Brief • 4 min Read

In The Harris Poll Tracker (Week 111) fielded from April 8th to 10th, 2022 among 2,121 U.S. adults, we look at how inflation has become both a concern and an excuse to forgo a purchase or an activity (even when money isn’t a concern) in partnership with Bloomberg. Also included is a partnership poll with STAT detailing how Americans are ready for their second COVID jab and our poll with Forbes found that Americans are not ready to wave the air travel mask mandate goodbye. To end, we have CEO Will Johnson’s surprise finding on how Americans are coping with inflation and a Harris Brand Platform case study.

Tune in for our America This Week: From The Harris Poll audio event, this Friday at 10am EST on LinkedIn for a data-driven discussion between our CEO John Gerzema and CSO Libby Rodney. They’ll be covering the latest trends in society, the economy, and the consumer marketplace.

As a public service, our team has curated key insights to help leaders navigate COVID-19. Full survey results, tables, and weekly summaries can be accessed for free at The Harris Poll COVID-19 Portal. We will continue to actively field on a regular cadence to track the shifts in sentiment and behaviors as the news and guidelines evolve.

Inflation is Recasting Americans’ Relationship with Money – and Each Other: Bloomberg-Harris Poll

In our latest survey in partnership with Bloomberg, we found that (84%) of Americans plan to cut back spending as a result of price spikes. It’s also changing consumer behaviors in some unexpected ways:

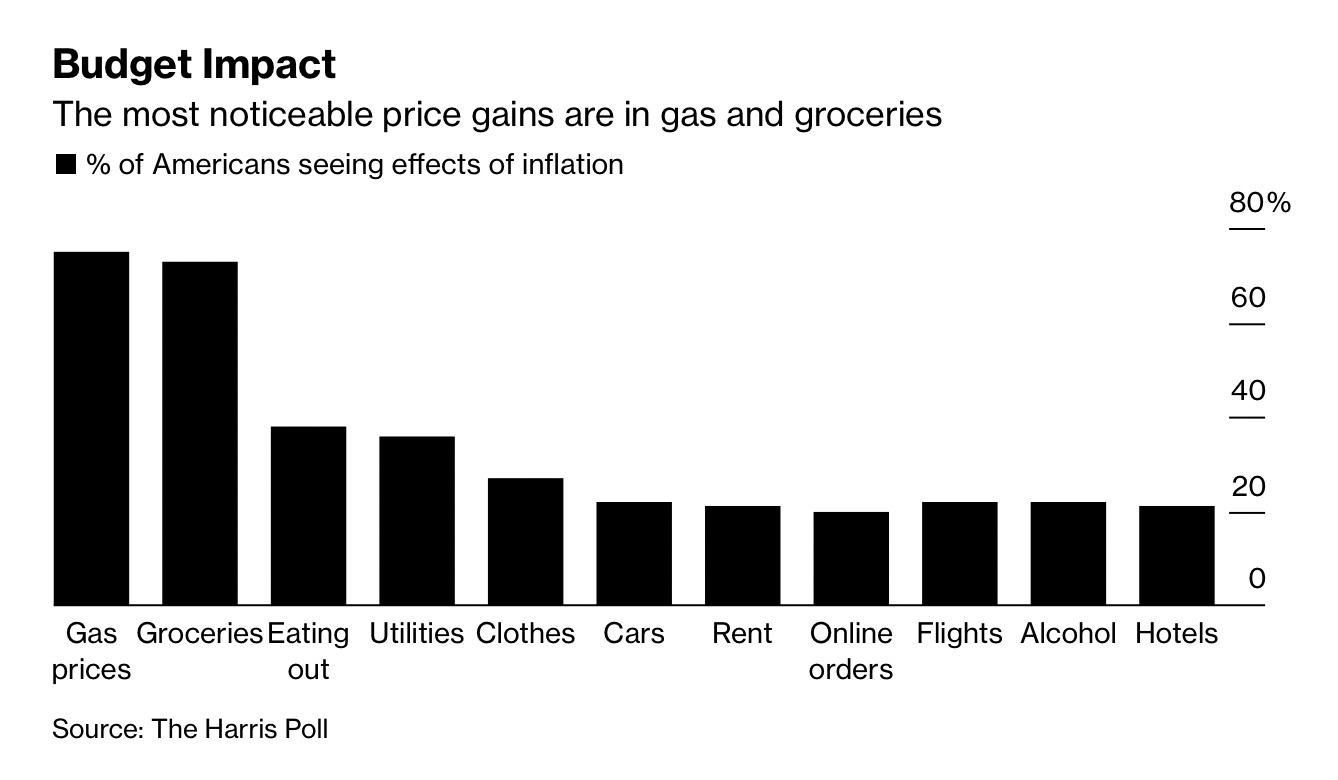

- More than 7 in 10 report feeling the effects of inflation the most in gas prices and groceries, which isn’t surprising given that consumer price index data shows gas prices surged (48%) and food rose (8.8%) from a year earlier.

