Brief • 2 min Read

In Germany’s online marketplace, Amazon.de and Kaufland.de have established themselves as popular retailers among Gen Z consumers by providing enticing deals and products. To kick off October, Amazon caught consumers’ attention by hosting Big Deal Days, a two-day online event where Prime members could cash in on exclusive deals.

The savings opportunity was accessible in 19 countries, but in this post, we focused on German Gen Z consumers to see how Big Deal Days impacted their perception of Amazon compared to Kaufland.

While Big Deal Days only ran from October 8-9, Amazon differentiated itself from Kaufland by sharing shopping guides and discounts on popular brands, such as Samsung and Disney.

Battle of the brands

While global giant Amazon sells “everything from A to Z,” Kaufland focuses on selling groceries, household products, and discounted care items online and in stores.

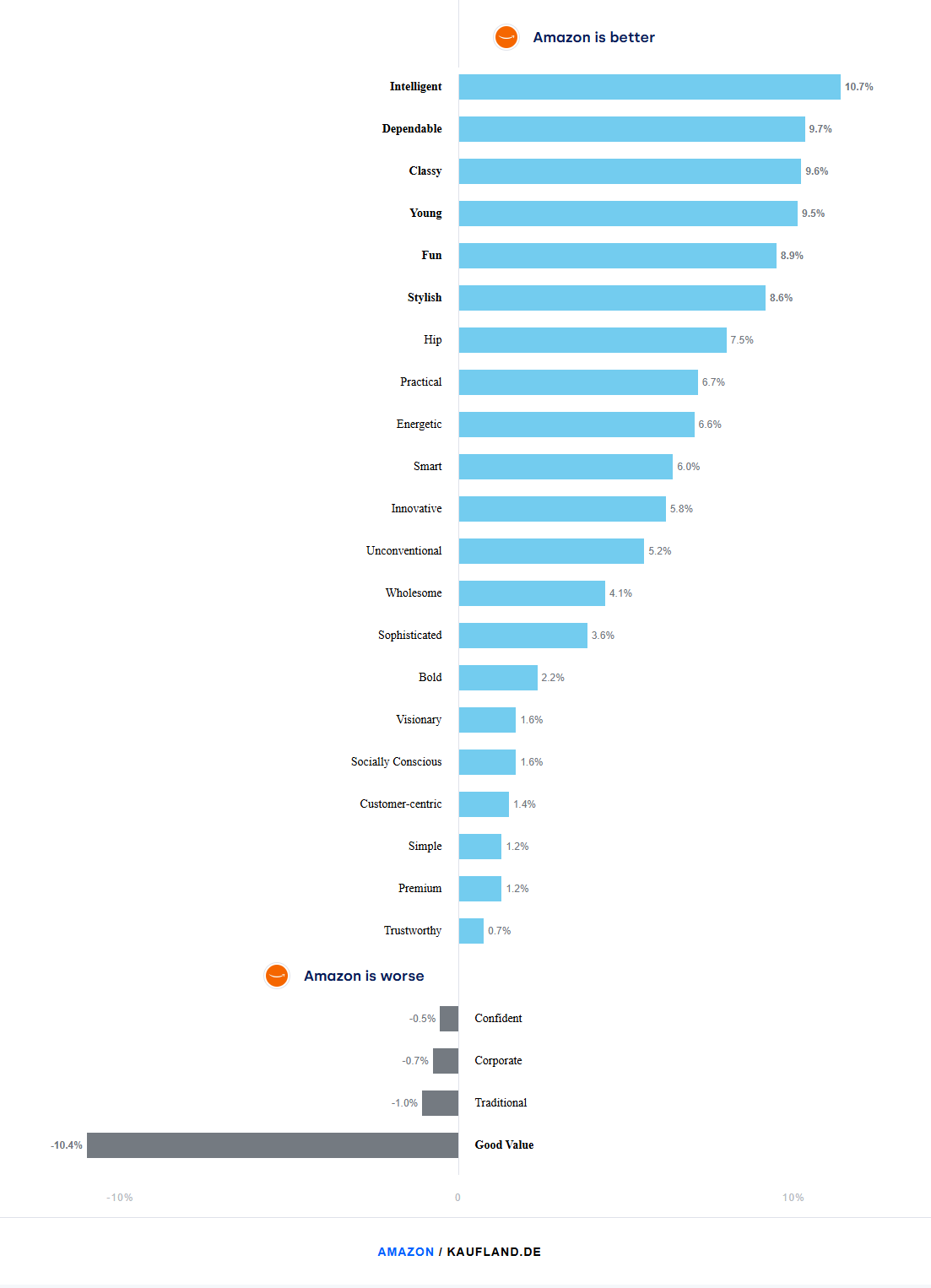

Comparing Amazon and Kaufland using data from QuestBrand by The Harris Poll, we can see that German Gen Z consumers more often describe Amazon as Intelligent (10.7%), Dependable (9.7%), Classy (9.6%), Young (9.5%), Fun (8.9%), and Stylish (8.6%).

Retailer Perceptions Among Gen Z German Consumers

QuestBrand. Base: Gen Z German Consumers. 4/1/2024-10/16/2024, Amazon, n=202. Kaufland.de, n=203.

In comparison, Kaufland was significantly more often described as Good Value (10.4%) than Amazon, which is interesting considering Amazon’s widely marketed promotions.

This could be attributed to the two brands’ approaches to discounts. While Amazon targets October as a season for Prime member savings, Kaufland releases monthly savings catalogs available to consumers with a Kaufland Card. These loyalty programs could be drawing more Gen Z consumers who are looking for long-term savings and a smart, seamless shopping experience.

