Brief • 4 min Read

In The Harris Poll Tracker (Week 72) fielded July 9th to 11th, 2021 among 2,003 U.S. adults, we look at what Americans are thinking about the rise of the Delta variant, how Peloton’s brand withstood a recent crisis, if Americans are excited for VR and AR, who the biggest spenders will be this summer, and ageism in the workplace.

As a public service, our team has curated key insights to help leaders navigate COVID-19. Full survey results, tables, and weekly summaries can be accessed for free at The Harris Poll COVID-19 Portal. We will continue to actively field on a regular cadence to track the shifts in sentiment and behaviors as the news and guidelines evolve.

Delta Variant Brings 2020 Fear Déjà Vu and New Questions About Vaccines

Given the Delta variant of the COVID-19 virus now comprises over half of infections in the U.S., it’s no surprise we found (76%) of Americans have heard at least a little about the variant. Here is what else we uncovered about how the highly contagious variant is impacting the mindset of Americans:

- As the Delta variant spreads, American fear is back on the rise: Over seven in ten are fearful of more hospitalizations (71%), healthcare shortages (70%), and a rise in deaths (73%).

- What about the kids? Many are concerned about the threat posed to children (71%) and schools not being able to re-open in the fall as planned (62%).

- Jeopardizing herd immunity: (65%) say the news about the Pfizer vaccine not being as effective against the Delta variant is going to slow down vaccination rates in the U.S. even more and (70%) are fearful the variant will prolong herd immunity in the U.S.

- Seeding vaccine doubt: (62%) of unvaccinated people say “The Delta variant makes me second guess whether I should even get vaccinated,” and half (51%) of vaccinated people are questioning the efficacy of the vaccine they received.

- But some are unphased: Roughly half (47%) say “The Delta variant isn’t any more dangerous than the other strains of COVID we have dealt with” and that “People are overreacting about the Delta variant” (46%).

- Across the pond: The Wall Street Journal looks at how many fear the Delta variant could put Europe’s summer reopening at risk.

Takeaway: Though booster shots are not deemed necessary right now, many of those vaccinated are watching with caution. The rate at which this variant spreads poses, especially among communities with low vaccination rates, and a combination of new restrictions and fear could impact consumer sentiment as hot spots arise across parts of the country.

