Brief • 2 min Read

As more Americans ditched cable subscriptions in favor of streaming, the number of service options mushroomed. Today, Netflix and Amazon Prime Video maintain a strong lead in subscribers, while later entrants are fighting to attract users.

As part of QuestBrand’s research into the trends and brands of the entertainment industry, we look at how consumers view streaming giants Netflix and Amazon Prime Video in comparison to newer entrants Peacock and Paramount+.

We also examine where Paramount+ and Peacock are losing potential customers in their sales funnels. Using this information, we will determine where they can focus their marketing attention to grow their subscriber base.

How do consumers value each streaming brand?

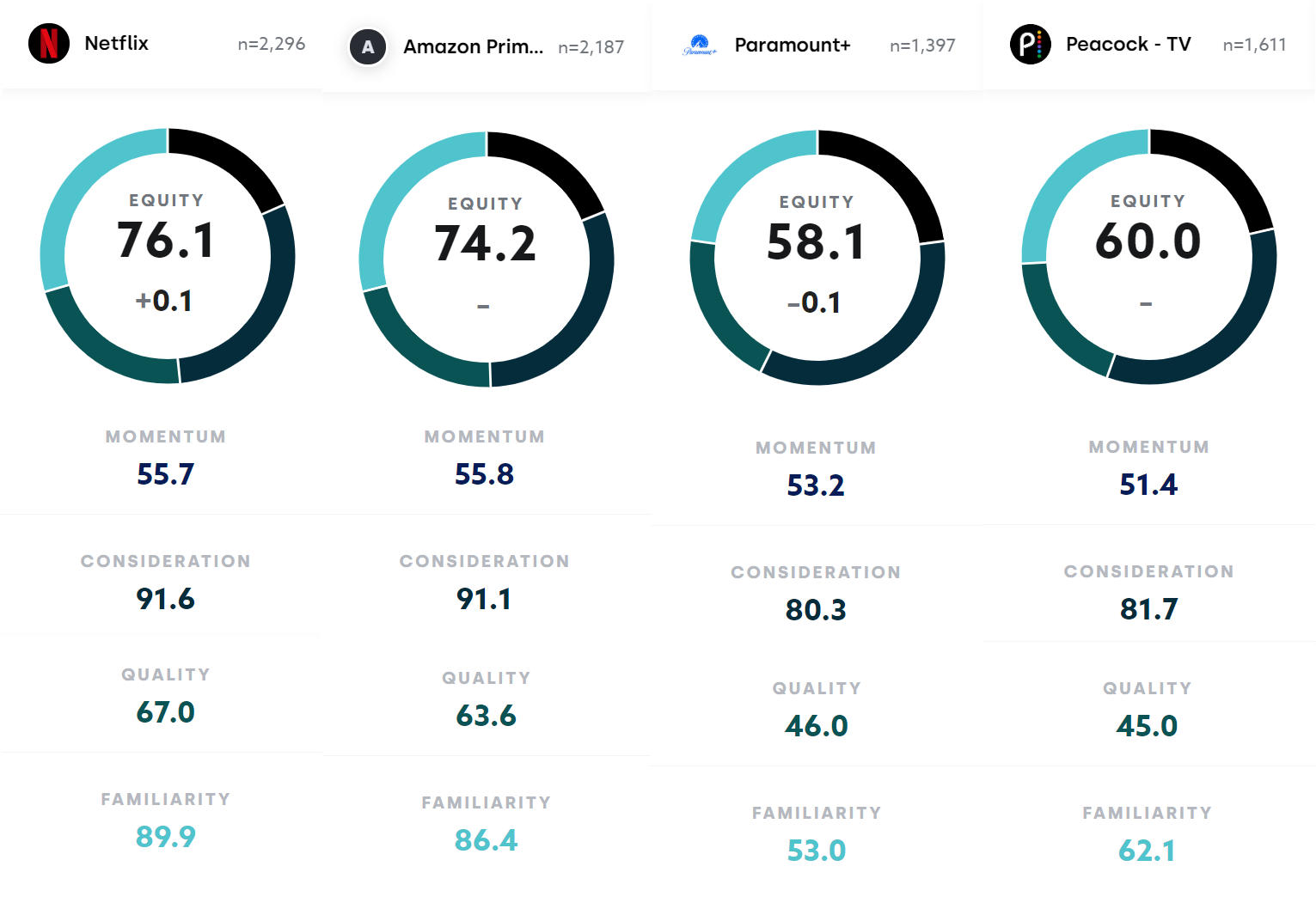

We will first look at each company’s QuestBrand brand equity score for a snapshot of how consumers perceive each brand’s value. A company’s brand equity score is comprised of four components – momentum, consideration, quality, and familiarity.

According to data collected in the last quarter of 2021 (October 1 – December 31), brand equity scores for our four streaming services are:

- Netflix: 71.4

- Amazon Prime Video: 67.2

- Peacock: 42.7

- Paramount+: 35.8

Comparing the equity score components, Netflix and Amazon Prime Video have higher scores across familiarity, quality, consideration, and momentum. At the center of the difference in scores lies the fact that consumers are significantly less familiar with the newer entrants than they are with Netflix and Amazon Prime Video.

Peacock and Paramount+ must first increase consumer knowledge of their brand and service offerings before they can hope to increase their subscriber base. This lack of brand knowledge is also evident when we compare how potential customers flow through each company’s sales conversion funnel.

Can a change in marketing focus increase subscribers?

Discrepancies in the number of each service’s subscribers are significant. Netflix has more than 200 million users, and Amazon Prime Video has more than 175 million. Comparatively, Paramount+ and Peacock have only amassed about a quarter of this (47 million and 54 million respectively).

