Brief • 4 min Read

In The Harris Poll COVID-19 Tracker (Week 51) fielded February 12th to 14th, 2021 among 1,984 U.S. adults, we look at sentiment around vaccines, new variants, and double masking and how some Americans are still struggling to get a COVID-19 test. We also look at new insights from our OAAA-Harris Poll report that points to new opportunities for out of home advertising during the pandemic. Lastly, we dive into findings from our new Brand Bowl index on how Super Bowl commercials resonated with audiences and what the GameStop drama tells us.

As a public service, our team has curated key insights to help leaders navigate COVID-19. Full survey results, tables, and weekly summaries can be accessed for free at The Harris Poll COVID-19 Portal. We will continue to actively field on a regular cadence to track the shifts in sentiment and behaviors as the news and guidelines evolve.

Vaccines Likelihood Rises, as Does Double Masking

As COVID-19 vaccines continue to roll out across the country, our latest data shows vaccine likelihood continues to rise as well; (70%) likely to get the vaccine as soon as it becomes available to them (up from October 24th when vaccine likelihood was at its lowest 54%). And with the arrival of new virus variants, we checked in on attitudes towards doublemasking:

- While vaccine skepticism is declining, there is still a racial disparity: Among those who are not likely to get the vaccine (30%) Black Americans remain the most unlikely to get the vaccine (39%) compared to White Americans (27%), citing lack of trust in the government to make it safe (21%) vs (14%) of White Americans.

- Based on the new covid-19 variants, scientists and experts are recommending that people ”double mask’, and our latest survey findings that the majority (61%) support double masking. We see higher support among those who are typically more at risk (64% Boomers vs 55% Gen Z) and those who are more likely to get the vaccine (70%) vs (39% not likely).

- But, support doesn’t always mean action: While, less than a third (28%) say “double masking is going too far,” more people say “I think it’s a good idea, but I’m not double masking right now” (40%) vs those who say “I think everyone should be double masking right now given how dangerous the new variants are” (32%).

- In fact, less than half (43%) say they are double-masking always/most of the time. This is up slightly from two weeks ago on January 31st, when (39%) said they were double masking. Interestingly, Hispanics, Black Americans and Asian Americans are more likely to be double masking than White Americans (62%, 58%, 54% vs 39% respectively).

Takeaway: While vaccine skepticism is dwindling, racial disparities still pose challenges, as does a passive mindset towards double masking (the top recommendation to protect against variants) where many say they support it but don’t plan on doing it.

1 in 4 Americans Were Unable to Get a COVID-19 Test When They Wanted One: STAT-Harris Poll

As the U.S. struggles to contain the COVID-19 pandemic, nearly a quarter of Americans say they wanted to get tested for COVID-19 but were unable to do so, according to the latest survey from STAT and The Harris Poll.

- Nearly one-quarter (24%) of Americans reported that they could not get a COVID-19 test due to various reasons – (10%) the wait for a test was too long, (8%) a testing site was not nearby, (8%) it was unclear where to go for a test, or (7%) transportation to a test site was unavailable. Some people cited more than one of these hurdles.

- At the same time, nearly one-third (31%) said they were able to get tested when they sought to do so. The rest (45%) said they have never wanted to be tested.

- Half (49%) of Americans have been tested for COVID-19: (19%) once; (16%) two to four times; and (14%) five or more times. Most (56%) have been tested at a hospital or drive-through site. For the vast majority (69%), the test was conducted using a nasal swab.

- The most common reason for receiving a COVID-19 test — at (28%) — was that they had come in contact with someone who had tested positive for COVID-19, while (24%) said they had possible symptoms of COVID-19 and (21%) were required to get tested by their job or school.

Takeaway: Vaccines will be the magic bullet to end the COVID-19 pandemic, but testing will continue to play a crucial role in containing spread until herd immunity is reached. The notable percentage of people who ran into difficulties getting tested underscores one of the ongoing challenges that federal and state officials face as the country attempts to contain the coronavirus.

OAAA-Harris Poll: 6 Consumer Habits That Will Boost OOH Impact in 2021

Late last month, the Centers for Disease Control and Prevention (CDC) announced in-person schooling can be done safely if proper precautions such as mask-wearing, social distancing, and local community restrictions are taken, even before teachers receive vaccinations. This week we asked Americans how they feel about reopening schools:

- Americans are becoming more receptive to outdoor messaging: 19% are noticing out of home (OOH) advertising much more, up 5-pts since the fall, as they are increasingly tired of looking at their smartphones: (75%) of respondents said they are experiencing digital device fatigue (up 7-pts since the fall).

