Brief • 2 min Read

Dove ranked 12th in our latest AdAge-Harris Poll Gen Z brand tracker. This quarterly index uses data from QuestBrand by The Harris Poll to rank the top 20 brands by brand equity growth among Gen Z adults (ages 18-27).

Over the last 20 years, Unilever’s Dove has challenged stereotypical beauty standards by featuring real women in its advertising campaigns. While “Real Beauty” pioneered Dove’s empowering efforts in 2004, the brand has continued to appeal to consumers and boosted consumer purchase consideration among Gen Z (+12.9) from Q2 to Q3 2024.

So, what caused this significant spike within the Gen Z audience?

Real Role Models

Dove kicked off Q3 by introducing a campaign that appealed to younger consumers – “Dove X Venus.” In this July campaign, Dove joined forces with professional tennis player Venus Williams to support girls in sports while offering a limited-edition Beauty Bar for the first time.

The #KeepHerConfident Beauty Bar was colored like a tennis ball, engraved with “confident,” and packaged in an exclusive canister. Pairing this public figure’s influence with a limited-edition product appeared to be a winning strategy for Dove to increase its brand equity score among Gen Z consumers in Q3.

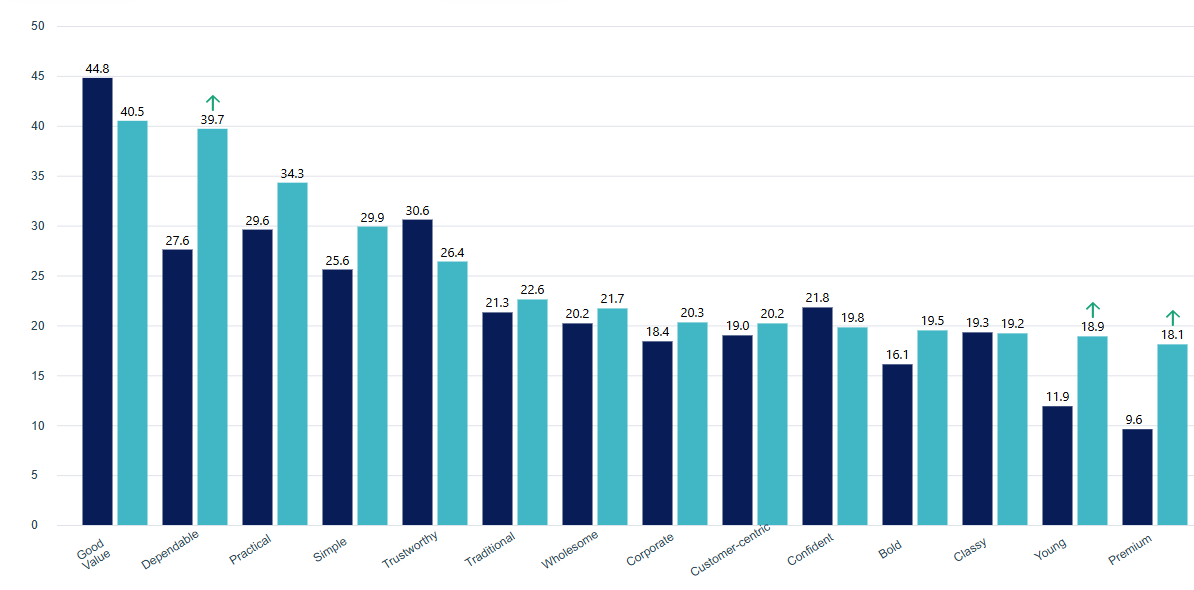

During this time, Gen Z consumers more often described Dove as Dependable (+12.1), Premium (+8.5), and Young (+7.0) compared to Q2.

Change in How US Gen Z Adults Describe Dove Q2 vs. Q3

QuestBrand. Base: US Gen Z adults. Pre: 4/1/24-6/30/24, n=218. Post: 7/1/24-9/30/24, n=227.

Inclusive Impact

Dove continued Q3 with “Beauty Never Gets Old,” a campaign highlighting women over 60 who have used Dove’s Beauty Bar for a lifetime.

Despite the campaign’s content featuring an older age demographic, Gen Z’s purchase consideration increased while the ads ran in August. This could be due to the campaign’s goal of combating beauty standards for women of all ages and featuring the longtime impact of Dove products.

Positive Brand Consideration Among U.S. Adults – 12 Week Trended Average

QuestBrand. 4/1/2024-9/30/2024. Base: U.S. adults, ages 18+, n=2,655. Base: Gen Z, n=445.

Observing Dove’s impact on young consumers during Q3 can help the brand strengthen its efforts to secure more Gen Z customers in the future.

Learning from Q3, Dove could develop a new exclusive product to coincide with the holiday season or connect with more influential individuals who resonate with Gen Z.

Will purchase consideration continue to increase among Gen Z consumers as Dove unveils more campaigns?

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Related Content