Brief • 3 min Read

In late April, Walmart joined the world of private-label brands when they launched ‘bettergoods.’ It’s counterparts, such as Costco’s Kirkland, Whole Foods Market’s 365, Kroger’s Private Selection, and Trader Joes, have done exceedingly well in a market of rising food prices and tightening budgets.

Private label brand sales increased 6% from 2022 to 2023. With wholesale food prices 22.4% higher in January 2024 than January 2022, and fast food up 29.6% nationally, it is no wonder consumers are exploring more affordable alternatives.

A Closer Look at Bettergoods

“Today’s customers expect more from the private brands they purchase—they want affordable, quality products to elevate their overall food experience. The launch of bettergoods delivers on that customer need in a meaningful way. Bettergoods is more than just a new private brand. It’s a commitment to our customers that they can enjoy unique culinary flavors at the incredible value Walmart delivers.” – Scott Morris, Senior Vice President – Food and Consumables – Private Brands at Walmart

Well-timed during a period of high financial anxiety, bettergoods came onto the market with products priced between $2 to $15. Their line also pushes trending foods through a three-category focus. These three categories include: culinary experiences, plant-based foods, and “Made Without.” “Made Without” offers items that are gluten-free, and made without artificial flavors, colorings, added sugars, dairy, etc.

A peek at the prices: bettergoods’ plant-based oat milk ice cream comes in at $3.44 a pint, plant-based cheese alternative at $4, ‘premium Bronze Cut Pasta from Italy’ at $1.97, and various seasonings for under $2. These are some serious deals when compared with items in your local supermarket.

Facts and figures aside, its important to note what costumers really think of these products. A food tasting review featured on Business Insider offered that “The foods tried impressed me so much that I’d repurchase even my lowest-ranked, least favorite items.” Similarly, Make It Dairy Free, a vegan and plant-based product review site, reported bettergoods’ great standing in the plant-based ice cream world.

Shifting Millennials’ Brand Perceptions

Private label products have especially caught the eyes (and wallets) of Millennials and Gen X – these groups make up more than a third (36%) of private label brand consumers. Millennials’ affinity for private label brands appears to extend to Walmart’s bettergoods line. From Q1 to Q2 2024, we see a significant shift in how Millennials perceive the Walmart brand.

