Brief • 3 min Read

Netflix started in 1997 as a mail-order DVD subscription service. Two decades later, they began streaming content in the US. By 2023, they had amassed 230.7 million subscribers worldwide.

While Netflix is the largest streaming service (by number of subscribers), it is not without its fair share of hiccups. Throughout 2022, Netflix lost almost 1.2 million subscribers.

This drop in subscribers can be attributed to multiple factors, including: high competition in the streaming sector, rising monthly subscription fees, and password sharing across multiple households.

Momentum swings in the wrong direction

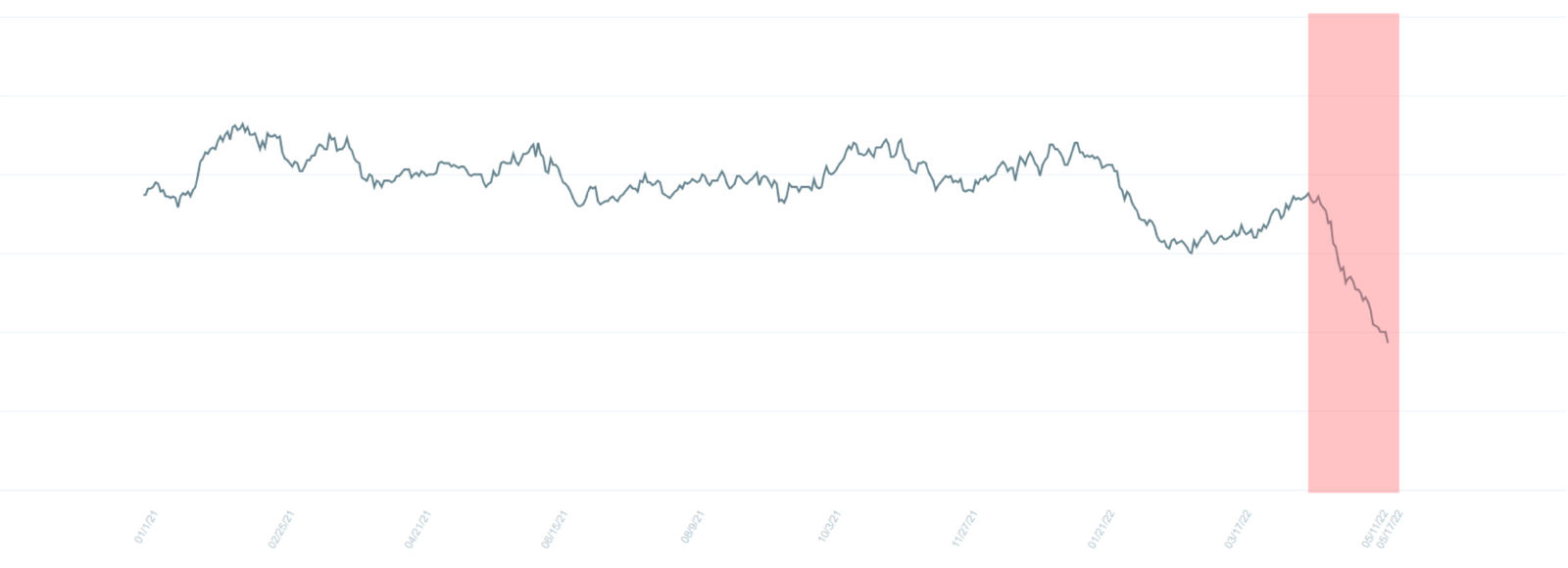

The graph below uses QuestBrand data to track Netflix’s momentum from January 2021 through mid-May 2022.

Momentum measures a brand’s ability to maintain market position and beat out competitors. In Spring 2022, Netfix’s momentum dropped steeply to its lowest-ever level (highlighted in orange).

This period of decline coincided with a slew of negative press, including Netflix’s drop in subscribers, a poor earnings report, and layoff announcements.

Netflix Momentum Jan 2021 – May 2022: 8 Week Moving Average

QuestBrand. Base: General population of US adults, n=15,571. 1/1/21-5/18/22.

Netflix enters a growing phase

“After a challenging first half, we believe we’re on a path to reaccelerate growth,” – Netflix Q3 letter to shareholders.

