Brief • 3 min Read

While homeowners have always sporadically decorated and renovated, the COVID-19 pandemic sparked new fervor in DIY homeowners.

Spending more time at home than ever before, Americans were inspired to update and makeover their spaces. In some cases, rooms needed to be repurposed to fit the “new normal,” adding home offices, school spaces, and gyms. Simultaneously, home prices spiked across the country, encouraging Americans who would have moved homes to remodel instead.

Even as early as September 2020, three in four homeowners reported that they had already completed a project since the start of the pandemic. About the same number reported having a project planned. Three of the most frequently completed home projects include interior painting, bathroom remodeling, and installing new flooring. There was also a significant increase in the number of households improving their backyards with porches, fences, and garden-work.

Illinois-based protective paints and coatings company Rust-Oleum benefited from the continuous wave of home improvement projects. Using data from QuestBrand, the brand saw significant growth in their brand equity score from Q4 2021 to Q1 2022 (+3.1%). This number signifies the increase in consumer perceived value of Rust-Oleum products. Rust-Oleum was the second highest growth home care brand over this period of time, behind Pedigree pet food.

Want to see the top five home care brands by brand equity growth? Check out our Home Care & Products: An Industry Snapshot report for industry insights and brand rankings.

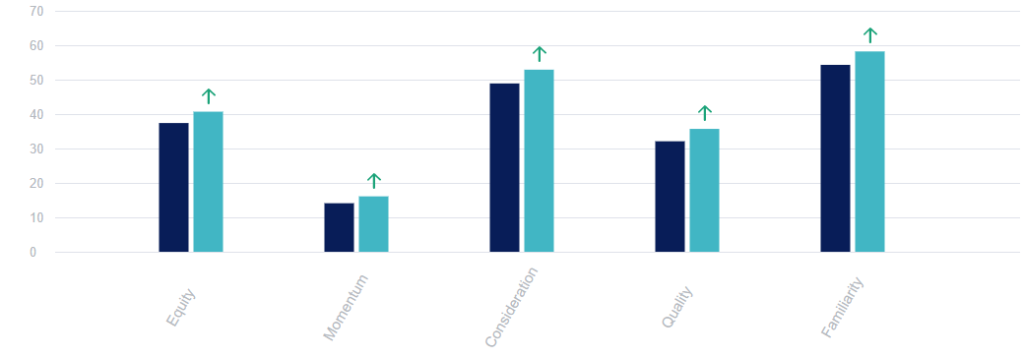

Rust-Oleum Brand Equity Q4 2021 Versus Q1 2022

QuestBrand. Base: general population. Pre: 10/1/21-12/31/21 n=2,586. Post: 1/1/22-3/31/22 n=2,501.

While Rust-Oleum saw increases across all four components of brand equity (familiarity, quality, consideration, momentum), the greatest increases are seen in brand familiarity (+3.9) and purchase consideration (+4.0).

This shows that consumers feel like they have a better understanding of the Rust-Oleum brand, and are more likely to consider the brand’s products for purchase. From these increases, Rust-Oleum’s overall brand equity increased from 37.4 to 40.7 (+3.3).

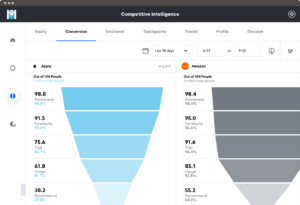

Rust-Oleum Sales Conversion Funnel Q4 2021 Versus Q1 2022

QuestBrand. Base: general population. Pre: 10/1/21-12/31/21 n=2,586. Post: 1/1/22-3/31/22 n=2,501.

Similar to Rust-Oleum’s brand equity components, the brand saw increases across all phases of the consumer sales funnel. Notably, the brand saw a +3.4 and +3.1 increases in their trial and usage scores respectively. This reflects that more consumers are trying and using Rust-Oleum’s products.

Attracting customers with robust DIY content

Rust-Oleum’s website successfully speaks to the DIY homeowner, with pages dedicated to DIY Projects, Tips & Techniques, How-To Videos, and information that makes their products more accessible to first-time project doers. This was especially important during the COVID era, when many homeowners were wary of inviting contractors and other construction professionals into their homes. Many more Americans were willing to try their hand at home improvements to reduce the risk of sickness.

Even though fear of COVID has abated from 2020 levels, the DIY trend has not disappeared. With soaring inflation, project costs are higher than ever. Many homeowners would prefer to save money by trying to complete a project themselves rather than pay hundreds or thousands of more dollars to hire a professional.

The future of home improvement: Where do we go from here?

While Rust-Oleum’s brand equity significantly increased last quarter, homeowners will determine whether the brand’s equity continues to rise, or if it levels out. If housing prices begin to fall, more Americans may choose to relocate to new homes rather than renovate existing properties, decreasing the need for DIY materials. However, timelines for potential decreases in housing costs are up in the air, and the DIY home care trend could continue to flourish throughout 2022.

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Related Content