Brief • 2 min Read

Bullish vs. Bearish

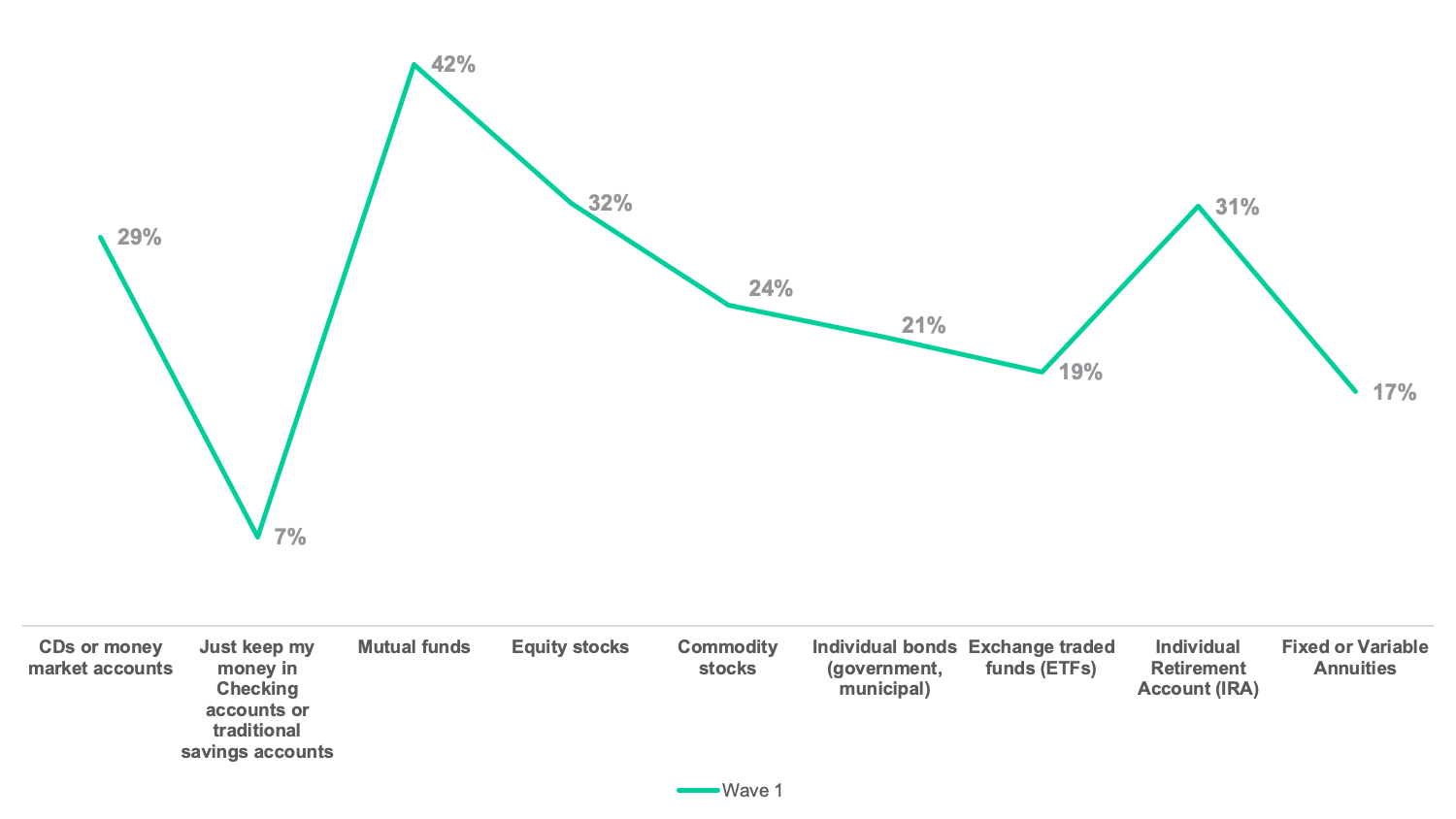

Although there is a lack of confidence in returns over the next 5 years, data shows that people are still feeling aggressive in investing in the stock market right now.