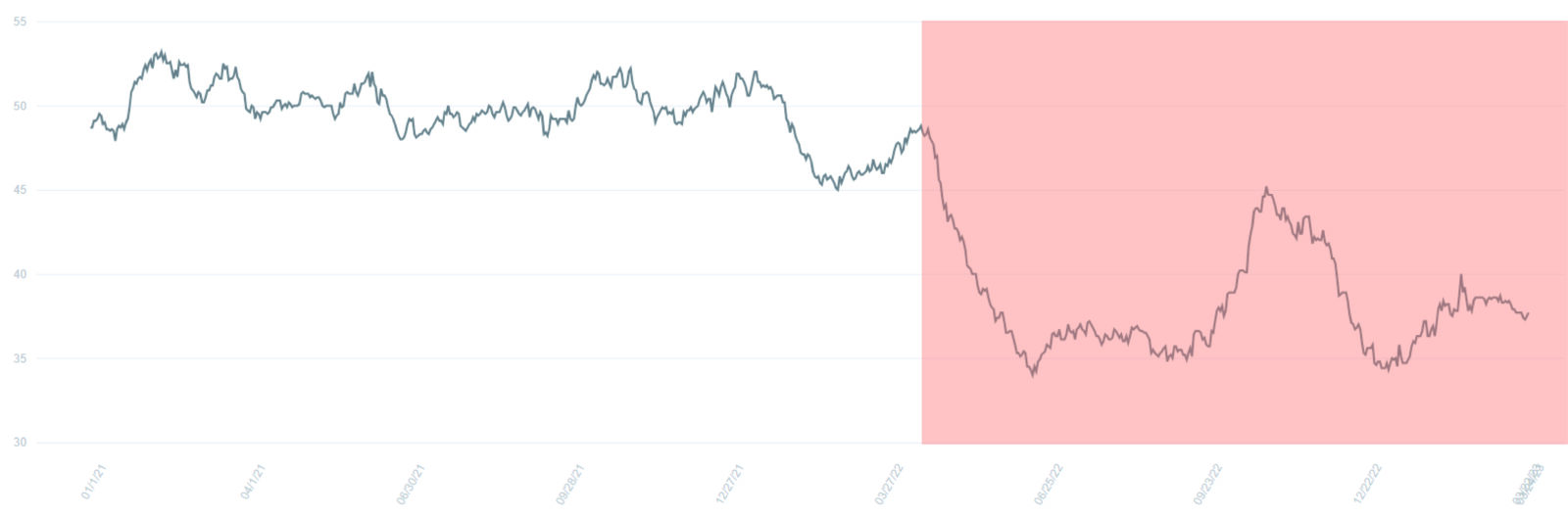

The graph below shows Netflix’s momentum from January 2021 – March 2023. Around June 2022, Netflix’s momentum begins trending in a more positive direction, and leads into a sudden momentum spike in the fall.

Netflix Momentum Jan 2021 – March 2023: 8 Week Moving Average

QuestBrand. Base: General population of US adults, n=23,062. 1/1/21-3/27/23.

After Netflix’s challenges early in 2022, the streaming giant had several exciting announcements in the fall that could help explain their surge in momentum.

In the third quarter, Netflix gained 2.4 million new subscribers, and they predicted adding an additional 4.5 million subscribers in the final quarter. Netflix’s Q3 earnings report was significantly better than expected. Together, these positive announcements drove Netflix’s share price up 13%.

In November, Netflix also released a less expensive, ad-supported subscription tier (“Basic with Ads”) to attract more price-conscious consumers.

More changes on the horizon

Account sharing has been one of the primary hurdles slowing Netflix’s growth, as multiple households stream their favorite shows off a single paid account. Netflix estimates that about 100 million non-paying households are using Netflix worldwide due to shared passwords.

They’ve started trying to crack down on account sharing in an attempt to force more paid subscribers. Netflix is testing a fix abroad before implimenting in the US. Under this plan, the account holder would set their “primary location.” They could then add up to two “sub accounts,” but would be charged a fee to add these other persons onto the account. You can bet that we will see some response from US consumers if/when Netflix rolls out this plan domestically.

While Netflix’s fall momentum surge was short-lived, their momentum has been slowly, but surely, rising throughout the beginning of 2023. Perhaps a few more positive announcements from the company this year could help bring their brand momentum back to 2021 levels.

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Related Content