- COVID hasn’t completely ruined the commute: Over the next few months, (70%) of workers will be commuting at least part time; (45%) will commute daily and (26%) mix working from home and commuting (26%).

- Different levels of income are also tied to workers’ need to commute: (57%) of households with an income of less than $50,000 per year will commute compared to (34%) of households that make more than $150,000. But (66%) of the $150,000 households will commute at least part-time.

- OOH advertisers will want to reach consumers where they are: Most Americans (86%) are visiting the grocery store and (70%) are driving on the highway at least once a week. In general, (83%) of people notice OOH while driving on highways, more than driving around a home town (82%) or when visiting a city or town where they don’t live (71%). One-quarter (24%) said OOH informed them of a new brand this past year, while in larger metropolitan areas, (34%) said outdoor ads pushed them to buy a product.

Takeaway: “People are eager to make up for lost time,” said John Gerzema, CEO, The Harris Poll. “They’re looking to get back out into the world with a vengeance. Brands should meet consumers where they are, which will be anywhere but at home on Zoom.”

Harris Poll Inaugural Brand Bowl

Last week, The Harris Poll was excited to release the inaugural Brand Bowl report which looks at the impact Super Bowl LV’s commercials had on brand equity – momentum, consideration, quality, and familiarity – for both emerging and established brand – by measuring before and after the big game to determine who saw the biggest gains. What did it find?

- Most Super Bowl viewers preferred ads that were “funny or clever” (59%). Ads that featured celebrities Americans liked also fared well, with (43%) of viewers enjoying these spots, as did commercials that were uplifting (42%).

- Most (70%) of Americans claimed to have watched this year’s Super Bowl and (93%) of watchers paid attention to the commercials. Over 8 in 10 (82%) tuned in on a TV, with (60%) using cable or a satellite and (23%) streaming. Over one-quarter (28%) of viewers across all devices used an official stream, compared with (10%) who admitted watching on an unofficial one.

- Lesser-Known Brands See Big Game Boost: Dr. Squatch, the fast-growing soap brand, took a chance with an offbeat ad and tied with Paramount+ for first place in driving post-game awareness. And the ad’s unconventional take on an infomercial succeeded in changing consumer perception: the day after watching the ad, consumers were significantly more likely to associate Dr. Squatch with attributes such as ‘innovative’ (+23%), ‘young’ (+20%), and ‘visionary’ (+14%).

Takeaway: Ad Age cites the Brand Bowl in a profile of Jeep’s highly covered commercial with rock legend Bruce Springsteen: “The Harris Poll showed the spot as boosting Jeep’s brand equity, falling in the top half of that score among all Super Bowl advertisers. The ad led to an increase of 93% in web traffic to Jeep brand pages on online retail site cars.com. That placed the brand behind Cadillac (whose ad put a new spin on “Edward Scissorhands”) but ahead of Toyota.”