32% of people feel bullish, saying this is a good time to increase investments in the stock market (41% of men feel this way vs. 21% of women), whereas only 19% of people feel bearish, saying that it is a good time to decrease investments in the stock market. Gen Xers are the most aggressive with investments in the stock market right now with 67% of people between 35-44 say it is a good time to invest and only 9% of people between 35-44 saying it is a bad time to invest. The next most aggressive age group is 18-34 with 37% of them saying it is a good time to invest, but 32% of them saying it is a good time to decrease investments.

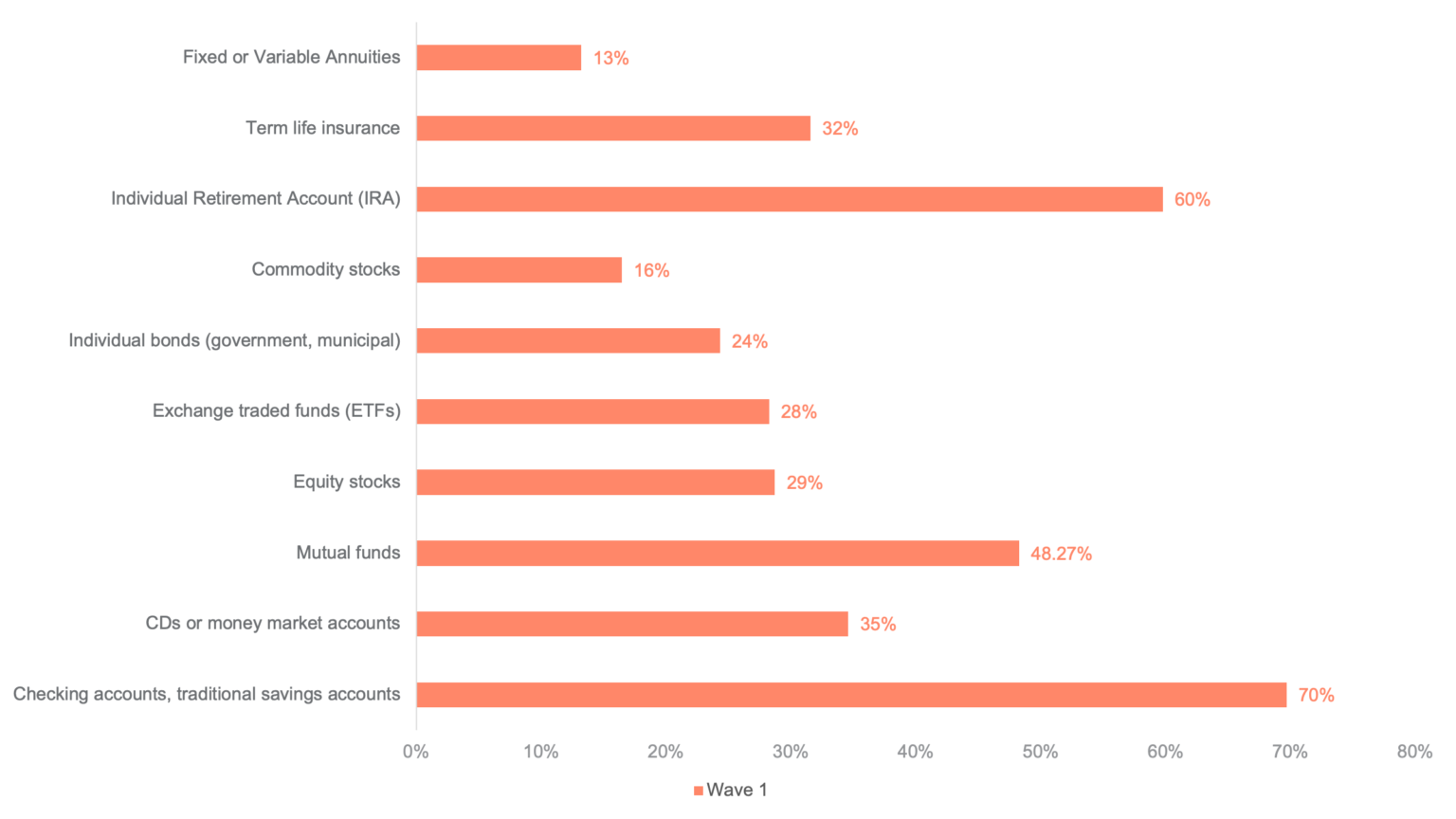

Individual Equity Investments are In, Saving Accounts are Out

92% of 18-34-year-olds have some form of individual equity investments and only 42% of 18-34-year-olds have general checking or saving accounts.

