Brief • 2 min Read

With just over half of the UK population owning a pet, demand for pet food is high, and so are consumers’ values when choosing a brand to satisfy their furry friends.

Pedigree, founded in 1957, has consistently captured a large slice of market share and UK consumer brand familiarity. Recently, the wholesome food brand Lily’s Kitchen, founded in 2008, has earned higher consumer consideration. While the two brands are popular choices, Lily’s Kitchen has recently seen momentum growth among UK consumers.

Premium priorities

UK pet owners are investing more in their furry friends – even more than dating and childcare. A majority of UK pet owners spend about £26–£50 on their pets per month, and the UK pet food market is worth a total of £3.3 billion. So, where do consumer choices play into this?

Pedigree has had a greater headstart in capturing consumer attention. Originally founded in Manchester, the company moved its headquarters and primary production to the US after being acquired by Mars. Pedigree takes pride in nutrition and charity, as well as offering affordable prices.

In comparison, Lily’s Kitchen has stayed true to its London roots, producing food in the UK and shipping globally. Henrietta Morrison, a UK pet owner, developed Lily’s Kitchen by making homemade meals for her unwell dog, Lily. Morrison has grown Lily’s Kitchen by collaborating with veterinarians, nutritionists, and Nestlé Purina PetCare. The homemade feel of Lily’s Kitchen may attract pet owners despite the brand being pricier than Pedigree.

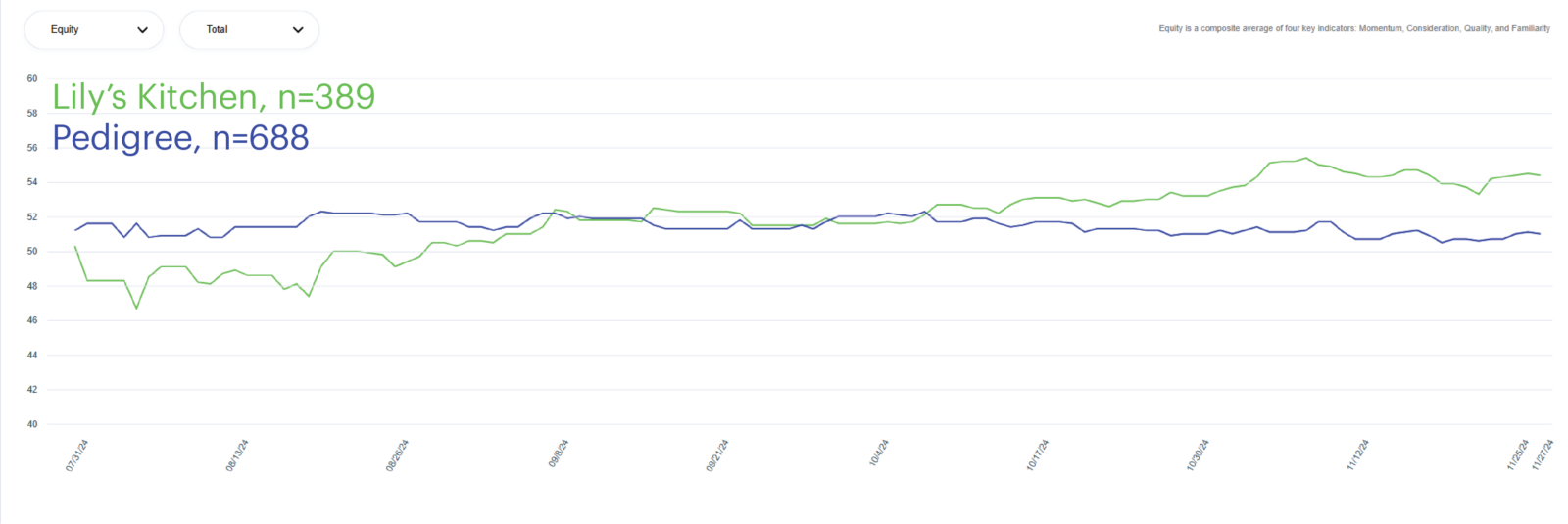

According to data from QuestBrand by The Harris Poll, Lily’s Kitchen experienced strong growth in overall brand equity near the end of 2024. Brand equity is an average of familiarity, quality, consideration, and momentum and measures the value consumers see in a brand during a specific time.

Lily’s Kitchen and Pedigree’s Brand Equity among UK adults – 12 Week Trended Average

QuestBrand. 7/31/24-11/27/24. Base: UK adults familiar with the brands. Lily’s Kitchen n=389. Pedigree, n=688.

