Brief • 5 min Read

In The Harris Poll COVID-19 Tracker (Week 56) fielded March 19th to 21st, 2021 among 1,948 U.S. adults, we look at post-pandemic anxiety, out of home advertising’s role in a fashion boom, the impact of AstraZeneca’s vaccine on trust, how advertisers can target emerging post-pandemic consumer groups, and what Americans think about self-driving vehicles.

As a public service, our team has curated key insights to help leaders navigate COVID-19. Full survey results, tables, and weekly summaries can be accessed for free at The Harris Poll COVID-19 Portal. We will continue to actively field on a regular cadence to track the shifts in sentiment and behaviors as the news and guidelines evolve.

Ad Age-Harris Poll: How Brands Can Reach New Emerging Post-Lockdown Consumer Groups

Not all consumers are planning for the new normal in the same way. While a plurality of Americans is poised to jump-start the economy, others are more cautious. Harris Poll CEO Will Johnson breaks down how brands can cash in on the “Roaring ‘20s” with three emerging consumer groups in a survey shared exclusively with Ad Age.

- Pent-Up Spenders: Demographically, they are likely to be Millennials and/or those with robust incomes. In short, these groups are eager to make up for their lost year, so marketers should focus on them when pushing new and innovative products.

- Status Quovians: This stay-the-course cohort is largely composed of Gen Xers and Boomers as well as those in the middle class. They will be a bit more conservative with their pocketbooks, so advertisers should emphasize durability and discounts and stick to the basics with them as they’re not inclined to get adventurous in their shopping.

- The Pandemic-Shy: Lower-income households remain the most reserved. They’re going to need more time to feel comfortable opening their wallets again. For advertisers, that means less emphasis on new products and more on engaging content.

Takeaway: Consumers of all ages and incomes are ready to start spending at some level again. Brands need to take how the pandemic has affected these groups into consideration when advertising and hit these key points make sure that spring is the new holiday season.

Post-Pandemic Anxiety: APA-Harris Poll in CNBC

For the past year, Americans have dreamt of when our lives could go back to “normal.” As we inch closer to this dream becoming a reality, The American Psychological Association and The Harris Poll take a closer look as to why Americans are anxious about getting back to our pre-pandemic lives and featured in CNBC.

- Nearly half (49%) reported feeling uncomfortable about returning to in-person interactions once the pandemic ends including (48%) of vaccinated Americans.

- The Pandemic as a Wake-Up Call for Personal Health: as reported in The New York Times, (42%) of Americans say they gained an average of 29 “pandemic pounds,” increasing their COVID risk.

- Additionally, nearly 1 in 4 (23%) reported drinking more alcohol than usual to cope with pandemic-related stress.

Takeaway: Americans have adjusted to isolation and the thought of being surrounded by other people (outside of our bubble) is anxiety-inducing. As The Harris Poll explains, COVID-19 PTSD is real, and we may feel the side effects of it for a long time.

The Big Fashion Comeback? OAAA-Harris Poll in Vogue Business

Since the start of the pandemic, out-of-home (OOH) advertising has gained the attention of consumers looking to get outside, as reported in our research with the Outdoor Advertising Association (OAAA) and featured this week in Vogue Business. The medium has become more interactive and accessible and brands, especially as fashion brands are learning to programme their OOH ads to achieve a variety of goals.

- Fashion is betting big on OOH: “We’re seeing a 573% increase in commitments from fashion brands and retailers this January and February 2021 compared to the same time last year,” says Chris Gadek, vice president of growth at AdQuick, which sources OOH ad options for Drake’s OVO fashion brand, M.M.LaFleur and The Kooples.

- Not your grandparents’ billboards: “Marketers have had to adapt to consumers’ altered schedules,” says Anna Bager, CEO and president of the OAAA. “Eyeballs have shifted from very metropolitan places like Piccadilly Circus in London or Times Square in New York, but that doesn’t mean that they’re not outside; they’re just now somewhere else.”

- OOH advertising still has clout: the channel informed more than 25% of US adults of a new brand this past year, while in larger metropolitan areas, 34% said it influenced their purchasing decisions according to our recent study.

- Dynamic, digital campaigns: Since the pandemic began, (31%) of US adults have used QR codes more and 19% used augmented reality more. More than 4 in 10 are also interested in deals available through contactless tech, with (45%) willing to use tap-to-pay transactions and (41%) willing to scan QR codes.

Takeaway: “Out is ‘in’ this year,” concludes John Gerzema, chief executive of The Harris Poll. “People are eager to make up for lost time. They’re looking to get back out into the world with a vengeance [and] this makes out-of-home advertising an especially smart buy right now. Brands should meet consumers where they are, which will be anywhere but at home on Zoom.”

AstraZeneca’s Impact on Vaccine Confidence

After more than a dozen countries in Europe paused administration of the AstraZeneca COVID-19 vaccine due a possible connection to blood clots, Europe’s regulatory agency reviewed a second time and found the vaccine to be safe. How does this impact the public’s sentiment towards vaccines in general?