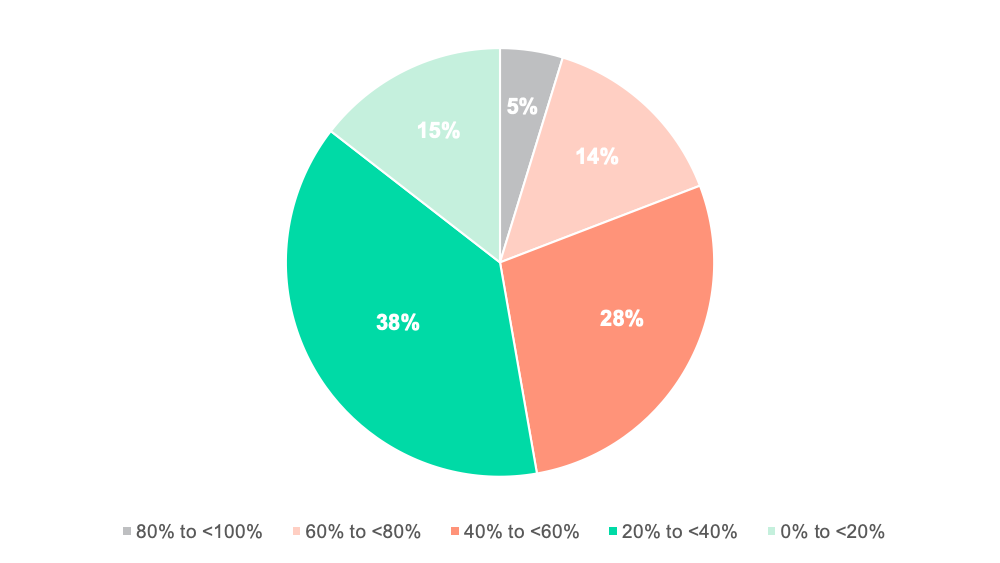

Nearly Half of Americans Have More Than 40% of Their Savings in Equities

47% of people have more than 40% of their personal savings invested in equities.

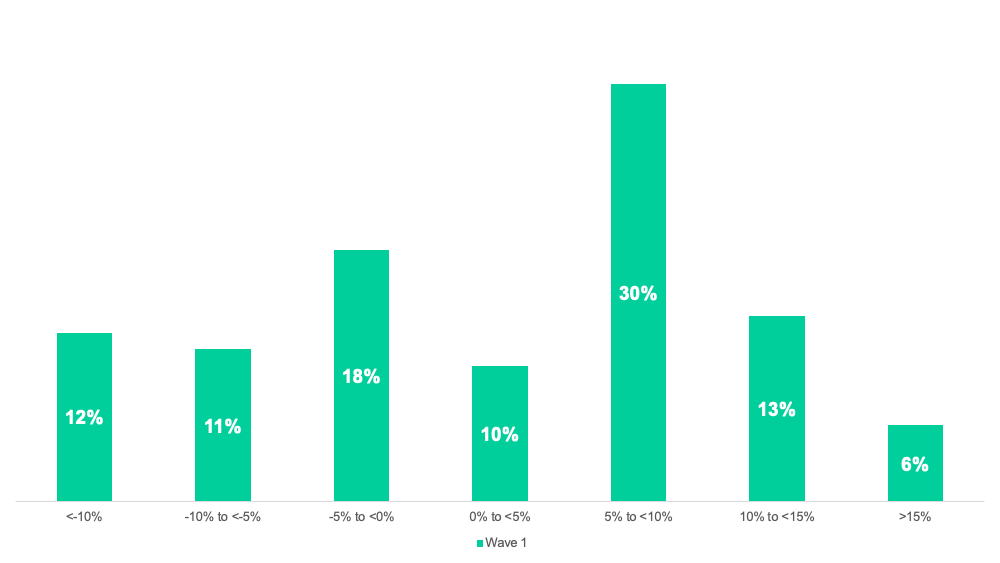

Optimism in Equity Investment Return is Low

41% of people with equity investments believe that their expected annual returns over the next 5 years will be negative, and 51% of people with equity investments believe returns will be <5%.