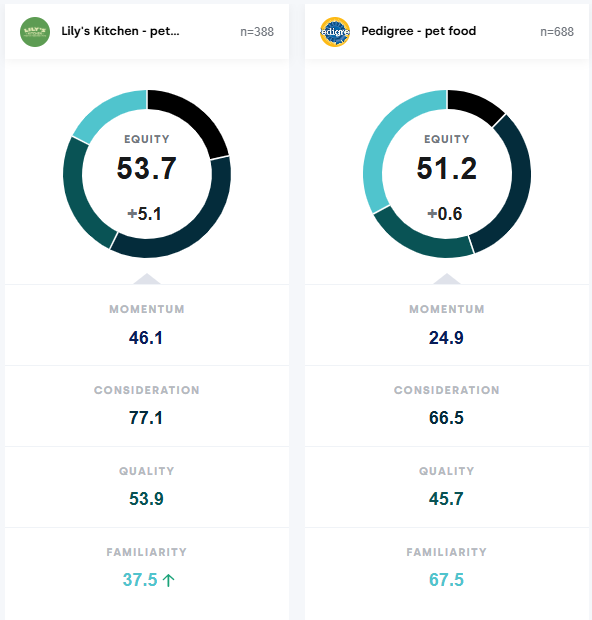

Side By Side Brand Equity Comparison – Lily’s Kitchen vs Pedigree

QuestBrand. 7/31/24-11/27/24. Base: UK adults familiar with the brands. Lily’s Kitchen n=388. Pedigree, n=688.

While Pedigree has a consistently higher familiarity score, Lily’s Kitchen scores higher in quality, consideration and momentum. Lily’s Kitchen’s quality score could be attributed to its use of high-quality, natural ingredients and organic meat.

Additionally, consumer purchase consideration could go beyond the food bag and be influenced by messaging and consumer engagement.

Beyond the bowl

Aside from feeding their pets nutritious foods, UK consumers may be more attracted to brands that practice philanthropy.

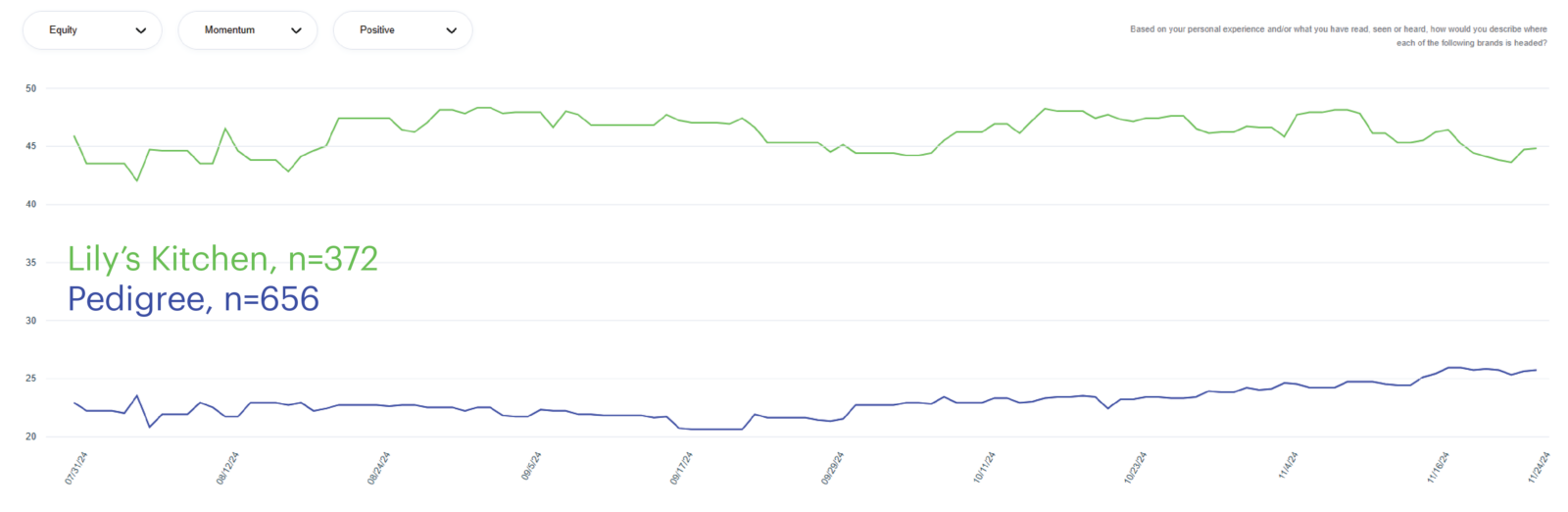

Both Pedigree and Lily’s Kitchen are investing in the pet community by supporting animals in need. The Pedigree Foundation has awarded over 6,200 grants and $12 million to U.S. shelters and Lily’s Kitchen has supplied over 750,000 meals to UK rescue centres. Additionally, both brands have spread their mission through different advertising forums. This could be contributing to the positive momentum consumers foresee in both brands, especially Lily’s Kitchen.

Lily’s Kitchen and Pedigree’s Positive Brand Momentum Among UK Adults – 12 Week Trended Average

QuestBrand. 7/31/2024-11/24/2024. Base: UK adults familiar with each brand. Lily’s Kitchen, n=372. Pedigree, n=656.

While Pedigree has produced a plethora of heartfelt ads, Lily’s Kitchen has turned to in-person experiences pet owners can attend. During September, Organic Month in the UK, Lily’s Kitchen hosted a Fish & Chips Roadshow in England to share its recipes with people and pets in a playful environment. This active experience could be what shifted the brand equity score for Lily’s Kitchen, and consumers may be looking forward to more events in the future.

As both companies continue to capture consumer attention, it will be interesting to see if Lily’s Kitchen eats more into Pedigree’s market share despite Pedigree’s long history of success and recognition.

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Related Content