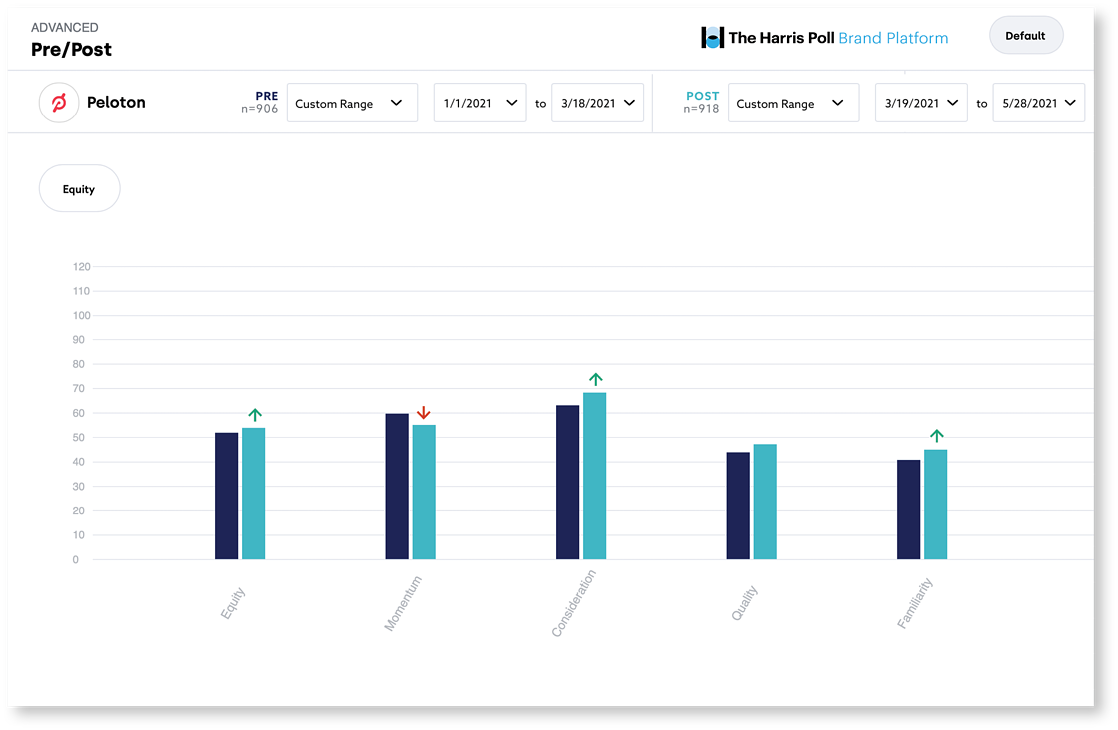

Weathering the Storm: How Peloton’s Brand Withstood a Crisis

In March 2021, Peloton faced its first major crisis as a fledgling brand following a high-profile accident involving its treadmill that left a child dead. In a new brand tracking case study, we look at data from our Harris Brand Platform to see the real-time impact on Peloton’s brand in the eyes of consumers during and after the crisis.

- Brand equity for Peloton increased overall following this incident, due to an increase in consideration and familiarity (two of the four components comprising brand equity).

- Although more consumers say they are thinking about purchasing from Peloton than before (consideration has increased by 8%), they also feel less confident in the direction of the brand (momentum has fallen by 7%).

- Digging deeper, we can measure consumers’ emotional responses and find that they see the brand as less trustworthy than they did pre-crisis.

- Similar adjustments to emotional perception indicate a deeper, tectonic shift in how consumers perceive the brand: Peloton’s perception among consumers as a ‘fun’ brand has dropped off while its perception as ‘corporate’ rose.

Takeaway: While Peloton appears to have emerged unscathed at first glance from its high-profile safety scandal, a deeper analysis shows there have been underlying – and unintentional – changes to how consumers think about the brand.

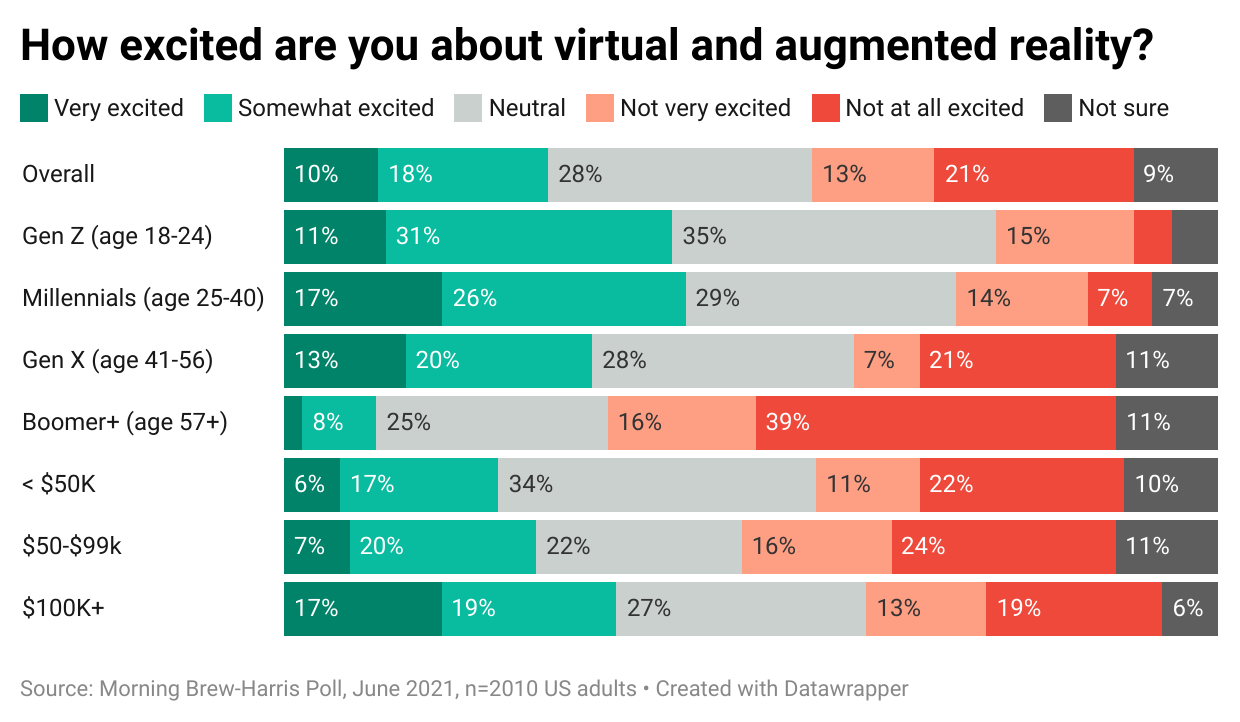

Nearly One Quarter of Americans Have Used a VR or AR Headset: Morning Brew-Harris Poll

In a recent poll in partnership with Morning Brew, we found a surprisingly high stat: nearly a quarter (23%) of Americans have used a VR or AR headset. But how excited are consumers about the future of these technologies?