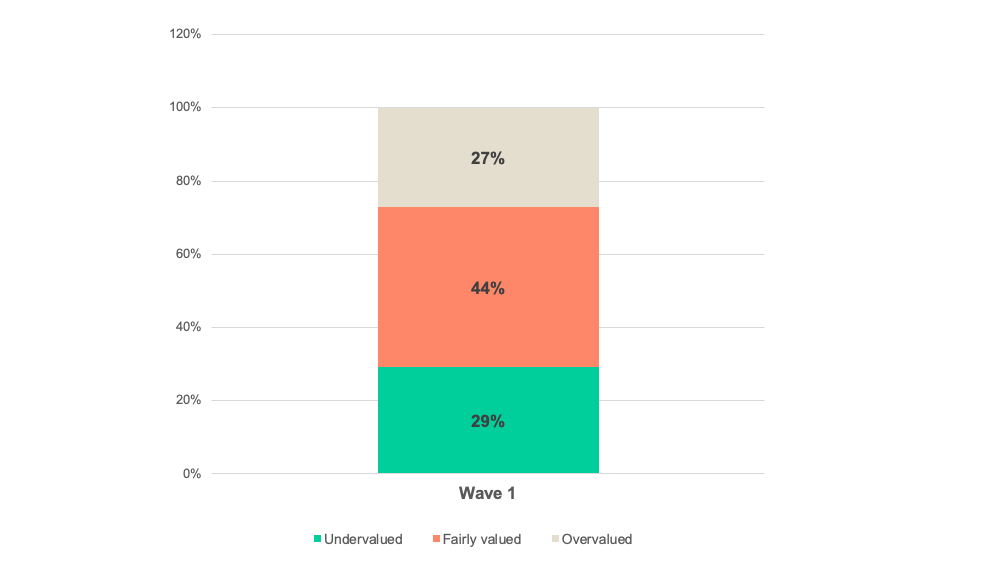

Mixed Market Valuation Emotions

Beliefs on the valuation of equity stocks right now are all over the place. 29% of people believe equity stocks are undervalued, 44% believe they are fairly valued, and 27% believe they are over valued.