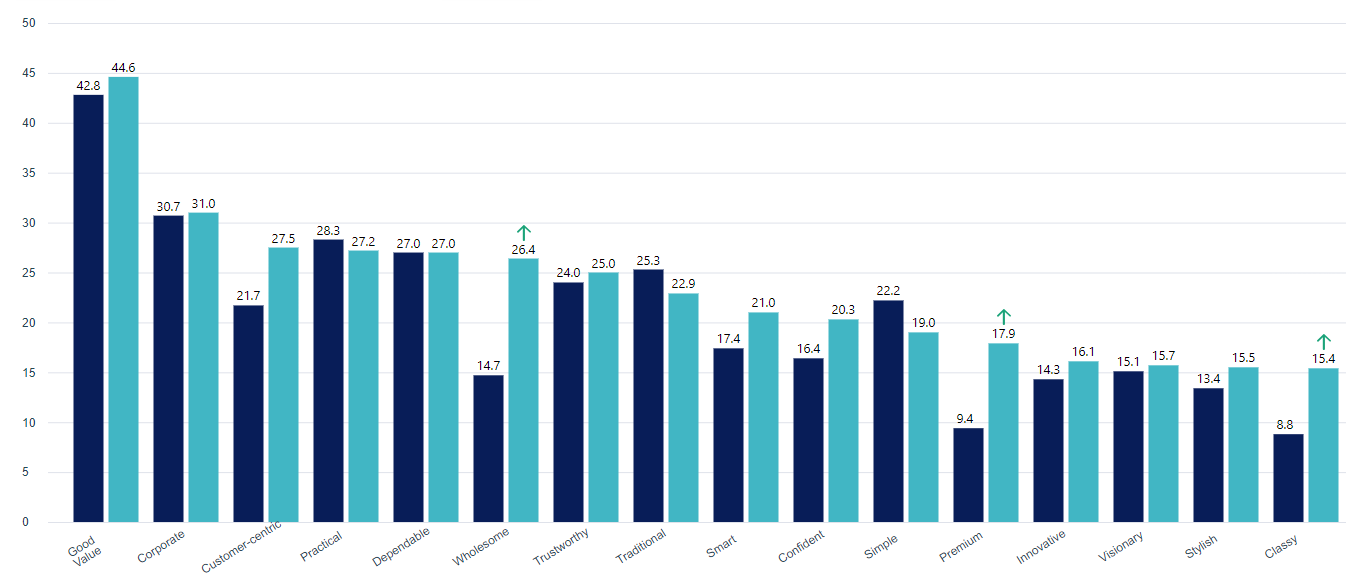

Using data from QuestBrand by The Harris Poll, we can measure how Millennials’ brand perceptions shifted from Q1 to Q2 (i.e. pre vs post the launch of bettergoods). In Q2, Millennials significantly more often describe the Walmart brand as “Wholesome” (+11.7), “Premium” (+8.5), and “Classy” (+6.6).

Attributes Millennials Ascribe to Walmart – Q1 vs Q2 2024

QuestBrand. Base: Millennials. Pre: 1/1/24-3/31/24, n=436. Post: 4/1/24-6/30/24, n=271.

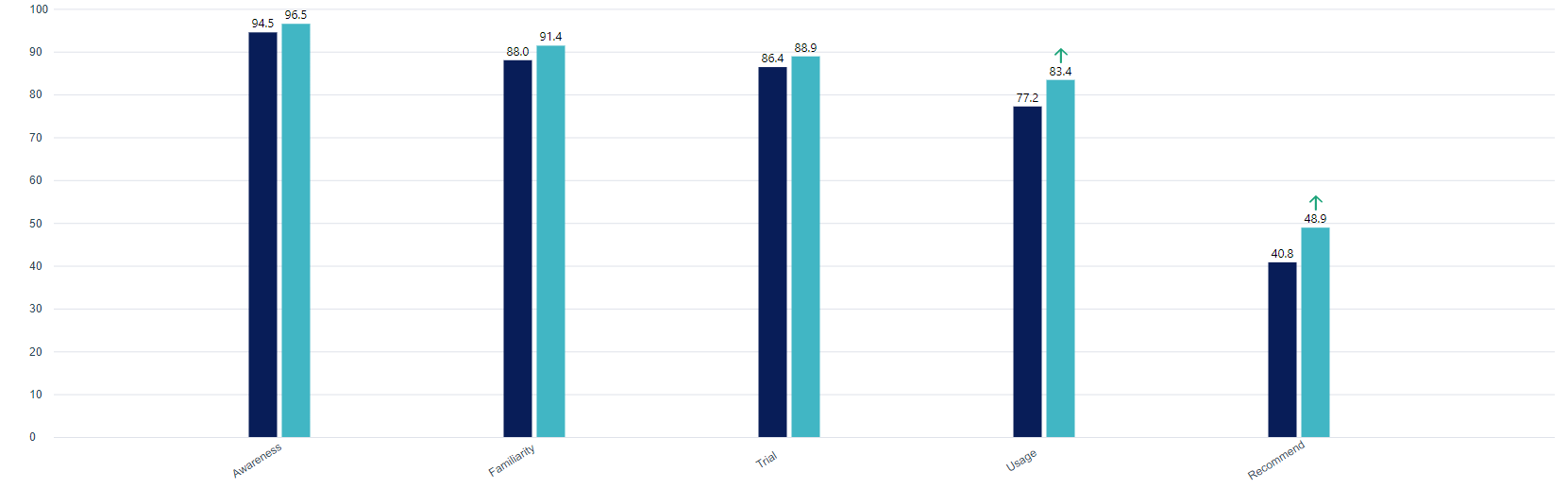

Similarly, we see a marked shift in Walmart’s sales conversion funnel. A sales conversion funnel tracks the consumer’s journey throughout the purchase process – from initial brand awareness through to product trial and usage. Eventually, the most satisfied customers make it to the final stage of recommendation.

In Q2, Millennials significantly more often report using (i.e. purchasing from) (+6.2) the Walmart brand and recommending (+8.1) it to others. This is a significant accomplishment for any retail business looking to expand its customer base.

Walmart’s Conversion Funnel Among Millennial Consumers – Q1 vs Q2 2024

QuestBrand. Base: Millennials. Pre: 1/1/24-3/31/24, n=436. Post: 4/1/24-6/30/24, n=271.

Overall, the strategic launch of Walmart’s private label brand has served to enhance Walmart’s brand perception among Millennial consumers, while maintaining its focus on providing high-quality, low-cost products. By staying attuned to consumer preferences and economic conditions, Walmart can look to drive growth and attract customers in an increasingly competitive retail landscape.

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Related Content