Brief • 3 min Read

Started in 1946, Tupperware remains a popular American storage brand nearly seven decades later.

Like saying “Kleenex” for tissues or “Google” for an internet search, “Tupperware” is often used as a noun to refer to any food storage container.

During the COVID-19 pandemic, Tupperware celebrated a wave of popularity as restaurant closures and stay-at-home orders necessitated at-home cooking and baking.

However, this spike in sales did not last. In March, Tupperware announced that 2022’s sales were 18% lower than the year prior. On April 7th, 2023, Tupperware warned that it was at-risk of going out of business.

Ten years ago, Tupperware was valued at approximately $100/share. In April, they languished below $2/share. Tupperware is hoping to get back on financial track by reaching out to new investors, opening new lines of credit, cutting costs, trimming real estate holdings, and attracting new customers.

Tupperware loses momentum

We can see a dip in consumer confidence when we examine Tupperware’s brand equity data in QuestBrand.

Brand equity measures the value that consumers see in a brand at a particular moment in time. It is an average of four components: brand familiarity, perceived quality, purchase consideration, and perceived momentum.

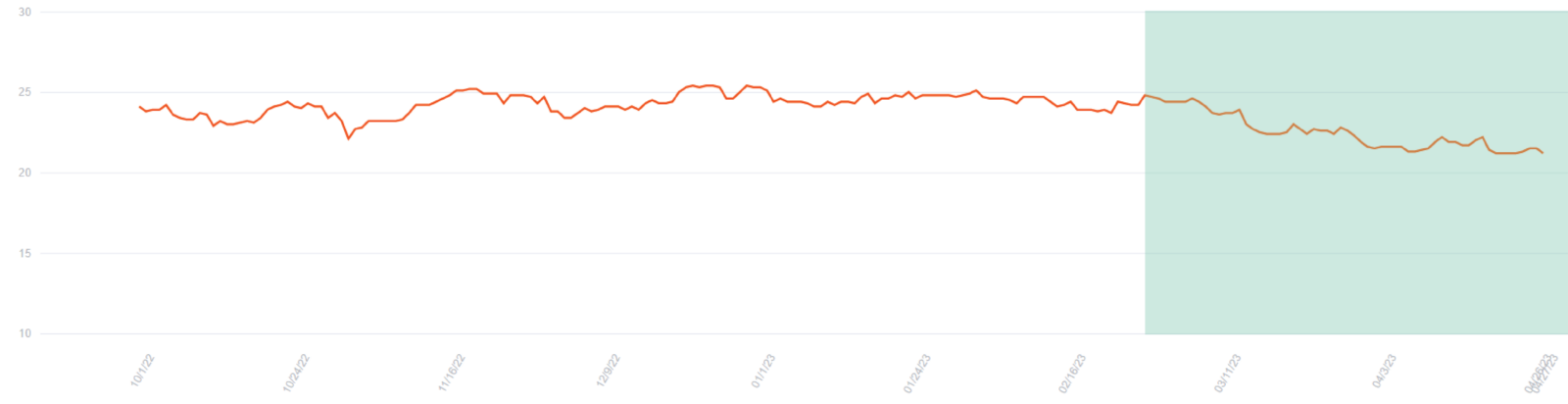

In the graph below, we can see that Tupperware’s momentum score began declining in the beginning of March 2023 and continued throughout April, showing an increased concern in Tupperware’s market position and future potential.

Tupperware’s Momentum – 12 Week Moving Average

QuestBrand. Base: US adults familiar with the Tupperware brand. 10/1/22-4/30/23, n=2,592.

Tupperware must attract younger buyers to remain relevant

One of Tupperware’s greatest challenges has been connecting with younger consumers.

From its start, Tupperware has primary been sold and purchased by suburban housewives at “Tupperware parties.” These self-employed salespeople host parties to sell containers to their friends. Tupperware’s approach of selling through independent salespeople has made it difficult for the brand to increase their number of young buyers, most of whom do not know a seller, or how to get their hands on Tupperware.

The container brand did not even launch an e-commerce store until 2019. During COVID, when in-person parties were verboten, Tupperware’s independent sellers began selling products online through platforms like TikTok, Zoom, WhatsApp, and Facebook.

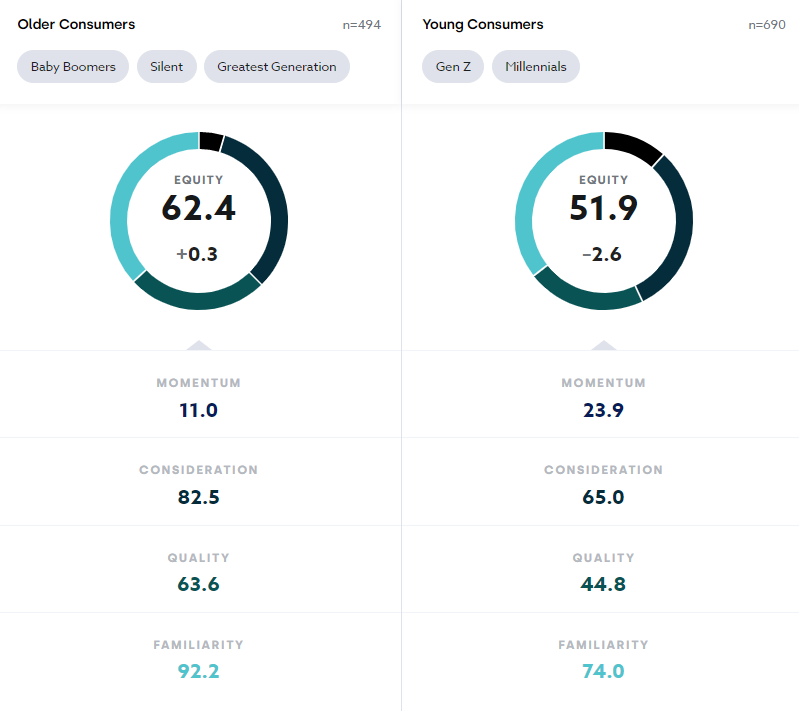

We can see Tupperware’s disconnect with younger consumers in their QuestBrand data. Tupperware’s brand equity is higher in older consumers than younger consumers across almost all components of brand equity (+10.5) – familiarity (+18.2), quality (+18.8), and consideration (+17.5). The sole exception is momentum (-12.9). Interestingly, younger consumers more often said that Tupperware was gaining momentum than older consumers.

Tupperware’s Brand Equity: Older Vs Younger Consumers

QuestBrand. 1/1/23-4/25/23. Base: Baby Boomers, Silent Generation, Greatest Generation, n=494. Base: Gen Z and Millennial adults, n=690.

That’s not to say that Tupperware is not trying to connect with a younger audience.

In 2022, Tupperware began selling their products in Target stores, making the product more accessible to shoppers of all ages. Most recently, the brand released a retro line of Tupperware that aligned with the season 5 release of The Marvelous Mrs. Maisel. The vintage containers made an appearance in season 4 of the show when one of the characters hosted their own “Tupperware party.”

As Tupperware tries to secure its future, the company will need to look for more opportunities to connect with Millennial and Gen Z consumers. While Tupperware has been popular with older generations for decades, they must court young buyers if they hope to thrive for another 70 years.

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Related Content