What We Can Learn About the Fall Out From GameStop: USA Today-Harris Poll

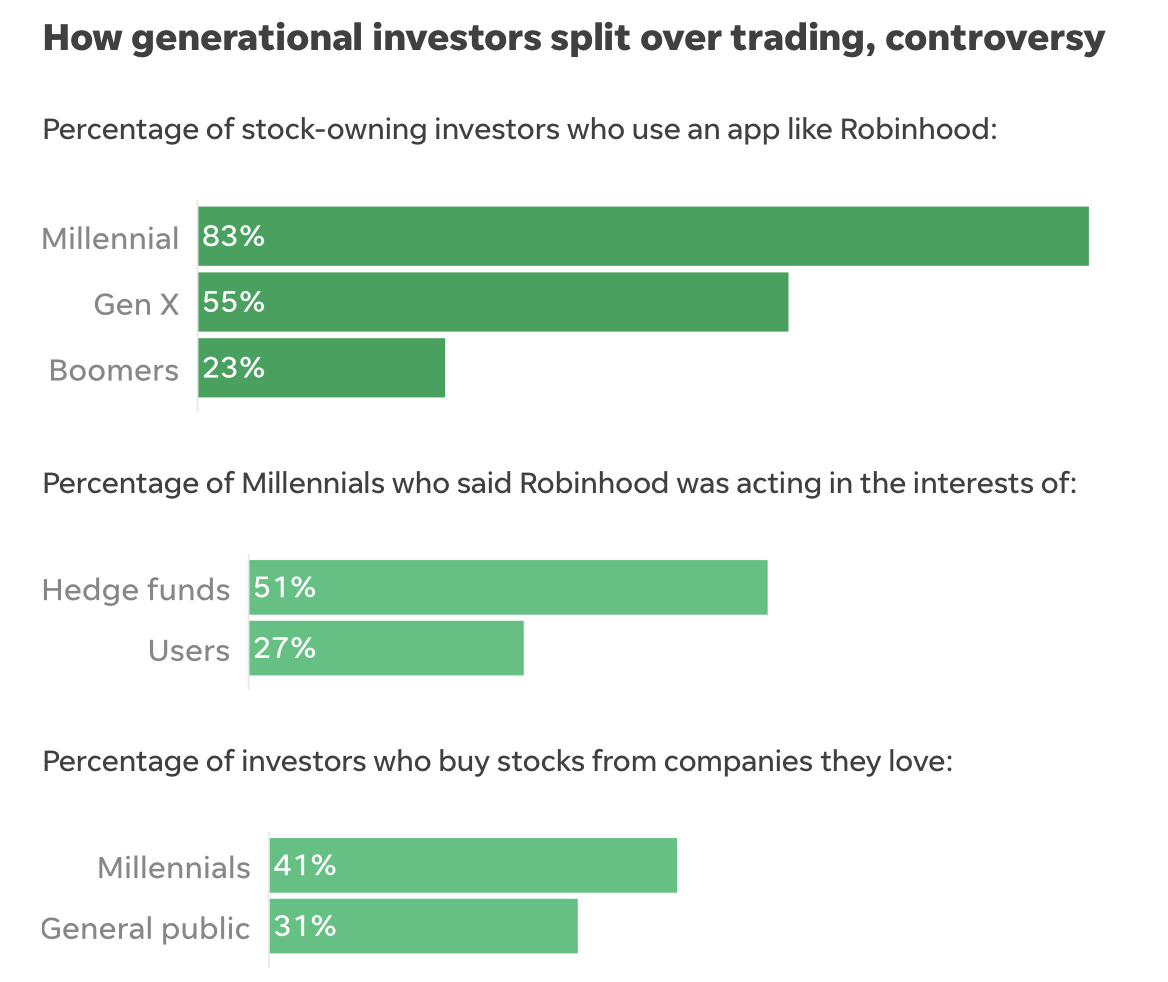

The drama involving GameStop, Robinhood, and Reddit from earlier this month will be a case study in years to come in brand reputation and adapting to the new platforms. Last week, Jessica Menton at USA Today used our data to look at what we can learn from the fall out of the GameStop story:

- Who do Americans blame? When asked who was the “most in the wrong” in the trading mania that set off one of the biggest short squeezes in history, nearly half of Americans polled said it was either hedge funds (27%) or online brokerage Robinhood (22%).

- Just (8%) said it was the Reddit retail investors on the r/WallStreetBets forum, who angered hedge funds that had bet GameStop’s stock would remain low. The small-time investors used the forum to help drive up the prices for shares such as GameStop, theater chain AMC Entertainment and several other companies.

- Why do Americans blame hedge funds or Robinhood? The Harris Poll CEO John Gerzema says it is because many Americans were angry that hedge funds were shorting stocks – betting that the share prices would fall – of companies that average people use and love.

Takeaway: “Many respondents were angry that hedge funds were shorting stocks – betting that the share prices would fall – of companies that average people use and love,” according to John Gerzema, CEO of The Harris Poll. “This wasn’t just an attack on a few weak companies. These are companies that are a part of middle-class America and ordinary people’s lives.”

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Download the Data

This survey was conducted online within the U.S. by The Harris Poll from February 12 to 14, 2021 among a nationally representative sample of 1,984 US. adults.

Download

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Download the Data

This survey was conducted online within the U.S. by The Harris Poll from February 12 to 14, 2021 among a nationally representative sample of 1,984 US. adults.

DownloadRelated Content