Brief • 4 min Read

The latest trends in culture and society from The Harris Poll

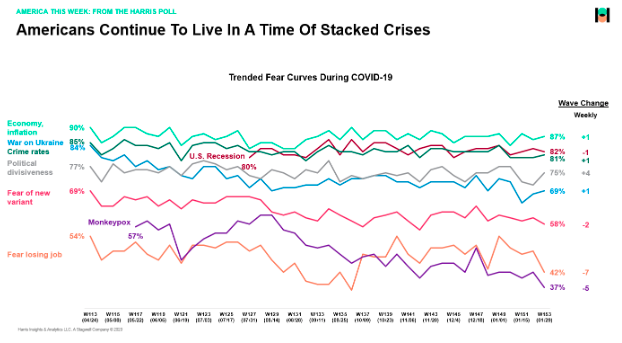

The Fed is meeting today to discuss another rate hike. And our America, This Week survey, fielded January 27th to 29th among 2,022 US adults, shows no slowdown in concerns about the economy and inflation (87%), with (75%) believing that the worst of inflation is still ahead. And Americans believe the prices of food and groceries, utilities, gas, and interest rates will continue climbing over the next few months (77%, 72%, 69%, 68%).

Here are a few other things to know this week:

- Want to retain talent? Over half of working parents would stay at jobs that provided childcare benefits.

- High mortgages are taking a toll: Americans seeking to buy a home in 2023 see an uphill battle.

- It’s not just regular Americans; even investors think they’ll have to work post-retirement.

- Consumers are wary of AI tools, but there may be room for them in marketing.

Lastly, check out the latest America This Week monthly summary slide deck and tabs for more insights into inflation and shifting consumerism. Download the new January report here.

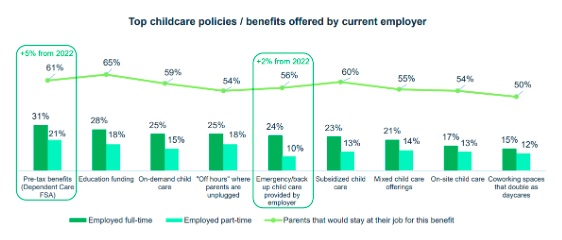

American Parents Want More From Employers and Government: KinderCare-Harris Poll

The latest Parent Confidence Report, in partnership with KinderCare, finds that while parent confidence remains high, working parents increasingly expect more childcare support from employers and the government.

- Parents feel unsupported in the workplace: 6 out of 10 (61%) working parents say there is a disconnect between the level of support they need and what benefits their employer provides.

- Even as childcare benefits remain highly desired by working parents: Childcare benefits were the second most important reason for parents staying at their current job – with a fifth (18%) even ranking them as the most crucial benefit – behind health insurance but above PTO.

- And over half of working parents would stay at their current job if they provided childcare benefits such as pre-tax benefits, emergency/backup childcare, on-site childcare, etc.:

- American parents also expect the government to address the childcare crisis: 7 in 10 (70%) parents agree that childcare is at a crisis point in terms of accessibility and affordability, and two-thirds (66%) believe the government should offer universal childcare to all children, from birth to kindergarten.

Takeaway: The majority of parents agree that having access to quality child care allows them to not only excel at work but also be more present as a parent when they are with their children, with over 8 in 10 (82%) of parents who use daycare or preschool for childcare noting that they are highly self-confident. Conversely, nearly two-thirds (64%) say they are constantly thinking about childcare gaps, with half noting that piecing together enough childcare coverage is a significant source of stress.

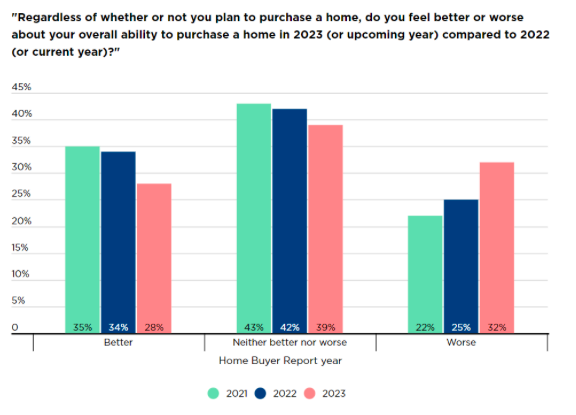

Home Buyers Face High Rates, Economy With Resolve: NerdWallet-Harris Poll

For the fifth year in a row, many Americans (83%) say buying a home is a priority. But in our latest survey with NerdWallet, high mortgage rates and a seller-friendly housing market prove to be obstacles:

- Many buyers may have unrealistic home price expectations: Over ten percent (11%) of Americans plan on buying a home next year. And those prospective buyers hope to spend $269,200 on average. However, according to the National Association of Realtors, this is significantly lower than the typical home price (as of October 2022) of $379,100.