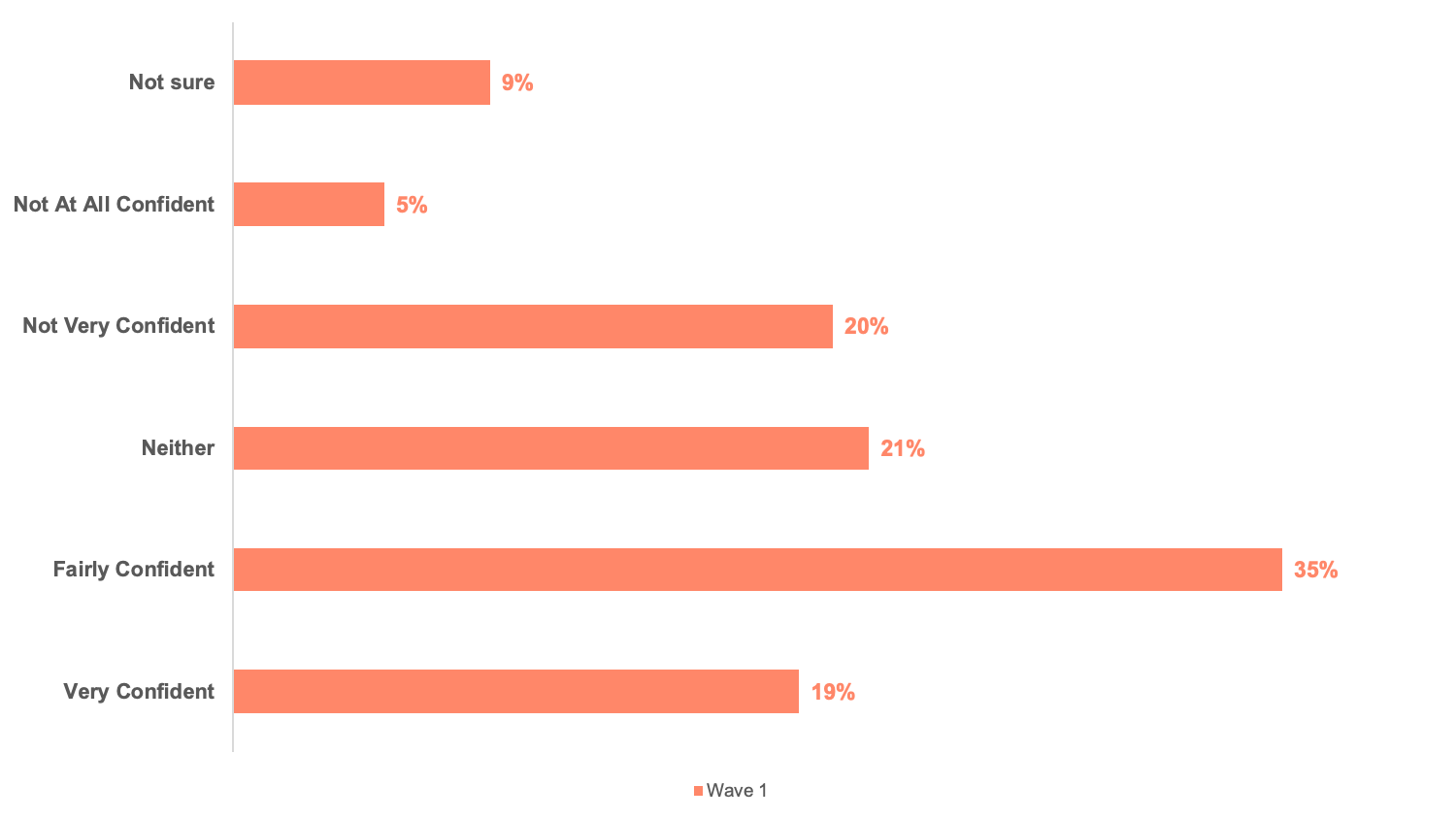

Cautiously Confident

Although the majority of people (54%) are confident in achieving their investment goals, only 19% of people are very confident they will achieve these goals and 25% of people are not confident they will achieve their investment goals.

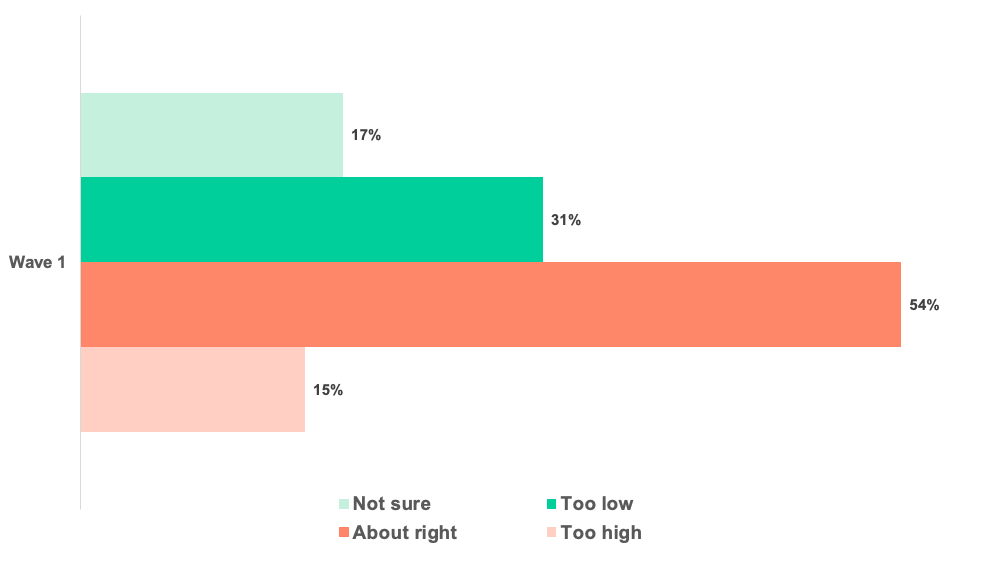

Faith in the Fed

The majority of people (54%) think that the Federal Reserve has set interest rates just right.