- Among those who have used VR or AR, (31%) own a headset, (24%) have used a family member’s gear, and (13%) have tried hardware provided by a retailer. Nearly all (90%) of those who have tried a headset say they’re likely to use one again.

- Millennials are the most prolific users, with (42%) having tried the tech. Gen Z was the next highest demo at (29%).

- Compared with those who have tried a VR/AR device, the general public isn’t as enthusiastic about embracing the technology. Under 3 in 10 (28%) of all respondents say they’re excited about VR/AR, (28%) say they’re neutral, and (34%) are not excited.

- Four in 10 (41%) would be willing to buy a headset; and one quarter (25%) of them would be willing to pay $500 or more. For reference, the Oculus Quest 2 sells for $299.

- What’s your go-to brand? (35%) named Apple as their first-choice company to buy a device from, while only (5%) named Facebook.

Takeaway: Big Tech and many other metaverse aspirants are spending heavily to develop technologies that are far from must-haves for most consumers. But to paraphrase Steve Jobs, sometimes customers don’t know what they want until you show it to them.

How to Connect with Post-Pandemic Consumers Amid Summer Spending Spree: AdAge-Harris Poll

A new consumer landscape of emboldened spenders resulting from pandemic habits is emerging and marketers need to understand the lasting impact of the last year: which groups are increasing spending and who is still cautious, according to Harris Poll CEO Will Johnson in AdAge.

- The virtualization of American life is unlikely to diminish: a majority of consumers plan to buy groceries (53%) as well as other items (70%) online and two-thirds plan to get take-out from restaurants as often or more than they did during the pandemic.

- The first consumer group leading summer spending are the coupon-clipping bargain hunters, who plan to spend more on things like electronics and in-home entertainment.

- Stir-crazy parents, anxious to get out of the house, are the second group who plan to increase spending, especially on activities such as concerts and movies (40% of parents with children <18 plan to spend more, as compared to only 23% of those without kids).

- The third group of spenders are those mid-career (aged 35-44): They have pent-up income and are anxious to dispose of it after a year in lock-down. How do marketers reach them? More than anything else in advertising, they want the concrete facts about products: tell them where they can find it, how it works, and how durable it is.

- Gen X leads these lingering COVID-cautious consumers: A larger share of this generation plans to spend less, signaling ongoing financial insecurity. Take eating out: (27%) of Gen X plans to spend less (as opposed to 20% of the general public).

Takeaway: Just as temperatures are heating up, so are pocketbooks: not all consumers will be splurging this summer, but marketers will need to know which segments of the public are splurging – and on what.

Millennials Face Yet Another Workplace Challenge – Ageism: Fast Company-Harris Poll

Nearly one-third (31%) of working adults have experienced ageism in the workplace, according to our new poll conducted exclusively for Fast Company. Here is how assumptions in the workplace can impact how we see our coworkers:

- Among Younger Millennials (25-32) and Gen Z, more than one-third (36%) say they have experienced ageism – likely due to a perceived lack of experience as (44%) of this group agree that people their age are viewed as inexperienced (compared to 28% of Older Millennials 33-40 and Gen Xers).

- On the flip side: (37%) of all working adults say that people their age are viewed as out of touch at work and that grows to (39%) for workers over age 41.

- But it’s not just older workers who feel they are viewed as out of touch: (38%) of Gen Z and Younger Millennials do too, as well as (30%) of Older Millennials.

Takeaway: The disconnect is as old as time: the older cohorts consider the younger ones lazy and the younger ones wonder why the older ones can’t keep up, especially when it comes to technology. This pigeonholing can taint the working environment – and potentially, businesses’ bottom lines.

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Download the Data

This survey was conducted online within the U.S. by The Harris Poll from July 9 to 11, among a nationally representative sample of 2,003 U.S. adults.

Download

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Download the Data

This survey was conducted online within the U.S. by The Harris Poll from July 9 to 11, among a nationally representative sample of 2,003 U.S. adults.

DownloadRelated Content