Brief • 4 min Read

In The Harris Poll Tracker (Week 94) fielded December 10th to 12th, 2021 among 1,997 U.S. adults, we look how Americans show loyalty to vaccine brands, the desire to move to more affordable areas, social media food trends on grocery habits, decentralized autonomous organizations, and the confusion Americans have about their insurance plans.

As a public service, our team has curated key insights to help leaders navigate COVID-19. Full survey results, tables, and weekly summaries can be accessed for free at The Harris Poll COVID-19 Portal. We will continue to actively field on a regular cadence to track the shifts in sentiment and behaviors as the news and guidelines evolve.

Brand Loyalty Extends To Booster Shots

As Americans continue to get their COVID-19 booster shots, half of Americans (51%) consider being “fully vaccinated” to include a booster shot after an initial vaccination. So will Americans be sticking with their original brand for their booster, or mixing it up? Here’s what we know:

-

Americans will stick with what they know: (76%) of those who plan to get a booster tell us they plan to receive the same brand for their booster as their initial vaccination, while only 1 in 10 (10%) plan to switch brands and (14%) don’t have a preference either way.

-

Younger Americans are the most likely to switch brands for their booster: (20%) of Gen Z and (18%) of Millennials will be getting a different brand than their original (vs 7% Gen X, 3% Boomers).

-

Most of those vaccinated (43%) had little to no wait time in booking their booster appointment, while (25%) of those who have tried had to book more than a few days in advance and one-third (32%) haven’t tried to schedule yet.

Takeaway: Some studies are showing that mixing vaccine brands may provide a more robust response than sticking with the same. But as with traditional products, most consumers remain loyal to their original brand – whether it be Moderna Mafia or Pfizer Pham – given the initial trust we placed in these brands in the spring.

Dreaming About Moving? You’re Not Alone: Coldwell Banker-Harris Poll

Americans don’t feel tethered to one place anymore according to our survey in partnership with Coldwell Banker, with many considering moves to more affordable locations.

- Four in 10 (41%) Americans would be willing to take a pay cut or accept a lower salary in order to move to a more affordable location, especially younger generations (Gen Z: 51%, Millennials: 47% v. Gen X: 32%, Boomers: 27%).

- In expensive regions like the Northeast and West, nearly half (46%) of employed Americans indicated their willingness to move somewhere more affordable even with a pay cut or lower paying job.

- Americans are chasing the sun: nearly a third (31%) of Gen Z men would consider moving to Miami, while a fifth of Gen Z women would consider Austin, and households with children under 18 ranked Miami (21%) and Austin (17%) as top destinations.

- Don’t forget Atlanta: it ranked the highest among cities that Black Americans would consider relocating to (28%).

- However, before moving, homeowners want a real estate website that provides an estimated sale price for their home (39%) and a feature that would allow for cost of living comparisons among different zip codes (37%).

Takeaway: As Americans no longer feel constrained to live in the same city as their work, the professional freedom that the pandemic brought for many Americans will continue to shape the future of home ownership in addition to downtowns and the office.