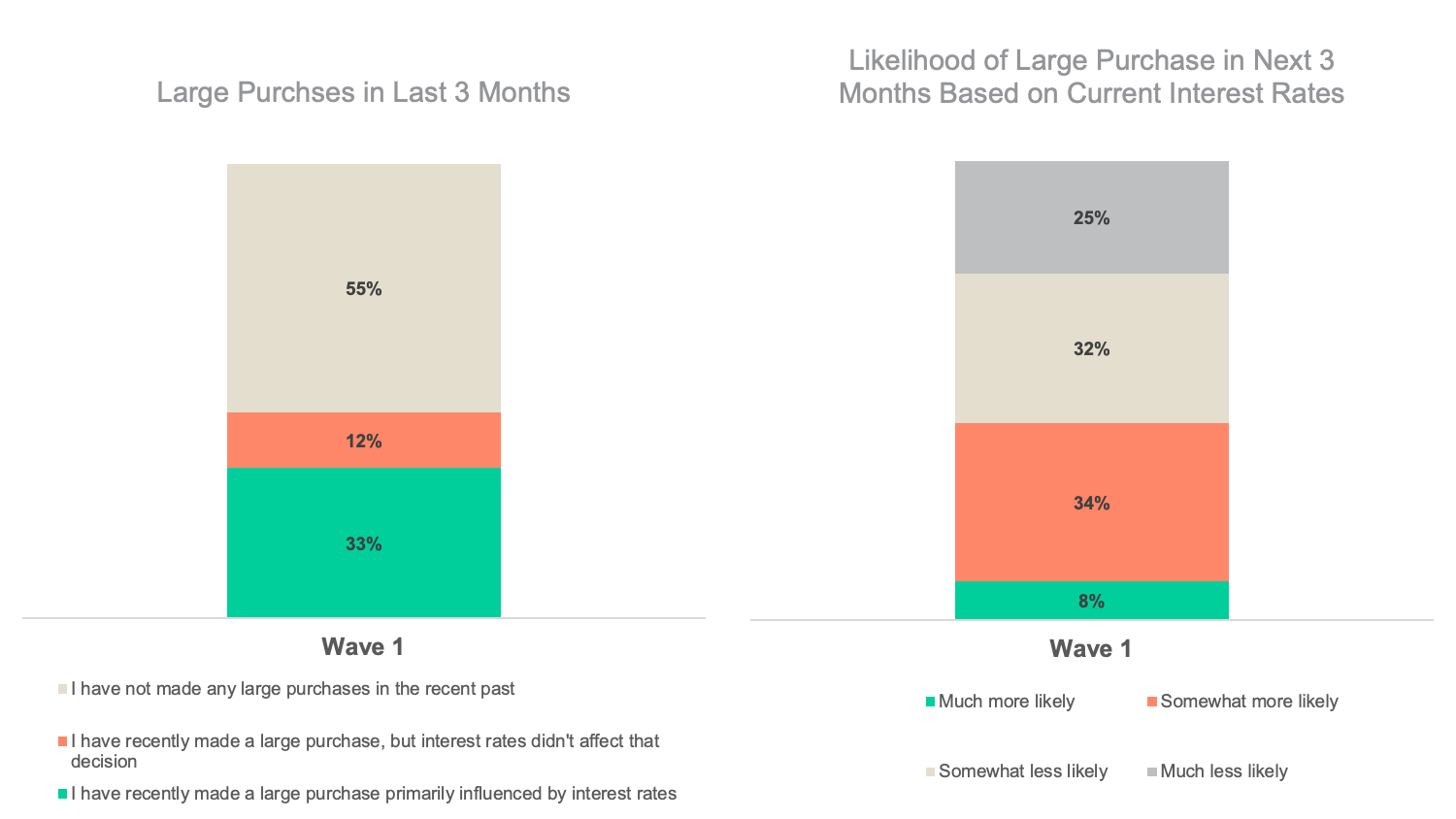

Purchases of the Past, Perceptions for the Future

One-third of people have made a large-scale purchase in the last 3 months as a result of current interest rates, but what are people saying about the next 3 months? In the last 3 months, 33% of people have recently made a large purchase primarily influenced by interest rates. Now, even more people (42%) are more likely to make a large-scale purchase in the next 3 months as a result of current interest rates.

