Brief • 4 min Read

The latest trends in culture and society from The Harris Poll

The Harris Poll, America This Week survey fielded October 21st to 23rd, 2022, among 2,022 U.S. adults, finds, not surprisingly, persistently high concern on the economy and inflation (89%) and a potential U.S. recession (85%). Notably, both are up (+3%-pts and +4%-pts) from last month.

Here’s what else you need to know this week:

- In our new annual APA study, three in five adults say that the nation’s divisiveness is causing them stress. (The mid-term ads aren’t helping).

- And would you say no to a cubicle in this economy? A USA Today/Harris Poll finds many remote/hybrid workers saying they’ll quit before returning to the office.

- Fintech (financial technology) adoption soars as the economy sours in a new study with Plaid.

- And in an Ad-Age/Harris Poll survey, we go inside Influencer storefronts.

To hear about these stories and more, check out our America This Week: From The Harris Poll podcast on Spotify and Apple Podcasts, where our CEO John Gerzema and CSO Libby Rodney dive into the numbers. For any polling ideas, reach out to [email protected].

Lastly, if you geek out on data in PowerPoint, here’s your fix: The America This Week monthly summary slide deck has dropped. Download the October report here.

Our National Stress: APA-Harris Poll

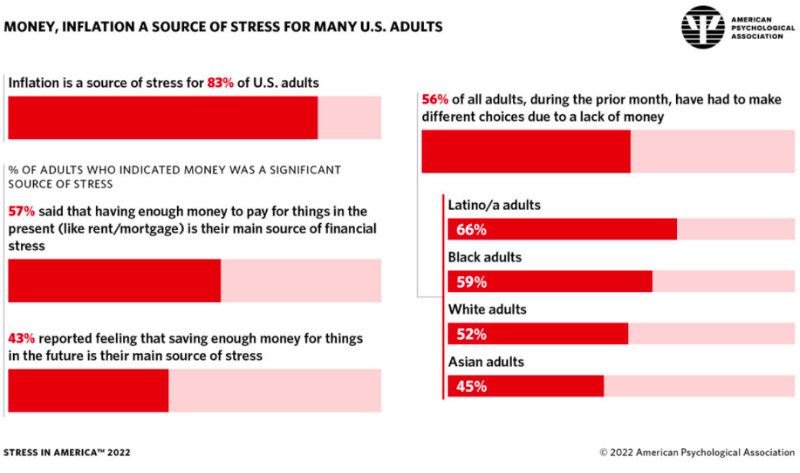

According to the latest 2022 Stress in America survey with the American Psychological Association, Americans are struggling with multiple external stressors that are beyond their control for some.

- Paralyzing anxiety: Over a quarter (27%) of Americans reported being so stressed that they could not function most days.

- Inflation is the #1 stressor: A majority of adults say inflation (83%), violence and crime (75%), the current political climate (66%), and the racial climate (62%) as significant sources of stress.

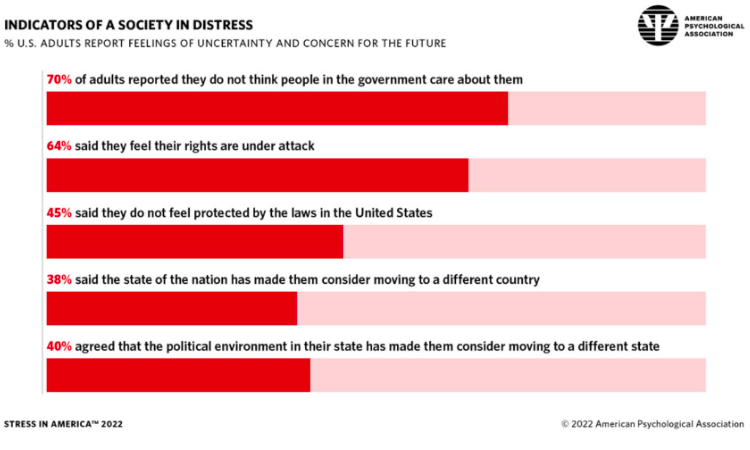

- And alone, attacked, and ready to move, Americans don’t feel protected by the government, and some are looking to leave:

Takeaway: While economic downturns come and go, Americans are living through forty-year high inflation, making this cycle seem delirious. Making matters worse, we don’t have institutions to fall back on: More than three-quarters (76%) said that the future of our nation is a significant source of stress in their lives, while (68%) said this is the lowest point in our nation’s history that they can remember. Of note: most Americans think American businesses can do a better job than the public sector, according to this year’s Milken Institute/Harris Listening Project.