- One in four (40%) of Americans who are not vaccinated but plan on it reported being worried by the news and may even delay their vaccination because of it. This hesitancy is especially true for Black Americans (51%), Millennials (44%), and Parents (42%).

- More than one-third (36%) say that the news makes them more concerned about other vaccines, but they’ll still definitely get the shot. And (24%) say it makes no difference to them.

- Wait and See: Americans continue to be split between getting the vaccine as soon as it’s available to them (27%) and the “wait and see” mentality (23%). Nearly one third (29%) of Gen X Americans are ready to be first in line as soon as the vaccine is available to them compared to just (15%) of Gen Zers.

- The New York Times looks at how trust in the AstraZeneca vaccine is shaken in Europe following the pause in inoculations. However, trust in the vaccine will likely take another hit as U.S. health officials raise concerns over how the company might have relied on out-of-date information for their U.S. trial that found the vaccine to be 79% effective.

Takeaway: Concern over side effects is the biggest barrier for Americans hesitant to get a COVID-19 vaccine: more than half (55%) of those taking a “wait and see” approach say unknown side effects are their biggest cause of concern. Halting an already approved vaccine, even out of an abundance of caution, could erode trust across the globe for other vaccines rather than build it.

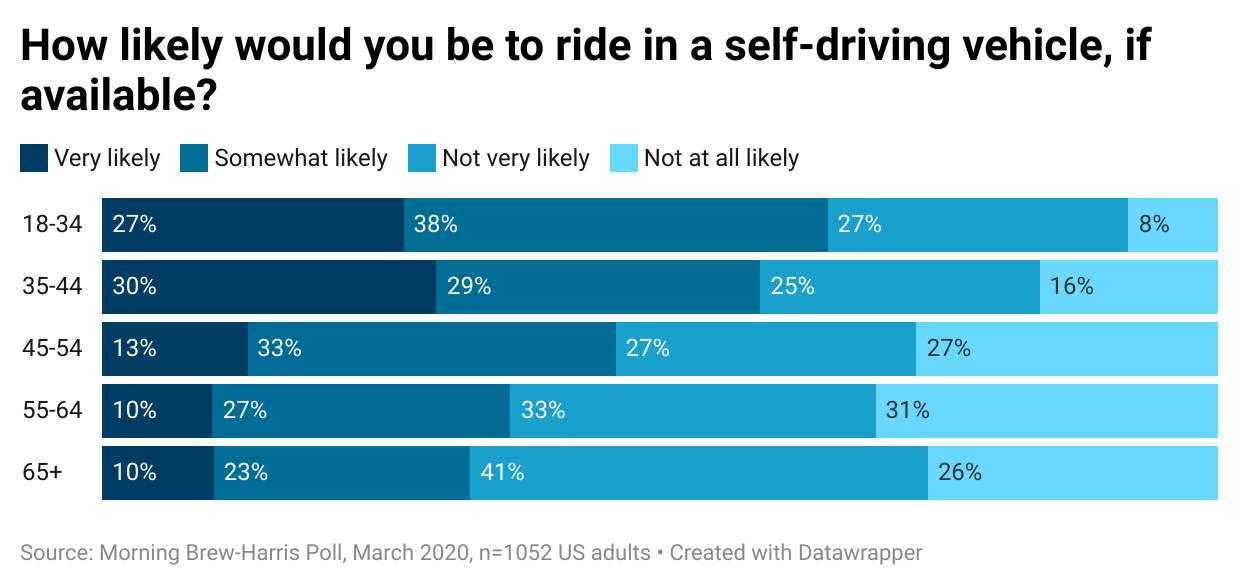

Morning Brew-Harris Poll: US Adults Have Mixed Feelings About Self-Driving Vehicles

Contrary to popular belief, there currently aren’t any self-driving vehicles available for purchase by consumers in any part of the world. Morning Brew and The Harris Poll look at the hypotheticals if a fully autonomous vehicle were available to the general public.

- Backseat drivers: Nearly half (48%) would feel some level of safety being in the passenger seat, while not surprisingly more (59%) would find comfort in the driver’s seat.

- Not my steering, not my problem: If you’re not actually driving a vehicle, where does the responsibility lie if an accident were to occur? Three quarters (75%) of Americans would like to understand where the liabilities exist if involved in an accident.

- Younger generations are more likely to adopt this new technology compared to their older counterparts. Gen Z (71%) and Millenials (62%) are almost twice as likely to ride as a passenger as Baby Boomers (32%).

Takeaway: Americans are curious about self-driving cars, and although we aren’t able to multitask while commuting to work just yet, there is a potential market for fully autonomous vehicles.

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Download the Data

This survey was conducted online within the U.S. by The Harris Poll from March 19 to 21, among a nationally representative sample of 1,948 U.S. adults.

Download

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Download the Data

This survey was conducted online within the U.S. by The Harris Poll from March 19 to 21, among a nationally representative sample of 1,948 U.S. adults.

DownloadRelated Content