Brief • 2 min Read

1: Home Care & Products: An Industry Snapshot

Our recent report on the state of the home care and products industry explores consumer sentiment towards green living and home improvement projects. Using QuestBrand data, we rank the leading home care brands by brand equity and growth. Here are some key takeaways:

- Seven-in-10 (71%) Gen Z adults say that they actively try to limit the negative impact their home has on the environment. This jumps to 80% among Baby Boomers.

- More than half (56%) of Millennials report that they have either completed or plan to complete a home improvement project in 2023.

- Nine-in-10 (88%) Millennials agree that home improvement projects are an effective way to raise their home value.

- Beyond increasing home value, 84% of Millennials say that they enjoy doing home improvement projects.

2: Could younger buyers reverse Tupperware’s dip in momentum? – Brand Story

Tupperware has had a difficult start to 2023. In March, they announced that their 2022 sales were 18% lower than the year prior. In April, Tupperware warned that it was at-risk of going out of business. While many factors are at play, Tupperware could greatly benefit from attracting more young buyers.

- From its early days, Tupperware has primarily been sold by housewives (self-employed salespeople) at “Tupperware parties.”

- It was not until 2019 that Tupperware even launched an ecommerce platform. Young consumers (Gen Z and Millennials) often do not know Tupperware sellers and have been unsure where to purchase the product.

- We can see Tupperware’s disconnect with younger consumers in their QuestBrand data. Tupperware’s brand equity is higher in older consumers than younger consumers across almost all components of brand equity (+10.5) – familiarity (+18.2), quality (+18.8), and consideration (+17.5).

Read our full brand story to see how Tupperware is trying to get back on stable financial footing.

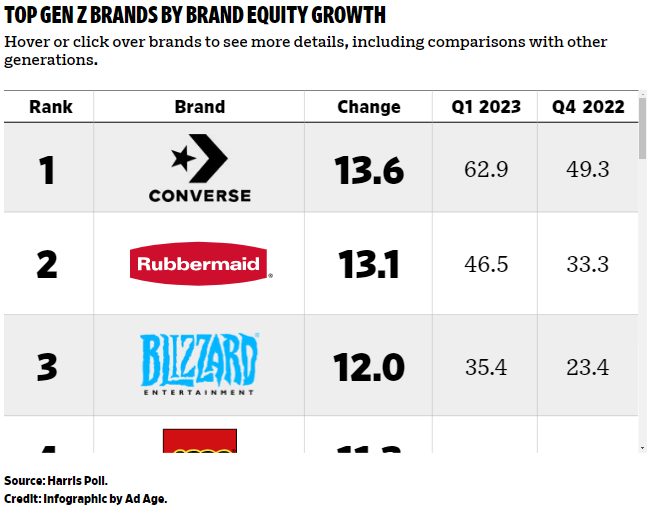

3: 20 Brands Attracting Gen Z’s Attention Right Now – AdAge-Harris Poll

May brought the release of our latest AdAge-Harris Poll Gen Z brand tracker. This quarterly index uses QuestBrand data to rank the top 20 brands by brand equity growth among Gen Z adults (ages 18-24).

- Converse (+13.6), Rubbermaid (+13.1), and Blizzard (+12.0) topped the list as the top growth brands from Q4 2022 to Q1 2023.

- Read the AdAge article to discover the top 20, and learn how these brands successfully grew in Gen Z’s esteem.

“We continue to see brands that leverage new media and culturally relevant partnerships win with Gen Z. If it’s Dr. Squatch releasing special edition soaps for ‘The Mandalorian’ and Jurassic Park, Lego bringing new attention to Indiana Jones and classic Disney characters, or Kraft Heinz partnering with Ed Sheeran to plug its new hot sauce, top-performing brands are recognizing they can reach new heights (and audiences) by tapping into cross-promotion.” – Harris Poll Co-CEO Will Johnson

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Related Content