Most Workers Say No Thanks to a Full-time Office: USA Today-Harris Poll

In our latest survey with USA Today, we keep tracking return-to-office requirements, and many employees are saying they’ll jump jobs if forced back full-time

- Over half (57%) of employed Americans say companies will start losing employees if they require workers to be in-person (but a 9%-pt decrease from June).

- Yet more working hybrid or remote roles believe this (hybrid workers: 74%, -2%-pts; remote: 65%, -12%-pts v. in-person: 47%).

- And nearly three quarters (73%) of remote and hybrid workers say they probably would find another remote or hybrid job if their company forced them to work from the office full-time – a 5%-pt decrease from June.

Takeaway: The strong (but softening) confidence in hybrid and remote workers is notable as a recession looms, at least in public perception. We found this month with Bloomberg that (57%) of workers now believe that employers have more power in the job market these days – a (5%-pt) increase from January. But the majority of workers in America currently believe a total return to office is a non-starter, at least for now.

Fintech Use Grows As Economy Sours: Plaid-Harris Poll

In a new Harris Poll with Plaid, the adoption of fintech (financial technology) grew during COVID as home-bound Americans gravitated to platforms to manage their money.

- Nine in ten users saw benefits from using fintech tools (93%), the highest number in three years. 8 in 10 (80%) consumers used fintech to manage their money in 2022, a significant jump from 2020 (58%). In addition, they report using payment apps (73%), investment tools (31%), and payroll advance tools for short-term needs (19%).

- While (95%) of consumers say they’re feeling financial stress, 6 in 10 (61%) say fintech tools helped them weather economic challenges, and nearly half (48%) said fintech helped them feel in control of their finances.

- Fintech is a lifeline for younger Americans: Over 7 in 10 Gen Z (73%) and Millennials (71%) said economic challenges made them more reliant on digital finance (v. Gen X: 64%, Boomers: 49%).

- And those disproportionality underserved by traditional financial systems: Hispanic and Black Americans use fintech at higher rates than white Americans (92%, 88% v. 74%).

Takeaway: The frictionless features and utility attract younger Americans and Americans of color. More than half are starting to invest for the first time in a digital app (53%). Additionally, when asked which is more accessible between crypto and traditional finances, nearly half of Black (46%) and Hispanic (44%) Americans say crypto, compared to three in ten White Americans (29%).

Inside Influencer Storefronts And How They’re Driving Sales For Brands: Ad Age-Harris Poll

A new Ad Age and The Harris Poll survey finds that nearly half of U.S. consumers consider input from influencers when purchasing a product or service–especially younger ones.

- While 8 in 10 (80%) Gen Z consult user reviews, (75%) also say that recommendations from influencers impact their decision to make a purchase (nearly double that v. gen pop: 43%).

- And 4 in 10 (40%) Z’s have made purchases directly through an influencer’s storefront on sites like Amazon and LTK (an influencer-oriented shopping app).

- (73%) also reported looking to TikTok creators for product input, with Instagram and YouTube influences also being popular choices.

Takeaway: “Last week, Amazon held its first-ever “Prime Early Access” sale, essentially an equivalent to the company’s annual “Prime Day” event, but with an added holiday shopping slant. During the sale’s 48-hour span, influencers flooded TikTok and other social media platforms with videos promoting specific products and major discounts; and social media users accordingly flocked to these videos. On TikTok alone, the hashtag #PrimeEarlyAccessSale was viewed over 24 million times in just two days” (Ad Age).

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Download the Data

This survey was conducted online within the U.S. by The Harris Poll from October 21st to October 23rd, among a nationally representative sample of 2,022 U.S. adults.

Download

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Download the Data

This survey was conducted online within the U.S. by The Harris Poll from October 21st to October 23rd, among a nationally representative sample of 2,022 U.S. adults.

DownloadRelated Content