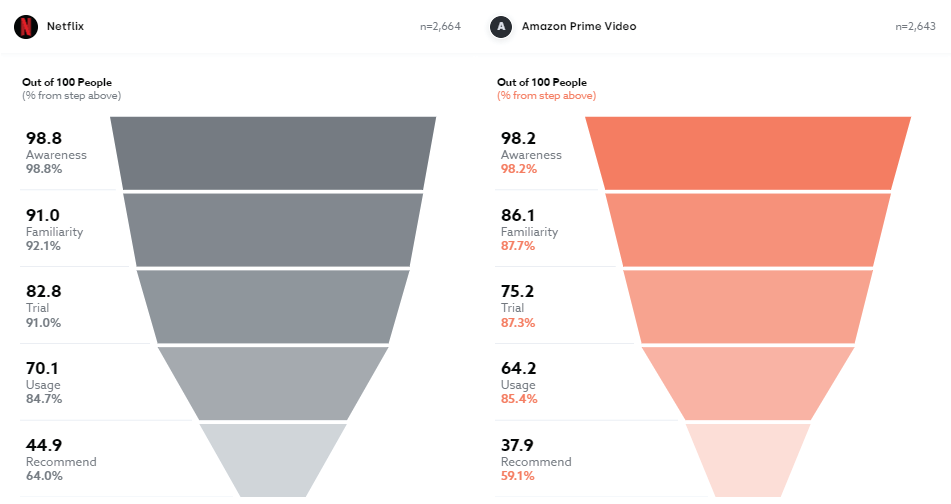

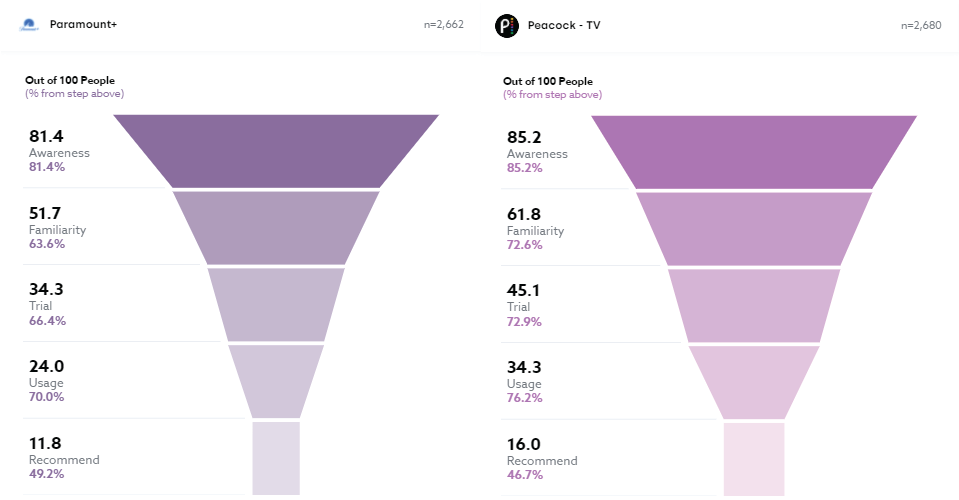

A closer look at each company’s conversion funnel helps explain where they can focus their marketing efforts to narrow the gap. Sales conversion funnels illustrate how each brand’s potential customers flow through the sales process and interact with the brand.

Companies can learn a lot from seeing where the most potential customers leave their sales funnel. Strengthening marketing efforts at the leakiest point of the consumer journey can generate more consumer brand interactions and boost the number of eventual sales.

Netflix and Amazon Prime Video’s Sales Conversion Funnels

Paramount+ and Peacock’s Sales Conversation Funnels

As leaders in streaming, Netflix and Amazon Prime Video maintain a high number of consumers throughout each stage of the sales funnel. Almost all consumers (98.8%) are aware of Netflix, 91% are familiar with the brand, and 70.2% report using the brand. In contrast, 81.3% of consumers are aware of Paramount+, 51.5% are familiar with the brand, and 23.8% use the brand.

When comparing Netflix and Paramount+’s sales funnels, Paramount+ has a higher rate of customer attrition between each stage of the sales journey. Paramount+ lacks Netflix’s high brand familiarity and trial that ultimately contributes to Netflix’s higher rate of user acquisition.

Paramount+ and Peacock lose the greatest number of potential customers between the awareness and familiarity rungs of the sales funnel. While most consumers have heard of the brand, much fewer know what value the brand provides. Fortunately, knowing where they are losing potential customers can help the companies reverse this trend with a thoughtful marketing strategy.

Marketing efforts that can benefit newer entrants

While reaching a Netflix or Amazon Prime Video level of subscribers may seem daunting for newer entrants, these brands could use knowledge of their brand equity score and conversion funnel attrition to make meaningful changes that increase their sales and revenue.

To strengthen consumer familiarity with their brands, the companies can develop actionable content that addresses key consumer questions or pain points. Consumers will not consider trying or purchasing a service without this key information. If the services provide more marketing materials that boost consumer familiarity, more potential subscribers will proceed to the trial and usage stages of purchase.

While expensive, high-profile partnerships can also provide newer entrants the recognition they need for growth. Leveraging its Olympic rights, NBCUniversal’s Peacock streamed all Olympic events live, in addition to NBC’s primetime show and studio programming. The investment paid off for Peacock. The brand saw a significant brand equity lift from the Olympic games, with a 10% rise from its pre-Olympics equity score.

To learn how you can use QuestBrand to make data-based decisions for your company, email [email protected] today.

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Related Content