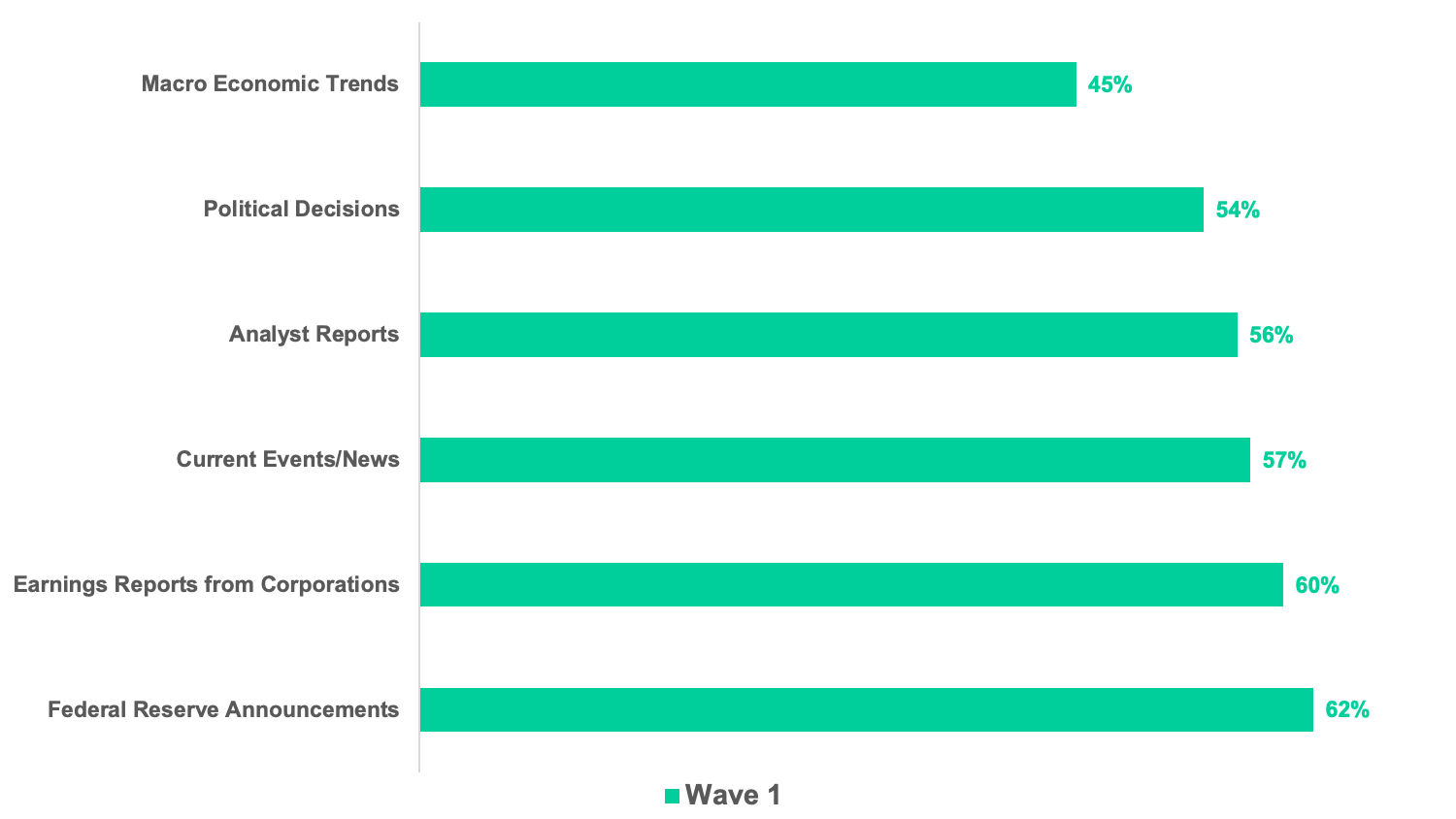

No More News for the Younger Generation

Overall, the news influences just more than half of people’s investment decisions. But broken down further, 81% of people 55+ years old use the news as a source of influence, while only 25% of people 18-34 years old say their financial decisions are influenced by the news.

More Than Three-Fourths of People Believe that Equity Investments are the Best Investments

Although the majority of women currently own more general saving or checking accounts as compared to equity investments, they believe that the best investments right now are equity investments. 69% of women believe equity investments are the best investments compared to 39% of women that say general saving or checking accounts are the best investments right now.