Brief • 2 min Read

What do a fighter jet, NASCAR, and Ozzy Osbourne have in common? They all play a role in daring beverage brand, Liquid Death’s, recent marketing frenzy.

Launched in 2019, Liquid Death has long turned convention on its head, with marketing campaigns that shock and entertain. These tactics have appealed to many consumers – especially young adults. For three straight years, Liquid Death has enjoyed “triple-digit” growth. As of March 2024, the beverage brand was valued at $1.4 billion.

But it’s just water…right? Liquid Death started by selling canned still water, and expanded its product line to include flavored sparkling waters, ice tea, and “Death Dust” (electrolyte powder). Customers love Liquid Death products, but the company’s surprising marketing maneuvers are even more alluring.

Want more information on food & beverage trends? Check out our Food & Beverage: An Industry Snapshot report for insights and brand data.

“Many marketers and brand owners undervalue the power of true curiosity. If your brand can truly stop someone in their tracks and make them curious or to make them actually have questions, you have a much better shot as a new brand to convert them into a new customer. True disruption is a highly complex art and science. The details and strategic nuance matter.” – Liquid Death founder and CEO Mike Cessario in an interview with BeverageDaily

Liquid Death’s Recent Marketing Wins

In May, Liquid Death announced that they were giving away a $400K fighter jet. In addition to the jet, the winner will receive six months of free hanger space, a pilot’s helmet, and a year’s supply of Liquid Death. If you don’t want the free fighter jet, Liquid Death will give you $250K delivered in a briefcase (which is also pretty cool).

But Liquid Death didn’t stop there. In April, Liquid Death announced a multi-year deal as the “Official Iced Tea of NASCAR.” In June, the beverage brand released a new campaign in which rock legend Ozzy Osbourne warns teens to not snort Death Dust (after a number of alarming comments on Instagram suggesting that customers were engaging in questionable consumption practices.) The Ozzy-fueled campaign hit just as Liquid Death released a new Death Dust flavor, ratcheting up hype around the product.

Trial Among Young Adults Grows

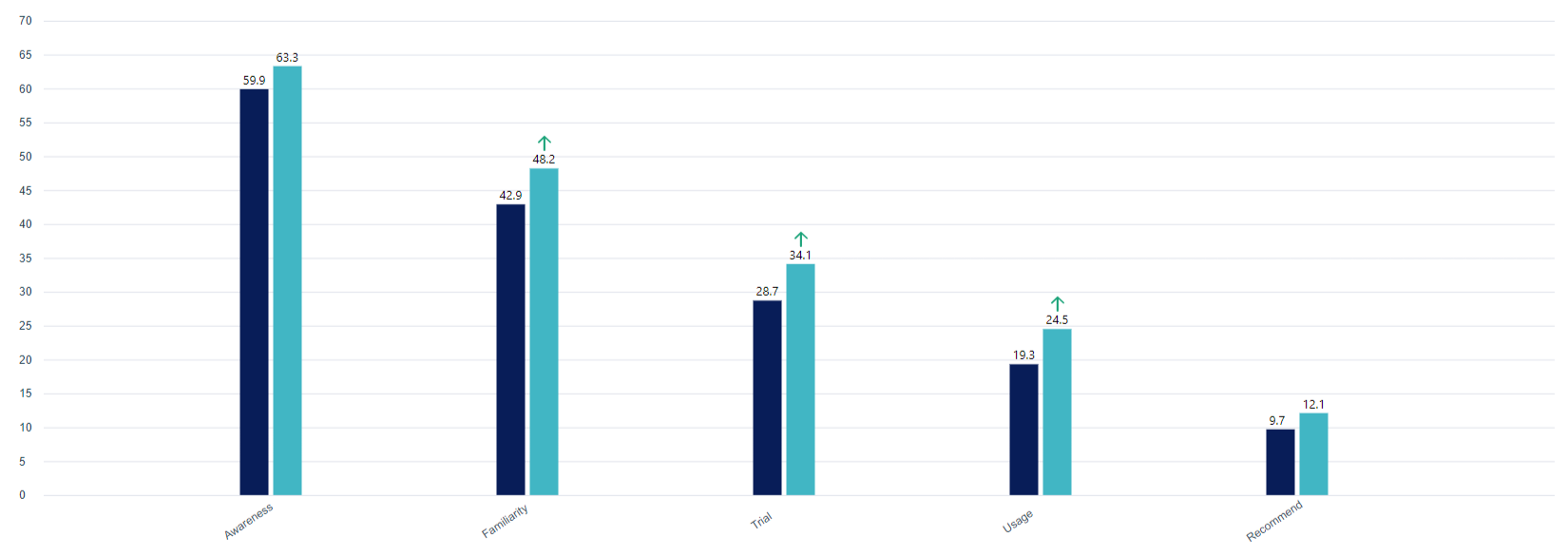

Liquid Death’s Sales Conversion Funnel Q1 vs Q2 2024 Among Young Adults

Figure 1. QuestBrand. Base: Millennials + Gen Z Adults. Pre: 1/1/24-3/31/24, n=1,1550. Post: 4/1/24-6/30/24, n=1,195.

