Brief • 3 min Read

In each month’s industry snapshot report, we rank the top 10 brands by brand equity, and the top five brands by quarter-over-quarter brand equity growth according to QuestBrand data. This month, Hyundai was the top automobile brand by brand equity growth from Q3 to Q4 2022. Brand equity measures the overall value that consumers see in a brand at a moment in time.

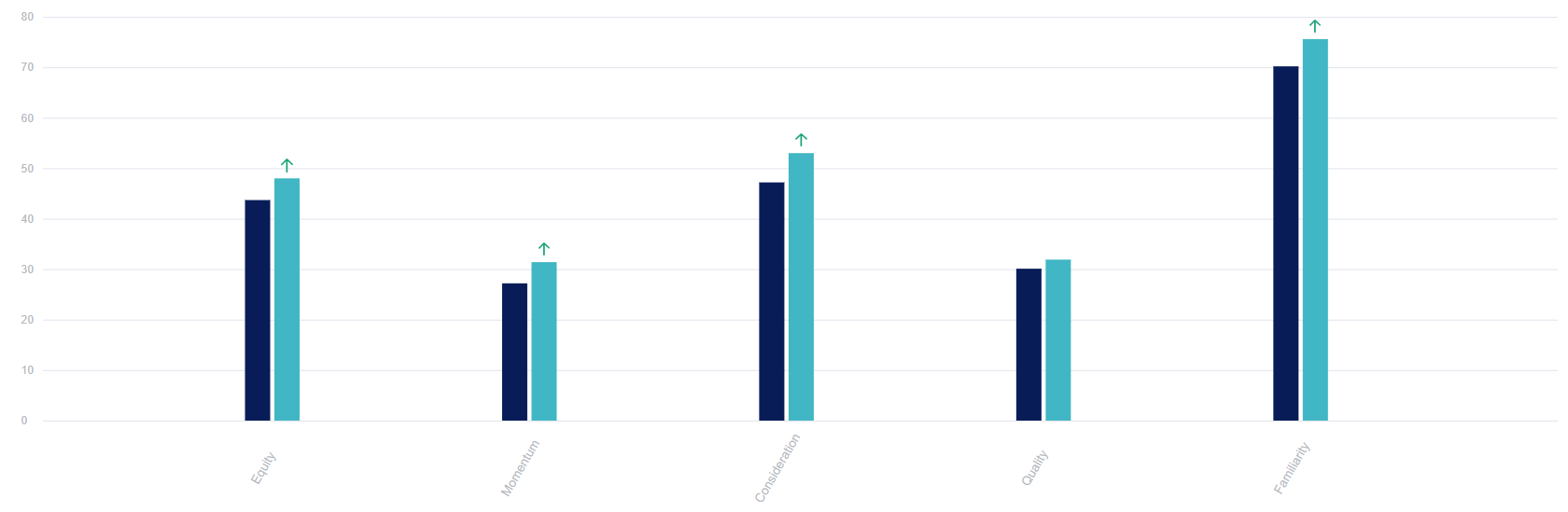

The vehicle manufacturer saw growth across all components of brand equity (+4.2): brand familiarity (+5.2), perceived quality (+1.8), purchase consideration (+5.8), and perceived momentum (+4.2). They saw the greatest increase in purchase consideration, signaling that consumers felt more inclined to consider purchasing a Hyundai in Q4 than in Q3 2022.

So what was Hyundai up to in Q4 that swayed consumer sentiment in their favor? It turns out, they were up to a lot.

Want to learn more about recent trends in the automotive industry? Check out our Automotive: An Industry Snapshot report for key insights and brand rankings!

Hyundai Brand Equity Q3 v Q4 2022

QuestBrand. Base: General population of US adults. Pre: 7/1/22-9/30/22, Total (n=1,940). Post: 10/1/22-12/31/22, Total (n=1,339).

In November, U.S. News & World Report awarded Hyundai the distinction of being the 2023 Best SUV Brand for the third year in a row.

Helping to drive Hyundai’s brand equity growth was consumer excitement for their lineup of EVs. In November, Hyundai’s 2023 IONIQ 6 made its debut at the auto show, AutoMobility Los Angeles. In December, Hyundai also gave consumers a sneak peek at the 2024 Hyundai Kona (non-electric versions are also available).

EVs have been a key component to the vehicle manufacturer’s sales success. In Q4, Hyundai set a company-record for the number of hybrid and all-electric car sales. Their EV sales rose by about 27% from 2021. In response to this positive growth, Hyundai increased this year’s EV sales target by 40%, highlighting their ongoing optimism for EV.

This fall, Hyundai also announced that they would be investing $5.5 billion in the launch of their first US-based EV plant, located in Georgia. Under current regulations, consumers are only eligible to receive tax credits for their EV purchase if it is manufactured in North America. Launching their first US-based plant could encourage more consumers to purchase electric Hyundai vehicles in the years ahead, since as earlier reported, having financial incentives (e.g., tax credits, insurance breaks) available would make 43% of US adults more likely to purchase an EV.

With such a strong end to 2022, we are excited to see what Hyundai brings to 2023, whether that be innovative EVs, top-notch SUVs, or a slew of US-based jobs.

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Related Content