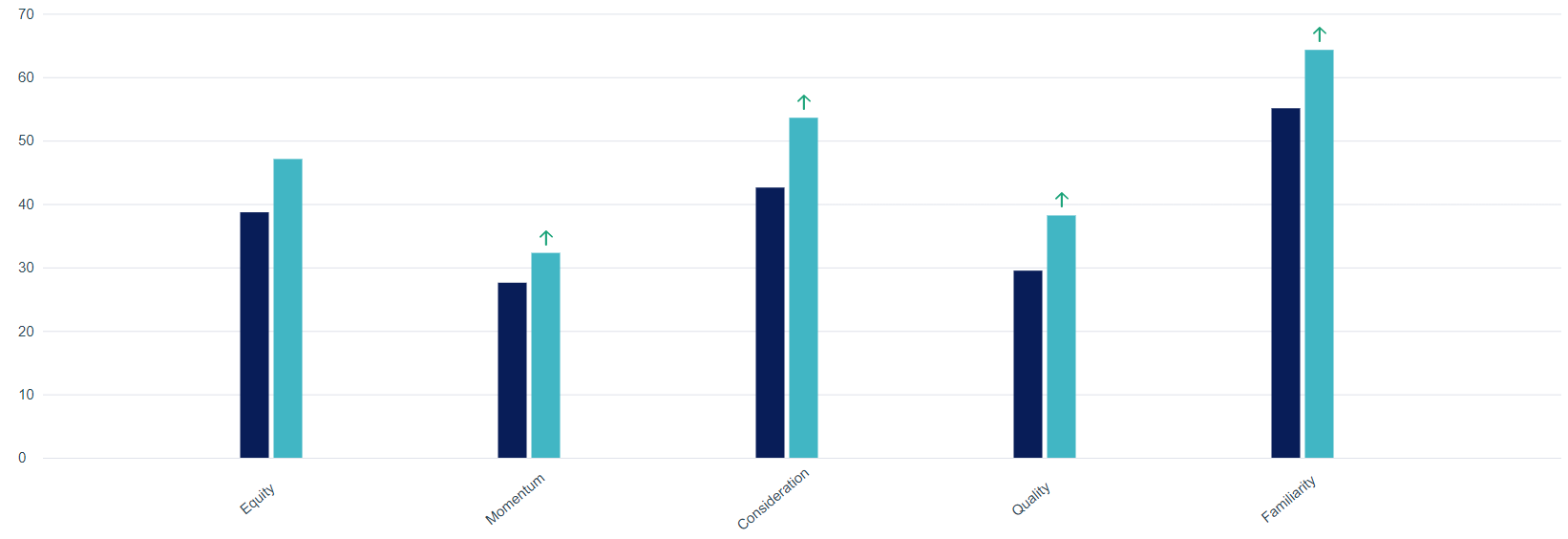

SoFi Brand Equity Among Young, High Earners Q2 vs Q3 2023

QuestBrand. Base: Base: Millennials + Gen Z adults, Income $100,000+ (Young, High Earners). Pre: 4/1/23-6/30/23, n=939. Post: 7/1/23-9/30/23, n=912.

The QuestBrand graph above compares SoFi’s brand equity among young, high earning adults in Q2 vs Q3. SoFi saw significant growth across all four components of brand equity – familiarity (+9.2), quality (+8.2), consideration (+11.0), and momentum (+4.7). These numbers reflect a growing familiarity with the SoFi brand, and a growing interest to engage with their products/services.

If SoFi continues on this path of significant quarter-over-quarter growth, we can expect good things from the popular fintech brand in 2024. Pretty soon, we may see SoFi push into a profitable quarter, or even celebrate a fully profitable year.

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Related Content