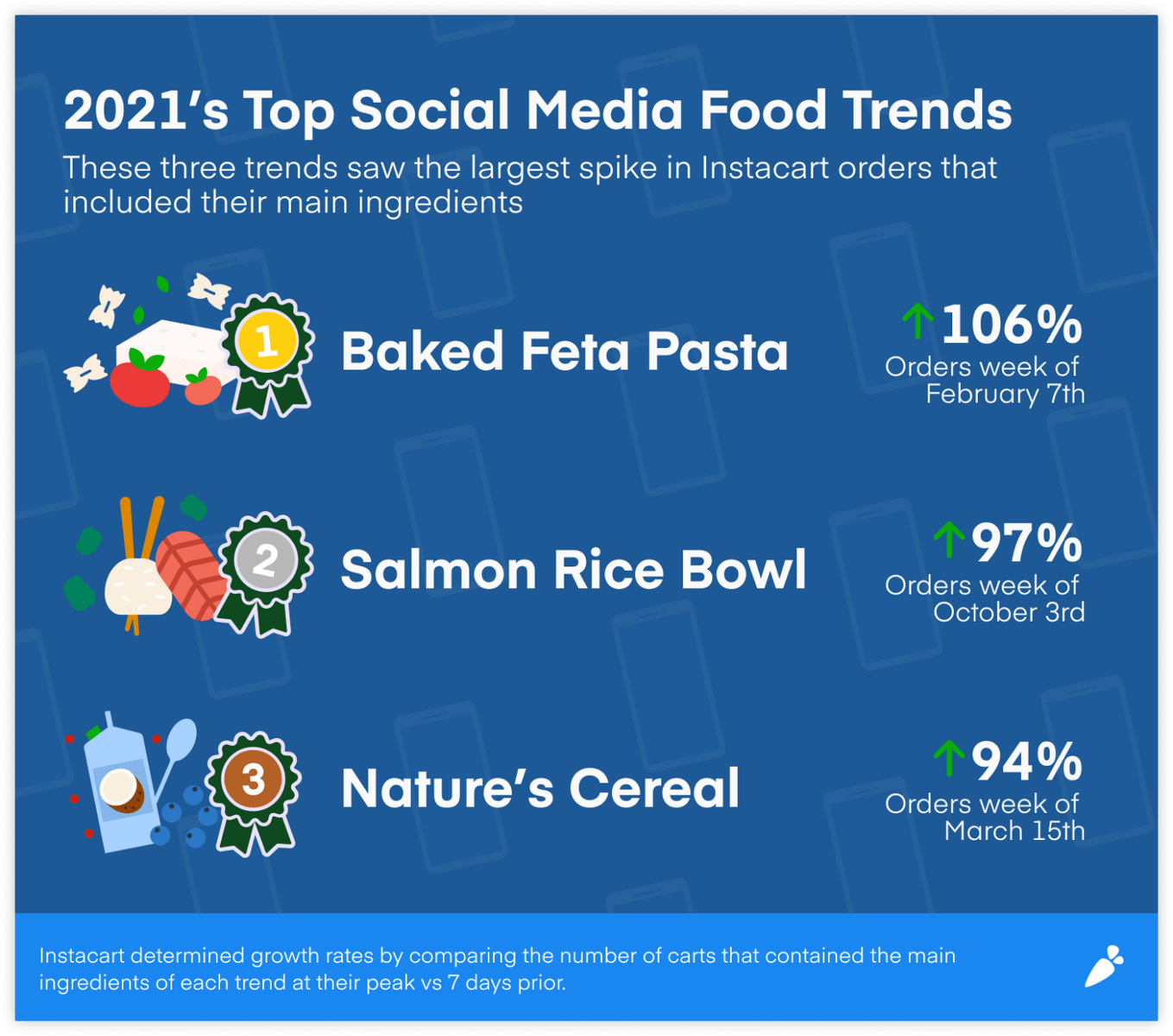

A Year Inspired by Food Trends and Back to Normal-ish Buying: Instacart-Harris Poll

2020 changed us, and so much of what we did during the early days of the pandemic has continued to influence our shopping behavior. In a nutshell, 2021 was back-to-normal(ish) for groceries. In partnership with Instacart, here is what we learned this year:

- ‘Tok’ of the Town: (44%) of Americans tried making a social media food trend in 2021. Further to that, more than 1 in 3 (36%) say social media has changed how they approach cooking at home.

- Gen Z & Millennials Are Here👏For👏The👏Trends: Gen Zers and Millennials are more likely to have tried making a viral food trend recipe in 2021 than older generations. Nearly three quarters of Gen Z’ers (71%) and Millennials (70%) tried making a social media food trend in 2021, compared to (35%) of Gen X’ers and (24%) of Boomers.

Takeaway: The impact of social media food trends will continue to influence our shopping lists, and grocery stores would be apt to utilize these latest cooking trends in their future marketing and promotion when engaging consumers.

Millennials Can’t Afford Houses, But They Could Purchase (A Piece Of) The Constitution

Last week, we discussed how Millennials are more familiar and interested in the metaverse and cryptocurrency than their peers, as covered in Insider. It seems their interest also applies to decentralized autonomous organizations (DAOs) as well. Here’s what we know:

- While only a quarter of Americans (27%) say they are familiar with DAOs – online users that collectively bring their cryptocurrency together – close to half (47%) of Millennials are aware (v. Gen Z: 32%, Gen X: 30%, Boomers: 8%).

- Millennials were largely in support (58%) of DAOs crowdfunding to purchase rare copies of art and documents such as, say, the Constitution. However, Gen Z, Gen X, and Boomers were less supportive (48%, 44%, and 25%, respectively).

- While Gen X (40%) and Boomers (15%) have little interest in the decentralized fractional ownership of DAOs, close to two-thirds of both Gen Z (63%) and Millennials (64%) are.

- Many minority Americans have switched from traditional banking and have turned to cryptocurrency: (57%) of Black, (54%) of Hispanic, and (51%) of Asian & Pacific Islander are interested in decentralized fractional ownership (v. White: 36%).

Takeaway: Crypto, the metaverse, DAOs, NFTs, and Web3 may be meaningless words to many Americans, but they are the next frontier in the online world so marketers and brands should likely take note. Millennials, even more than their Gen Z counterparts, are currently set to lead the way into the next phase of the internet.

75% of Health-Insured Individuals in the U.S. Are Concerned About Medical Bills

Our recent MITRE-Harris Poll Survey found that (75%) of health-insured individuals in the U.S. have some level of concern about financial hardship due to medical bills – nearly matching (77%) of uninsured sharing that same worry. Here’s what else we found:

- More than 4 in 10 of those insured report receiving an unexpected medical bill for reasons such as their insurance provider not covering as much as anticipated (47%), not realizing a procedure wasn’t covered (42%), or a doctor/facility being out of their network (33%).

- More than a quarter (28%) admitted they never check their coverage before using their insurance, partly because trying to figure out what is and isn’t covered is their biggest frustration (28%), followed by finding someone to answer questions (20%), and figuring out who is and is not in-network (20%).

- Many Americans are paying for insurance plans they don’t understand: only (33%) feel they understand their plan “completely,” while (53%) say they understand it “somewhat.” Regarding mental health services, a quarter (26%) say they did not understand what mental health services were covered by their plans.

- Nearly half (45%) say insurance companies are primarily responsible for making health insurance plans easier to understand. However, younger Americans feel there is shared responsibility among insurance companies, healthcare providers, and the government.

Takeaway: A consumer information gap exists for health insurance and if insurance companies aren’t proactive in making sure their consumers fully understand their benefits, they may lose trust in their provider and seek out a provider they are more trusting of.

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Download the Data

This survey was conducted online within the U.S. by The Harris Poll from December 10 to 12, among a nationally representative sample of 1,997 U.S. adults.

Download

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Download the Data

This survey was conducted online within the U.S. by The Harris Poll from December 10 to 12, among a nationally representative sample of 1,997 U.S. adults.

DownloadRelated Content