Brief • 3 min Read

In recent months, Gen Z has prioritized cost-conscious grocery shopping amid rising consumer prices. According to data from the Agriculture Department, Americans are spending more than 11% of their personal disposable income on food.

Many young consumers looking to combat growing grocery bills have turned to buying in bulk at warehouse clubs, such as Costco. As Gen Z moves into the bulk shopping game, we’ve seen Costco grow in their esteem.

Mandatory Memberships

A little background information for those of you who haven’t shopped at Costco:

Costco requires shoppers to purchase an annual membership to access their stores and to purchase goods. Membership fees allow the company to offer lower product prices by offsetting expenses. To prevent membership sharing, Costco employs on-site ID checks and guest limits.

But Gen Z is working hard to sidestep these guardrails.

Supersized Stock Up

Costco’s lower per-unit food costs and wide selection of items have attracted Gen Zers along with their friends and family — who sometimes band together to shop under a single membership.

Gen Zers have been reducing their individual grocery bills by bulk buying in groups and splitting items. Almost four in 10 shoppers between the ages of 25 and 34 have used this group-purchasing strategy.

Costco may be missing out on some membership dues, but it’s not all bad news for the retailer. Perhaps partially due to the influx in younger shoppers, Costco has seen increased net sales over the past year.

Gen Z’s Esteem for Costco Grows

As Gen Z spends more time in the Costco aisles, we see their perception of the wholesaler shift.

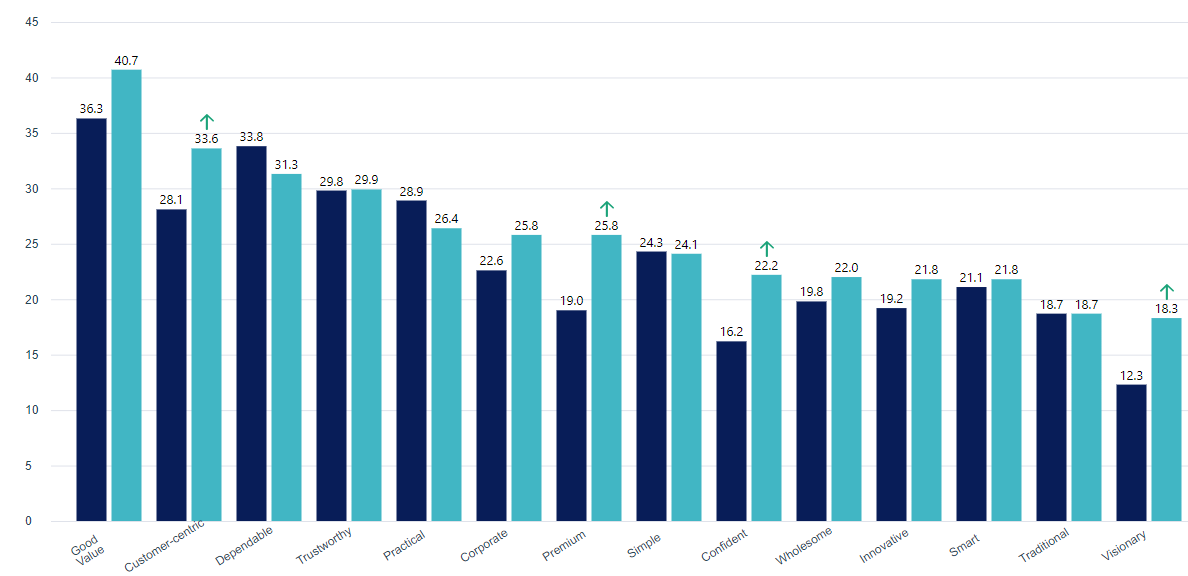

According to data from QuestBrand by the Harris Poll, Gen Z adults significantly more often described Costco as “premium” (+6.8) “confident”(+6.0), “visionary” (+6.0), and “customer-centric” (+5.5) in the first half of 2024 than they did in the second half of 2023 (Figure 1).

Attributes Gen Z Adults Ascribe To Costco – Second Half of 2023 vs First Half of 2024

Figure 1. QuestBrand. Base: Gen Z US adults. Pre: 7/1/23-12/31/23, n=737. Post: 1/1/24-6/30/24, n=512.

We similarly see a positive uptick in young consumers’ perceived quality of the Costco brand in 2024 (Figure 2).

Throughout most of 2023, Gen Z’s trended quality score closely matched that of the general population of US adults. In 2024, we see Gen Z’s line pull away from the general population, reflecting Gen Zers’ high opinion of the Costco brand.

Costco’s Perceived Brand Quality Among Gen Z Adults – 12 Week Trended Average

Figure 2. QuestBrand. 1/1/23-7/29/24. Base: General population of US adults, n=20,097. Base: Gen Z US adults, n=2,943.

Will Gen Z’s Costco Habit Continue?

In the months ahead, we will have to see whether Costco furthers its crackdown on membership sharing. If so, how will Gen Z react? Will they continue to count on the wholesaler for affordable groceries, or look elsewhere to save money?

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Related Content