Deals drive momentum

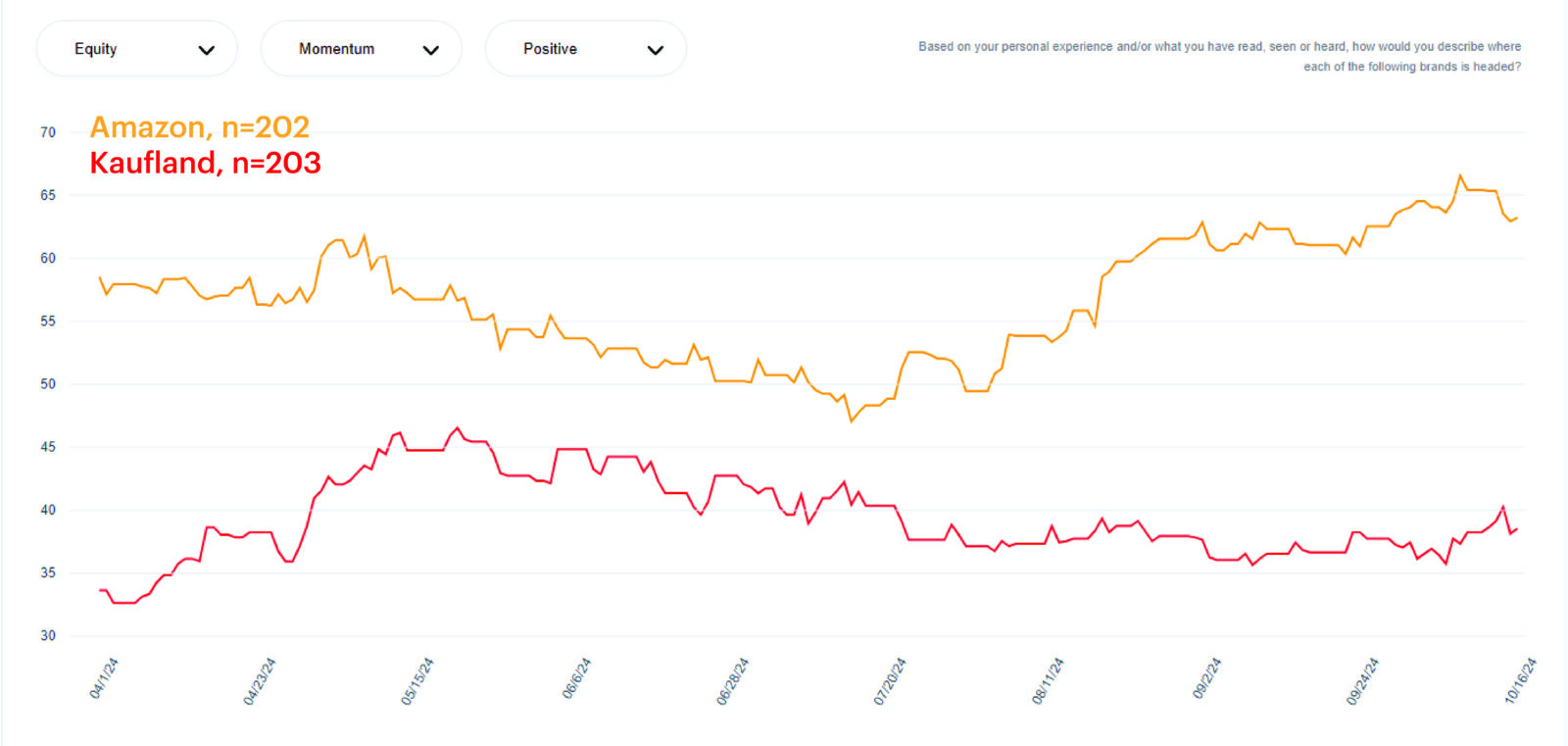

Over the last six months, QuestBrand data shows that Amazon and Kaufland’s equity scores increased among Gen Z German consumers. Kaufland emerged with significant growth (+8.1%) during this period.

Amazon and Kaufland’s Brand Equity Scores Among German Gen Z Consumers

QuestBrand. Base: Gen Z German Consumers. 4/1/2024-10/16/2024, Amazon, n=202. Kaufland.de, n=203.

This change in Kaufland’s equity score could be due to the brand’s annual e-Commerce Day held on April 26. This event is a trade fair presented by Kaufland that brings together exhibitors, sellers, service providers and manufacturers interested in e-commerce. While this event doesn’t offer promotions like Big Deal Days, it’s an opportunity for Kaufland to increase brand credibility and showcase its commitment to both sellers and consumers.

Amazon, on the other hand, has been the consistent leader in Germany’s online marketplace, recording 42.5 million users in 2023 compared to Kaufland’s 32 million.

When German consumers were asked where they thought Amazon’s market position is heading, there was a significant uptick in brand momentum among Gen Z consumers leading up to and following Big Deal Days. This could be due to Amazon’s promotional efforts and push for consumers to benefit from Big Deal Days.

Positive Brand Momentum Among Online Retailers – 12 Week Trended Average

QuestBrand. Base: Gen Z German Consumers. 4/1/2024-10/13/2024, Amazon, n=202. Kaufland.de, n=203.

With Big Deal Days over, it will be interesting to see how Germans perceive Kaufland ahead of the brand’s participation in Singles’ Day – a global online shopping event, with exclusive savings, from November 6-12. Will Gen Z consumers temporarily turn their attention away from Amazon, or will the online super giant continue to be a popular brand of choice among German shoppers?

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Related Content