Brief • 2 min Read

1: Nonprofits: An Industry Snapshot

Our recent report on the state of the nonprofit space explores what types of charitable causes appeal to donors of different backgrounds, and what factors convince donors to give to a specific charity or organization. Using QuestBrand data, we rank the leading nonprofit brands by brand equity and growth. Here are some key takeaways:

- Of those who contributed to a charitable organization in the past year, 79% agree that an organization’s mission is more important than its reach.

- The majority (89%) of recent donors said that an organization’s financial transparency impacts their charitable contributions.

- More than nine in ten (94%) white donors, but 86% of donors of color, agree that if they provide resources to a charitable organization, they trust they will be used in a way they approve of.

- Donors of color (10%) significantly more often than white donors (2%) said they made a financial contribution to a charitable cause in the past year because they felt pressured to do so.

2: Gen Z Opens the Pandora Jewelry Box – Brand Story

Pandora ranked 3rd in our latest AdAge-Harris Poll Gen Z brand tracker. This quarterly index uses QuestBrand data to rank the top 20 brands by brand equity growth among Gen Z adults (ages 18-24).

- From Q1 to Q2 2023, Pandora experienced a +12.6 lift in brand equity among Gen Z adults. In contrast, the popular jewelry brand experienced a -3.4 drop in brand equity among the general population of US adults.

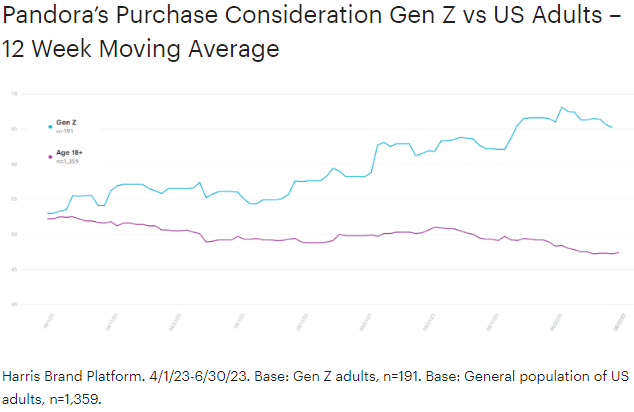

- From the graph below, we can see how Pandora’s purchase consideration among Gen Z adults considerably increased throughout Q2 2023.

- At the start of April, Pandora’s purchase consideration among Gen Z adults almost matched consideration among the general population of US adults at 53.0. By the end of June, consideration climbed (+12.2) among Gen Z adults, reaching 65.2.

Want to know how lab-grown diamonds, Taylor Swift, and Disney helped Pandora gain popularity with Gen Zers? Read the full brand story now.

3: Welcome to the Jumbled, Balkanized Future of Sports Media – SBJ Op-Ed

In a recent op-ed for Sports Business Journal, Harris Poll co-CEO Will Johnson explores the rapidly evolving sports media landscape.

How consumers watch popular sporting events is changing. Branching away from traditional cable/satellite TV plans, NFL enthusiasts now may have to subscribe to Amazon Prime Video, ESPN, Peacock, and YouTube TV to catch all their desired games. But football is not alone in this trend – MLB, MLS, and the NHL have also signed streaming agreements.

Why the change? “Sports franchises are reaping the benefits — to an extent. They are pulling in money almost faster than they can count it. The Googles and Apples of the world getting into the bidding only gooses prices higher, all the more important as legacy media companies tighten their belts.” – Will Johnson

Read Johnson’s full analysis for a deeper dive into how and why professional sport leagues are increasingly transitioning to streaming.

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Related Content