Brief • 2 min Read

1: Pedialyte: One Brand, Many Users – Case Study

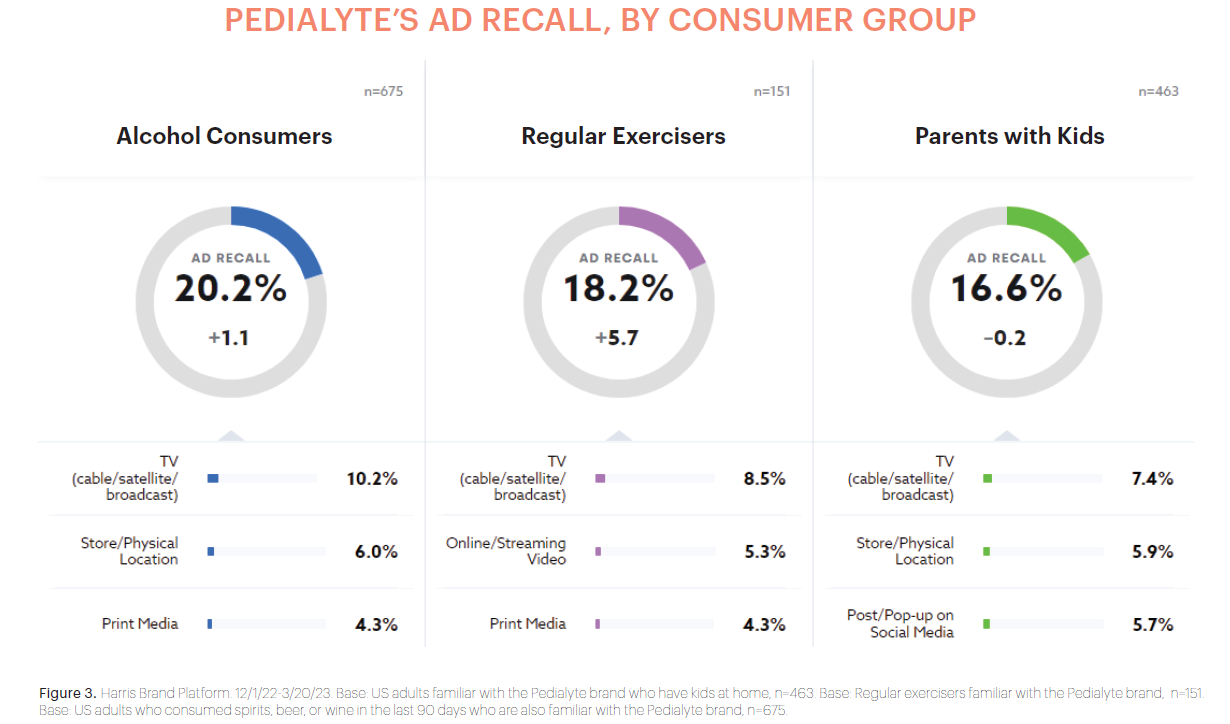

For more than 50 years, parents have trusted Pedialyte to rehydrate their sick children. More recently, Pedialyte has looked beyond children to serve dehydrated adults – travelers, alcohol drinkers, and exercise-enthusiasts. While unusual for a brand to simultaneously market to such distinct groups, it seems to be working (according to QuestBrand data).

- Previously, Pedialyte sales would rise during cold and flu season. Marketing to adults has steadied their sales throughout the calendar year.

- Now, adult consumers (buying Pedialyte for their own use) make up at least half of Pedialyte’s overall sales.

- Download the case study to learn how Pedialyte has successfully attracted these new types of buyers.

2: What Candies will the Easter Bunny Bring this Year?

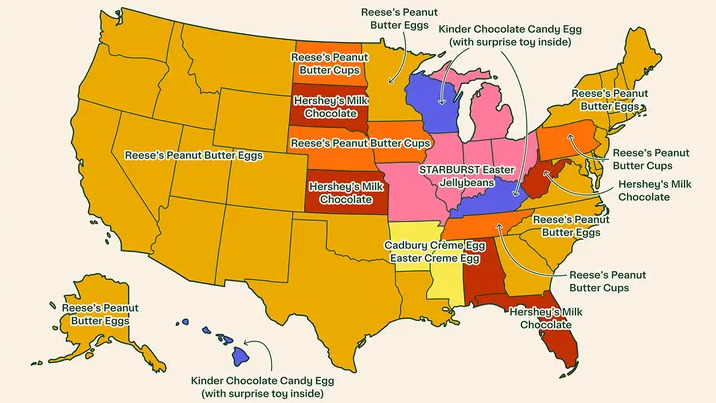

With Spring holidays quickly approaching, The Harris Poll conducted a survey on behalf of Instacart to reveal Americans’ favorite Easter candies and Passover foods.

- Of those who plan to celebrate Easter this year, a whopping 92% plan to buy candy.

- More than half of those buying candy plan to purchase jelly beans (51%), while slightly fewer (42%) plan to pick up marshmallow Peeps.

- Reece’s Peanut Butter Eggs are the number one selling candy in 29 states.

- Food is also an important component of the Passover celebration, with orders of matzah expected to increase +300%. Sales of lamb (+97%), matzo ball soup mix (+73%), gefilte fish (+58%), and brisket (+53%) will also see a holiday surge.

3: Should Brands Rethink their Super Bowl Advertising Strategies?

More than a month out from Super Bowl LVII, we’ve taken a step back to evaluate advertisers’ strengths and weaknesses to determine what creative strategies brands should bring to next year’s Big Game:

- Room for improvement. Little more than half (58%) of Super Bowl 2023 viewers were satisfied with this year’s ads.

- Give the people what they want. When Super Bowl viewers were asked what type of ads they want to see during next year’s game, half (49%) wanted more unique ads in 2024.

- Ads must go beyond the typical TV format. Forty-seven percent of Super Bowl LVII viewers used multiple devices to watch the game.

- Make it clear. Of viewers that had a favorite 2023 Super Bowl ad, only 14% noticed a call-to-action from the advertising brand.

You’ve gotten a sneak peak, now click to read all our Super Bowl ad insights.

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Related Content