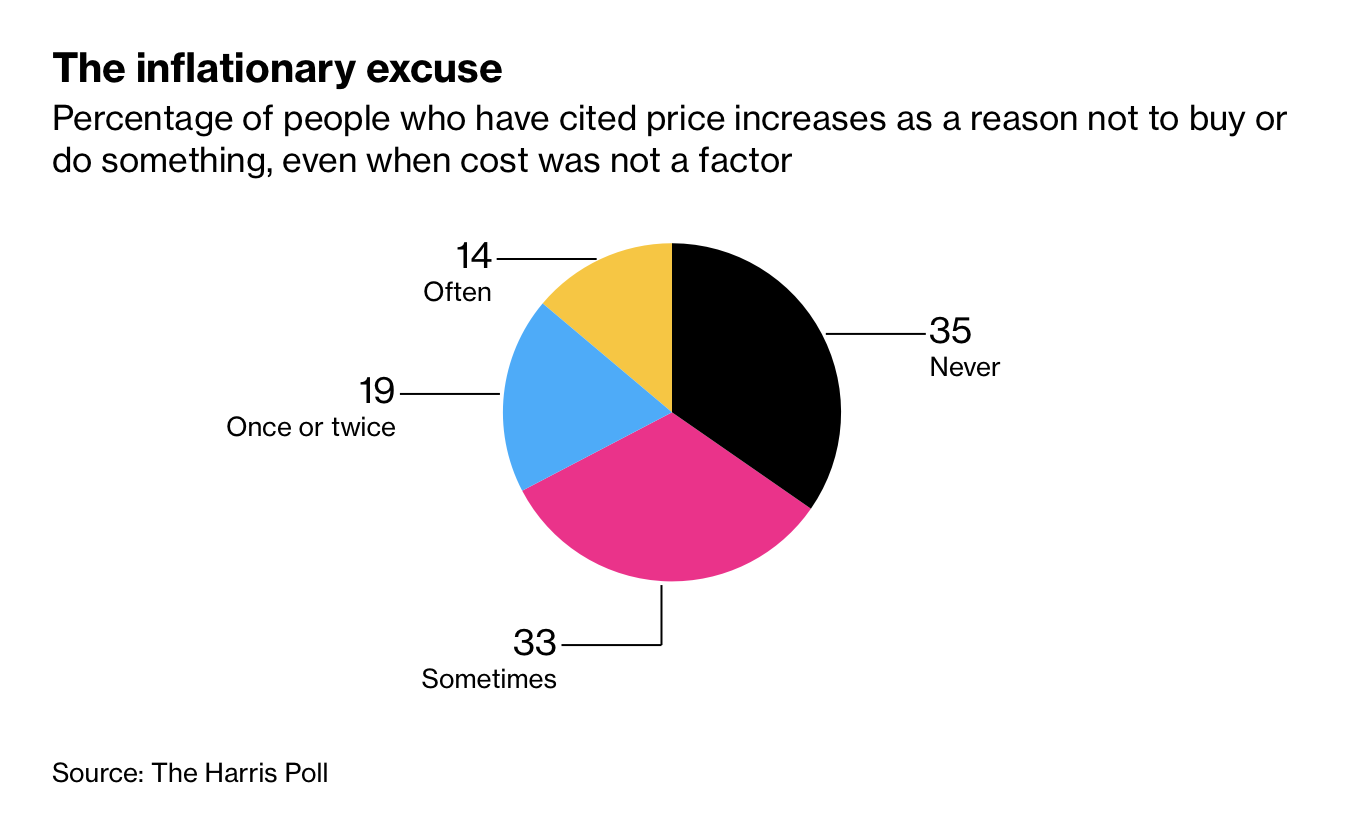

- Inflation may be the new excuse for skipping plans: Nearly half (47%) of Americans are using rising prices as an excuse to not buy or do something even when price wasn’t an issue (52%), and (51%) of high-income households say they have done so (v. 44% of low-income households).

- Other surprises? Pets are ranking higher than humans as while (71%) say they are likely to sacrifice the quality and quantity of spending on goods for themselves and/or their spouses or partners (56%), only (48%) would cut back on spending for their animals.

Takeaway: While over half of Americans do report some upsides to inflation – cutting back on impulse purchases, increased pay, and debts are easier to pay off – that doesn’t make their outlook any brighter. Only a quarter say they see inflation ending this year, while nearly a third expect it to last into 2023 and a fifth indefinitely.

Most Americans Would Get a COVID Booster Shot If Recommended: STAT-Harris Poll

As the FDA panel weighs the ongoing use of booster shots for COVID, our latest survey with STAT finds that 6 in 10 Americans have already decided they will get another booster if it’s recommended for them.