- About one-third (32%) of Americans feel worse about their ability to purchase a home in 2023 than in 2022 (a 7%-pt increase from last year). The top reasons include a worsening economy (58%), higher mortgage rates, and higher home prices (57%).

- Most expect a housing market crash: Two-thirds (67%) of Americans say a housing market crash is imminent in the next three years.

Takeaway: “Home buyers haven’t caught a break since the beginning of the pandemic,” says Holden Lewis, Nerdwallet Home and Mortgages expert. “Competition among buyers was fierce in 2020 and 2021, and mortgage rates skyrocketed in 2022. However, the housing market might finally be friendlier to buyers in 2023. As a result, mortgage rates could fall, and home prices might decline in some places” (NerdWallet).

Even Investors Will Keep Working In This Economy: Nationwide-Harris Poll

According to our later survey with Nationwide, turbulent market conditions and rampant inflation have forced even investors to consider working after retirement.

- In the face of prolonged economic uncertainty, investors are rethinking life after retirement: 7 in 10 (69%) non-retired investors say post-retirement employment could lie ahead.

- And more than two-fifths (44%) of these investors inclined to keep working say they’ll have to supplement their retirement savings or income out of necessity.

- Looking to move for costs, not family: Two-fifths (40%) of non-retired investors plan to move to a different city or region after retiring, with the most common reasonings being lower costs of living (43%) and lower taxes (34%), more so than being closer to family (22%).

- Ignorance may be bliss: Nearly half (49%) of non-retired investors with a financial advisor are “very nervous” about spending down their retirement savings in today’s current market environment, compared to a third (32%) without an advisor.

Takeaway: “The idea we have of what retirement looks like has changed for many people, whether due to necessity or because they are looking to stay active and engaged,” said Rona Guymon, Senior Vice President of Nationwide Annuity Distribution. “Regardless of the reason, now is the time for advisors and financial professionals to check in with clients who are approaching retirement to ensure they have a plan in place for their next steps.”

AI Tools Raise Safety Concerns For Consumers: AdAge-Harris Poll

Marketers may need to slow their roll when it comes to adopting AI tools such as ChatGPT and DALL-E2, according to our latest Harris Poll with AdAge.

- Over two-thirds (67%) of Americans are concerned about the safety of generative AI technology, with more than half (52%) agreeing they don’t trust the tech.

- The finding may surprise brands that have interpreted AI’s ever-growing hype on social media as evidence for positive consumer sentiment, says Ad Age.

- Lack of familiarity is not the issue: Over half (54%) are familiar with generative AI tools, and nearly a fifth have used one before. And only (29%) said they have not used generative AI nor are interested in doing so.

- The data suggests that consumers may have more practical reasons for distrusting generative AI: For example, less than half (44%) agree that it is easy to tell the difference between something created by AI and something created by a human. And (58%) think things created by generative AI tools are less impressive than things created by people.

- Fortunately for brands, the jury is still out on whether consumers want to see AI on Madison Ave: Two in five (39%) of respondents support brands using generative AI tools to make ads. Only (12%) oppose this use of generative AI, while half (49%) remain neutral.

Takeaway: Garnter’s ‘Hype Cycle’ applies here. Consumers may see AI’s shortcomings so much as to why it is relevant to me. Marketers can use AI learning to forecast fashion trends faster, predict consumer needs, create offers and rewards based on aggregating their past shopping behaviors, etc. AI needs to (and will) create real consumer benefits, not just advertising stunts.

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Download the Data

This survey was conducted online within the U.S. by The Harris Poll from January 27th to 29th among a nationally representative sample of 2,022 U.S. adults.

Download

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Download the Data

This survey was conducted online within the U.S. by The Harris Poll from January 27th to 29th among a nationally representative sample of 2,022 U.S. adults.

DownloadRelated Content