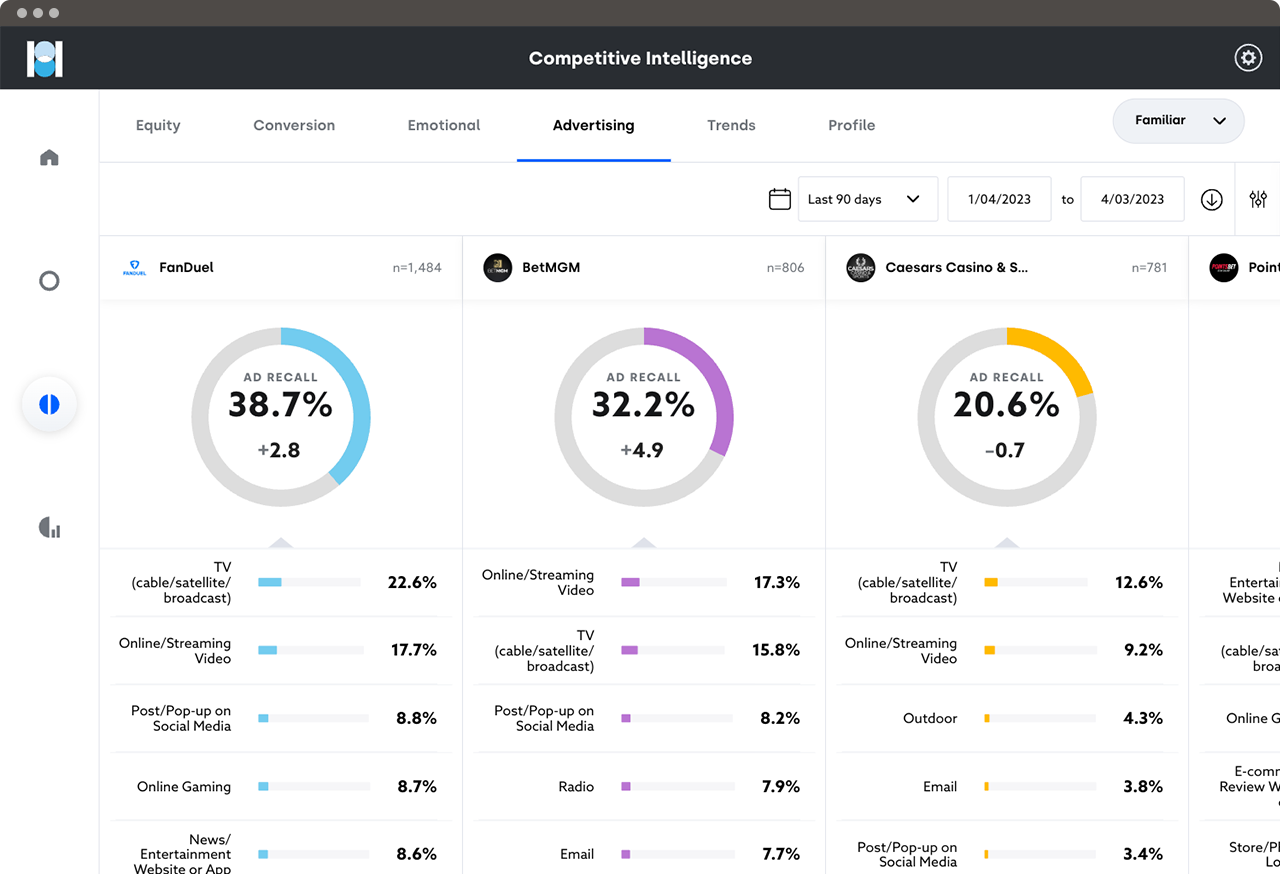

Using data from QuestBrand by The Harris Poll, we compared Liquid Death’s sales conversion funnel in Q1 to Q2 2024 among young adults (Millennials and Gen Z adults) amid this marketing onslaught. A sales conversion funnel tracks customers’ journey on the buying process, from initial brand awareness through to product purchase and recommending the product to others.

From the first to the second quarters of 2024, young adults’ brand Familiarity (+5.3), Trial (+5.4), and Usage (+5.2) all significantly increased. These increases signal that young adults are trying Liquid Death more in Q2 than Q1, a positive sign for the brand’s continued growth. With these numbers, we predict that Liquid Death’s sales will continue to rise among this demographic.

From 2022 to 2023, Liquid Death’s retail sales jumped from $110 million to $263 million. Liquid Death, let us know when your sales reach $500 million, and we’ll crack open a can of sparkling water to toast your truly impressive marketing prowess.

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Related Content