Brief • 3 min Read

Pandora ranked 3rd in our latest AdAge-Harris Poll Gen Z brand tracker. This quarterly index uses QuestBrand data to rank the top 20 brands by brand equity growth among Gen Z adults (ages 18-24).

Brand equity measures the value consumers see in a brand at a particular moment of time. It is an average of four components: brand familiarity, perceived quality, purchase consideration, and perceived momentum.

From Q1 to Q2 2023, Pandora experienced a +12.6 lift in brand equity among Gen Z adults. In contrast, the popular jewelry brand experienced a -3.4 drop in brand equity among the general population of US adults. Let’s take a look at what resonated with Gen Z adults.

Prioritizing Sustainability

Gen Z is passionate about the environment and sustainability, and so is Pandora. Pandora features a line of lab-grown diamonds paired with recycled silver and gold. Their Diamonds by Pandora line won Fast Company’s 2023 World Changing Ideas Awards. In 2022, only 10% of diamonds sold were lab grown, the vast majority were mined. As the world’s third-largest jewelry retailer, Pandora’s production choices can have a significant impact on the entire industry.

Lab-grown diamonds have a lower carbon footprint than mined diamonds. Pandora’s 1-carat synthetic diamond set in recycled gold has lower carbon footprint than your typical pair of jeans. By 2025, Pandora plans to exclusively use recycled metals in their jewelry – they are the first large jewelry company to make this commitment.

Nostalgic Partnership

In May, Disney’s live action remake of the Little Mermaid came to theaters. In celebration of the film, Pandora partnered with Disney to release a line of Little Mermaid-inspired jewelry. Disney played a key role in Gen Z’s childhood. Pairing trendy jewelry with beloved Disney characters goes a long way with these young adults.

This is not the first time that these two powerhouse brands have come together. Pandora and Disney have previously partnered to produce jewelry featuring Disney princesses, Marvel superheroes, and other popular characters.

The Taylor Swift Effect

Chances are that you’ve heard of Taylor Swift’s Eras tour – the music tour that broke Ticketmaster. Swift’s Eras tour surpassed $1 billion in ticket sales, leaving scores of Swifties looking for the perfect concert ensemble.

In Q2, Swifties connected Pandora’s Celestial Sun and Moon Ring set with lyrics from one of Swift’s songs Midnight Rain – “he was sunshine, I was midnight rain.”

In response, Pandora experienced an 18,200% increase in website searches for “sun and moon rings” in June. Additionally, a TikTok video showing the rings received over 8.4 million views. Pieces from this collection temporarily sold out across multiple sales regions.

Purchase Consideration Soars

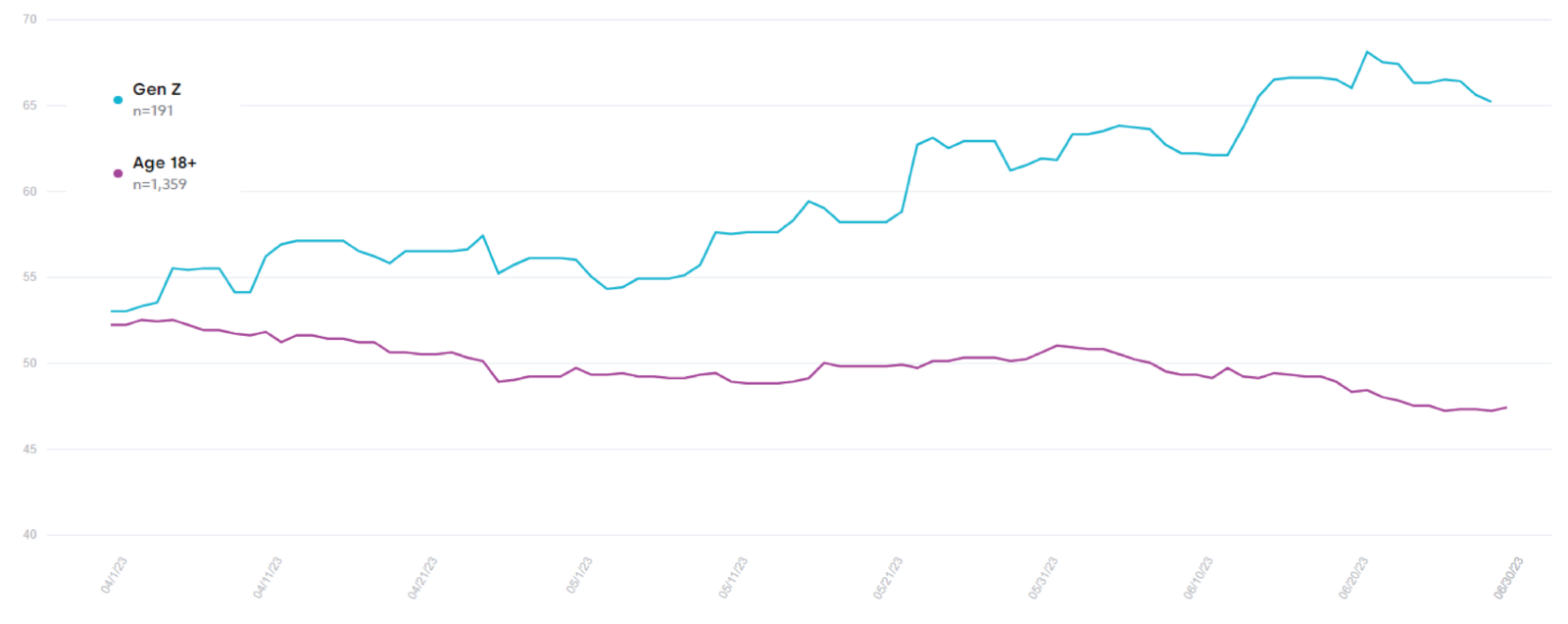

From the graph below, we can see how Pandora’s purchase consideration among Gen Z adults considerably increased throughout Q2, 2023. This indicates that Gen Z adults were significantly more likely to consider purchasing from Pandora at the end of June than they had been at the beginning of Q2.

Pandora’s Purchase Consideration Gen Z vs US Adults – 12 Week Moving Average

QuestBrand. 4/1/23-6/30/23. Base: Gen Z adults, n=191. Base: General population of US adults, n=1,359.

At the start of April, Pandora’s purchase consideration among Gen Z adults almost matched consideration among the general population of US adults at 53.0. By the end of June, consideration climbed (+12.2) among Gen Z adults, reaching 65.2. This occurred even as purchase consideration dropped among the general population of US adults over this same period.

Pandora made huge strides with Gen Z adults in Q2 due to their strong partnerships, sustainable sourcing, and a little T-Swift magic. As the youngest generation of adults, Gen Z is an important demographic to reach. If Pandora can convert these young consumers into regular buyers, the jewelry giant could acquire a loyal, long-term customer base whose buying power continues to grow.

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Related Content