Brief • 2 min Read

According to a recent Harris Poll survey, young consumers (ages 18-34) order items from quick-service restaurants (i.e., a fast-food or fast casual restaurant such as McDonalds or Chipotle) more often than older consumers (ages 55+).

Half (52%) of young consumers order from QSRs at least once a week, and 13% at least once daily. In contrast, 41% of older consumers order from QSRs at least once a week, and 3% at least once daily.

A quarter (23%) of older consumers, but only 5% of young consumers, eat at a QSR restaurant less than once a month.

Get more data on QSR consumer habits. Download our QSR & Fast Casual Industry Snapshot for brand rankings and industry insights.

With their frequent purchases, young consumers are an important customer group for QSRs to attract. Using QuestBrand data, we've examined how young consumers think about five popular fast-food chains - Burger King, Chick-fil-A, McDonald's, Taco Bell, and Wendy's.

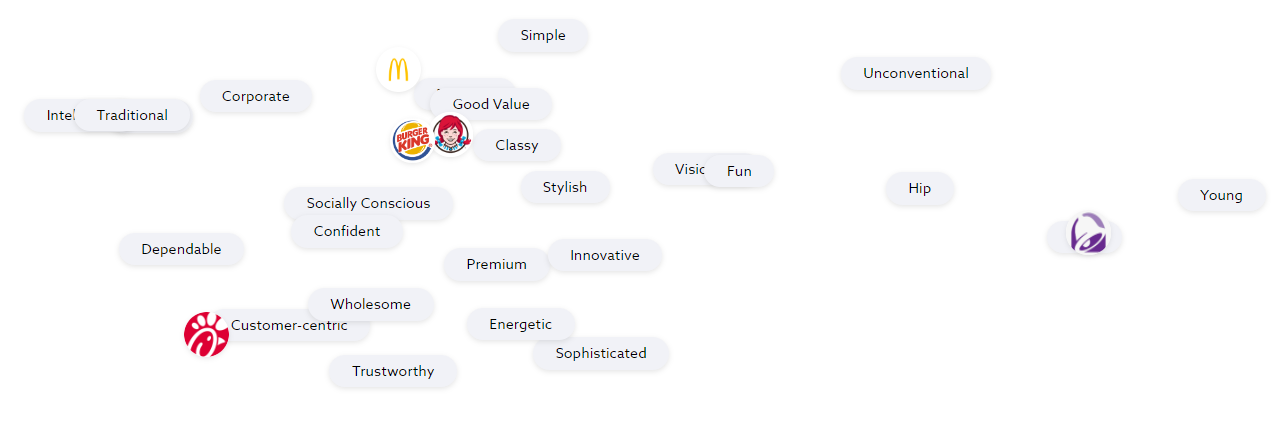

Below, we mapped these five QSR brands across 25 brand attributes (e.g., Customer-Centric, Fun, Young, Good Value) to reveal what defining characteristics young customers associate with each brand.

Young Consumers & Quick-Service Restaurants - Perceptual Map

QuestBrand. Base: US adults ages 18-34. 5/5/23-8/2/23. Burger King, n=749. Chick-fil-A, n=658. McDonald's, n=741. Taco Bell, n=781. Wendy's, n=724.

From the chart above, we see that young customers similarly describe Burger King, McDonald's, and Wendy's as "Practical," a "Good Value," and "Corporate."

Taco Bell and Chick-fil-A break away from these other brands and carve out more distinct personalities. Chick-fil-A is seen as "Customer-Centric," "Wholesome," and "Trustworthy." In comparison, Taco Bell is more often described as "Young," "Bold," "Unconventional," and "Hip."

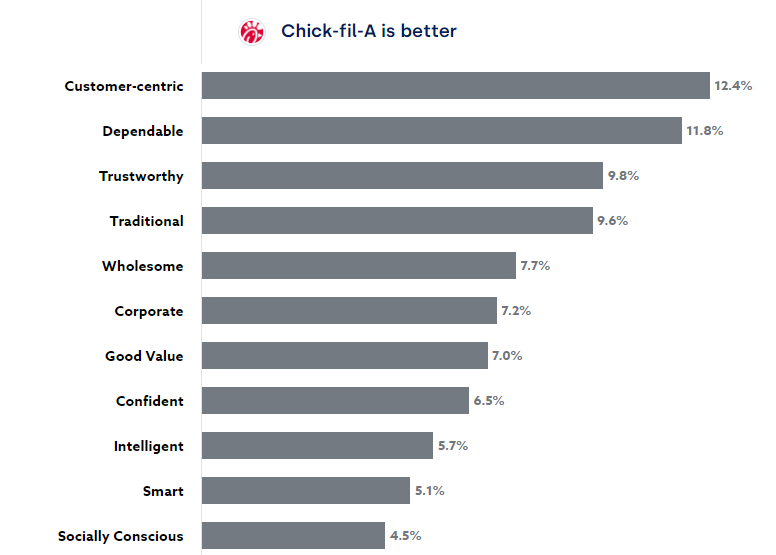

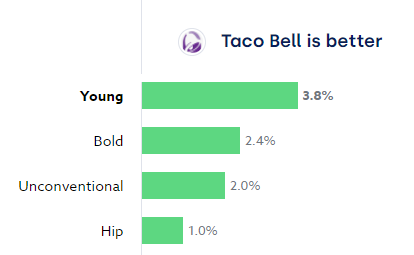

Below, we just compare Taco Bell and Chick-fil-A. Using Butterfly mapping, we illustrate the degree to which a brand owns each attribute, according to young customers.

Chick-Fil-A Scores Higher than Taco Bell - US Adults Ages 18-34

QuestBrand. Base: US adults ages 18-34. 5/5/23-8/2/23. Chick-fil-A, n=658. Taco Bell, n=781.

Taco Bell Scores Higher than Chick-Fil-A - US Adults Ages 18-34

QuestBrand. Base: US adults ages 18-34. 5/5/23-8/2/23. Chick-fil-A, n=658. Taco Bell, n=781.

Similar to what we saw on the larger Perceptual Map, Chick-fil-A owns "Customer-Centric," "Dependable," "Trustworthy," "Traditional," and "Wholesome." Taco Bell has cornered "Young," and is more often described as "Bold" and "Unconventional." These differing descriptors align with each QSR's personality and marketing efforts:

- Chick-fil-A: 2023 marked the 9th straight year that Chick-fil-A ranked first in the American Customer Satisfaction Index. Chick-fil-A's founder was a devoted Christian and philanthropist. Today, Chick-fil-A is still known for giving back to the community, supporting its employees, and for being closed on Sundays. Since 1973, Chick-fil-A has given more than $35 million in college scholarships to its employees.

- Taco Bell: Taco Bell is known for its young, edgy, and playful image. According to Christopher Ayres, Taco Bell's former Executive Creative Director, the QSR's target customer is "the eternal 25-year-old,” with a “rebellious, disruptive spirit, but always doing it with a wink, or some awareness and humor.” Unlike most American QSRs that cater to families, Taco Bell often serves customers at 2 a.m. who are refueling after a night of over-indulgence. Taco Bell fulfills 20% of all late-night fast-food orders.

Brand Perception Matters

Consumers' brand perception matters. How consumers feel about a brand drives their purchasing behavior, and determines whether they recommend the brand to others.

Do you know what consumers think about your brand? Request a QuestBrand demo and discover what emotional attributes your brand owns.

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Download the Data

This survey was taken from July 14-17, 2023 among 1,066 US adults.

Download

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Download the Data

This survey was taken from July 14-17, 2023 among 1,066 US adults.

Download

Related Content