- So, who’s getting the shot? Not surprisingly, (73%) of Baby Boomers and more than two-thirds of Democrats plan to get a booster, if recommended, compared with (48%) of Gen Zers and just over half of Republicans.

- Additionally, (73%) of Asian individuals and (65%) of white respondents are likely to receive a second booster, with Black and Hispanic individuals are a bit more hesitant (54%, 43%, respectively).

- However, just under one-quarter of adults indicated they will only receive a second booster shot if a new variant arises or there is a surge in COVID cases in their area, and (18%) have no plans to get a booster at all.

- Getting back to their lives: Among those surveyed, (62%) said they are running errands or shopping without wearing a mask, (57%) are eating at restaurants unmasked, and (51%) are going to work without wearing a mask.

Takeaway: Our polling is feeding into a larger national discussion about the ability to create a public health policy around regular booster shots for COVID, and the data underscores some of the challenges that policymakers may face since the booster shots have proved divisive among different groups.

Americans Aren’t Ready for the Mask Mandate for Air Travel to End: Forbes-Harris Poll

In less than a week, the federal mask mandate for public transportation is due to expire, but our latest survey with Forbes indicates that the majority of Americans are still not quite ready to see it go.

- Most Americans (60%) support extending the mask mandate, and a third (32%) say they “strongly support” the Administration in extending the mandate (v. strongly oppose: 19%).

- Vaccinated Americans were more likely to support an extension (62%) compared to their unvaccinated peers (50%).

- The partisan differences are telling: Among Democrats, (70%) support keeping the mandate in place compared to only (50%) of Republicans.

- Currently, a quarter of Americans (26%) aren’t comfortable flying given the COVID pandemic, and time will tell if that number increases if and when the mandate expires.

Takeaway: Though masks may not be as common as they once were in America, passengers are likely to seek the safety and security of mask wearing while in such close proximity to other passengers for the foreseeable future.

With Inflation at a 40-Year High, Who Feels Better Off Today? Fortune-Harris Poll

Overall, inflation is reducing living standards based on our new survey and featured in Fortune, as only a third of those whose income rose in the past year had their pay match or surpass inflation.

- What does that mean? Two-thirds of households – people whose raises lagged rising prices, whose incomes didn’t budge, or actually fell – are now worse off financially than they were in 2021.

- Wealthy households and college students are doing the best as two-thirds of both say their household income is higher today than it was a year ago, and half have boosted their savings over the past five years.

- At the other end of the income spectrum, things are rockier since 4 in 10 households with annual incomes of less than $50,000 say they cannot afford essentials like food and housing, two-thirds haven’t been able to put money into savings or investments, and (60%) don’t have enough savings to cover an emergency.

- A bright spot: A third of household heads with a high school education or less say their earnings rose faster or kept up with inflation over the past year, and for those in the $10,000-to-$49,900 income bracket, the share jumps to (41%).

Takeaway: “Vulnerable households have been able to defy inflation, but what’s surprising is that the less fortunate and the more fortunate feel they are coping almost equally with the worst bout of inflation in 40 years,” according to Harris Poll CEO, Will Johnson.

Clorox Case Study – Success Through Hardship: Harris Brand Platform

Using Harris Brand Platform, we look at the impact of Clorox’s response to the COVID pandemic on their brand equity and explore how a long-standing American brand found success by supporting consumers through the country’s most difficult times.

- Throughout COVID, Clorox released instructional cleaning videos, and increased production, to help Americans during unprecedented lockdowns and uncertainty.

- From Q4 2020 to Q1 2021 the company increased production of Clorox wipes from 1 million to 1.5 million canisters every day.

- From Q1 2020 to Q1 2022, Clorox’s brand momentum (+7.7) and perceived product quality (+5.1) significantly increased.

- From 2020 to 2022, the brand’s sales conversion funnel grew across almost all phases of the consumer journey, especially recommended (+7.8).

- Several positive brand emotional attributes increased during the two years of COVID, especially “Good Value” (+4.6), “Dependable” (+2.1), and Trustworthy (+2.0).

- Throwback: The Clorox Company took the top spot in our 2020 Axios Harris Poll 100.

Takeaway: Other brands can look to Clorox to better understand how to communicate their value and actively guide consumers through difficult times, whether that is inflation, war, sickness, or political turmoil at-home or abroad.

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Download the Data

This survey was conducted online within the U.S. by The Harris Poll from April 8 to 10, among a nationally representative sample of 2,121 U.S. adults.

Download

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Download the Data

This survey was conducted online within the U.S. by The Harris Poll from April 8 to 10, among a nationally representative sample of 2,121 U.S. adults.

DownloadRelated Content