Brief • 3 min Read

Recently, the growing fintech company, Revolut, announced that it officially secured its UK banking licence after a three-year process. During those years, Revolut demonstrated its dedication to the UK market by expanding its workforce, office, and market position.

Since Revolut has invested more in its UK client base and secured its banking licence, the company has seen a significant uptick in positive brand momentum among young investors. Compared to older consumers, young investors may be drawn to the convenience and seamless structure of online banking because they are so familiar with using digital tools in their daily lives.

Making strides in the UK

Even though Revolut’s headquarters are in London, the fintech company faced a prolonged approval process for its UK banking licence. Since first applying for the licence in 2021, Revolut has strengthened its presence in the UK ahead of a full launch.

Before receiving licence approval, the company hired a UK CEO, Francesca Carlesi, in December 2023. In June, the company announced that they will be relocating their global headquarters to London’s Canary Wharf in 2025, which will provide 40% more office space for the growing neobank.

These two exciting announcements set the stage as Revolut formally acquired their UK banking licence on July 25, 2024. At this point, Revolut entered the Prudential Regulation Authority (PRA)’s ‘mobilisation’ stage. During this period, Revolut can build out banking operations under authorisation with restrictions, such as only holding £50,000 of total customer deposits, until further notice.

This ‘mobilisation’ phase is a standard PRA process that provides a safety net for any developmental failures that may arise early on for new banks. It took longer for Revolut to reach this stage due to its share structure and delay in publishing 2021 accounts. To prove Revolut was worthy of the UK licence, and could effectively monitor finances, the company released its 2023 accounts ahead of schedule.

While nothing changes for UK customers during these restrictions, there have been significant shifts in how young investors are thinking about Revolut.

Notable shifts in consumer sentiment

In Revolut’s licence announcement, CEO Nik Storonsky said that “…we will ensure we deliver on making Revolut the bank of choice for UK customers.”

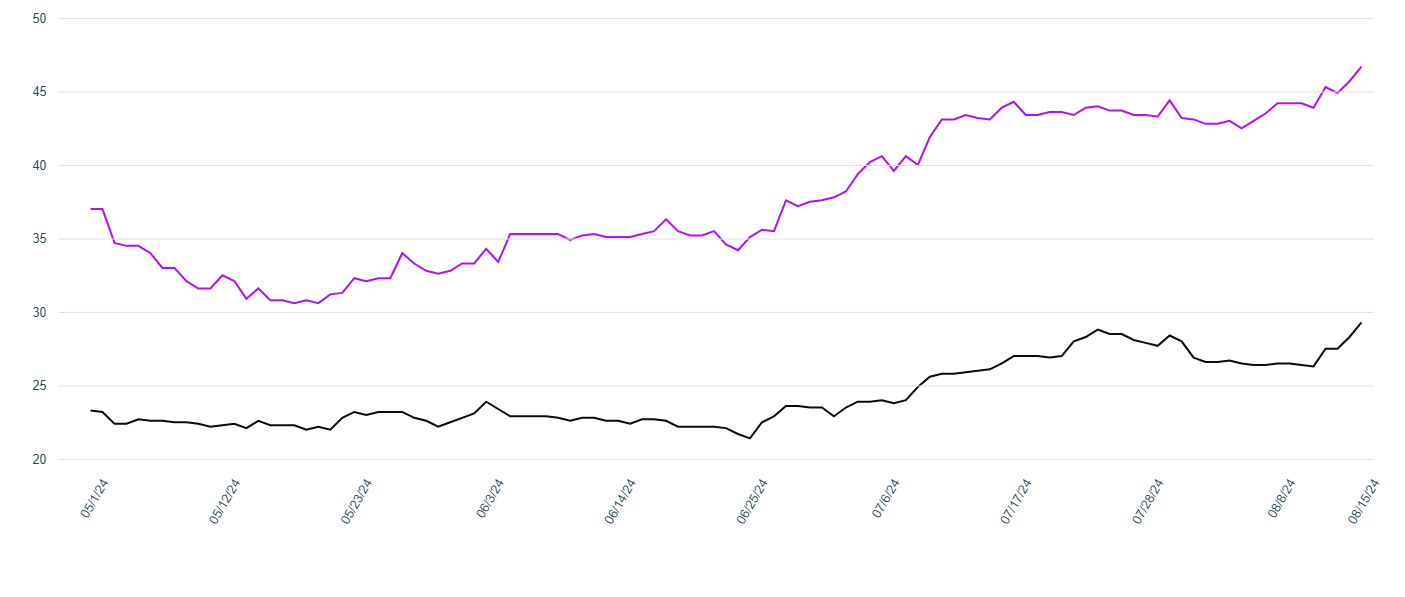

Leading up to and during the UK licence announcement, Revolut saw a significant increase in brand momentum among young investors, according to data from QuestBrand by The Harris Poll. Brand momentum is a component of brand equity that quantifies how consumers think a brand is doing compared to its competitors (i.e., is the brand gaining or losing market share).

Revolut’s Positive Brand Momentum Among Young Investors – 12 Week Trended Average

QuestBrand. Base: Young Investors (shown in purple) – defined as (UK adults ages 25-44 who own/use the following financial products – current or savings account, ISA, SIPP, employer-sponsored program, investment accounts, brokerage accounts, Junior ISA, unit trusts, annuity), n=466. Base: General population of UK adults, n=1,669. 5/1/24-8/15/24.

These trends illustrate how Revolut’s licence announcement positively impacted consumer brand perception over an 8 week period (both before and after the announcement).

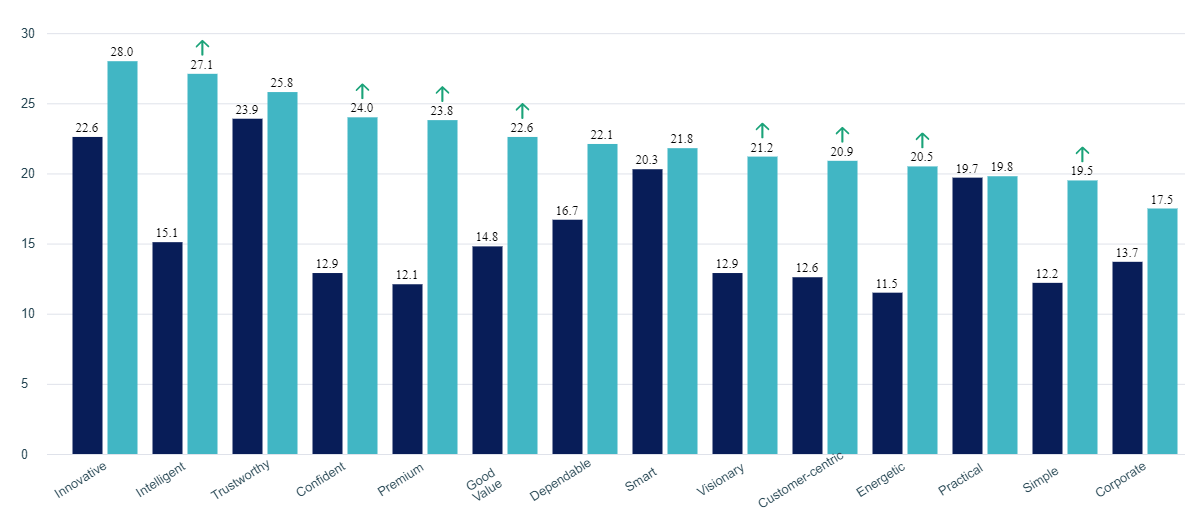

Change in Revolut’s Brand Attributes Among Young Investors

QuestBrand. Base: Young Investors (UK adults ages 25-44 who own/use the following financial products – current or savings account, ISA, SIPP, employer-sponsored program, investment accounts, brokerage accounts, Junior ISA, unit trusts, annuity). Pre: 5/1/24-6/30/24, n=250. Post: 7/1/24-8/15/24, n=215.

In addition to brand momentum, the way young investors think about the Revolut brand positively shifted from the licence announcement – young investors more often described Revolut as intelligent (+12.0), premium (+11.7), confident (+11.1), energetic (+9.0), visionary (+8.3), customer-centric (+8.3), a good value (+7.8), and simple (+7.3).

As Revolut moves beyond PRA restrictions, and further establishes itself in the UK financial landscape, we anticipate that positive consumer sentiment will continue to grow. Revolut’s UK strides have already presented an opportunity for the fintech company to capture consumer attention and fuel financial conversions in the future.

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Related Content