Brief • 2 min Read

Earnings reports tell you what happened. Brand equity tells you what’s coming.

That’s why smart investors, brand leaders, and hedge funds are paying attention to real-time consumer sentiment—because when brand trust, preference, and momentum rise, stock performance often follows.

QuestBrand by The Harris Poll tracks thousands of brands globally, capturing these shifts before the market reacts. It’s why 78% of hedge funds now use alternative data (source)—because the best signals aren’t buried in spreadsheets. They’re unfolding in real time through shifting perceptions, behaviors, and choices.

And few brands proved this better than Celsius.

While Wall Street panicked over a stock crash, brand equity pointed to a different outcome. And when the numbers came in, Celsius rebounded—just like the data predicted.

1. QuestBrand Called Celsius’ Comeback Before Wall Street Did

In 2024, Celsius was in freefall.

- Stock Collapse: Shares plummeted from $96 in May 2024 to $21 by February 2025—a nearly 80% drop.

- PepsiCo Pulled Back Orders: Celsius’ largest distributor ordered over $100 million less product than expected, likely to optimize inventory levels—spooking investors into thinking demand was drying up.

But while Wall Street panicked, QuestBrand data signaled something else.

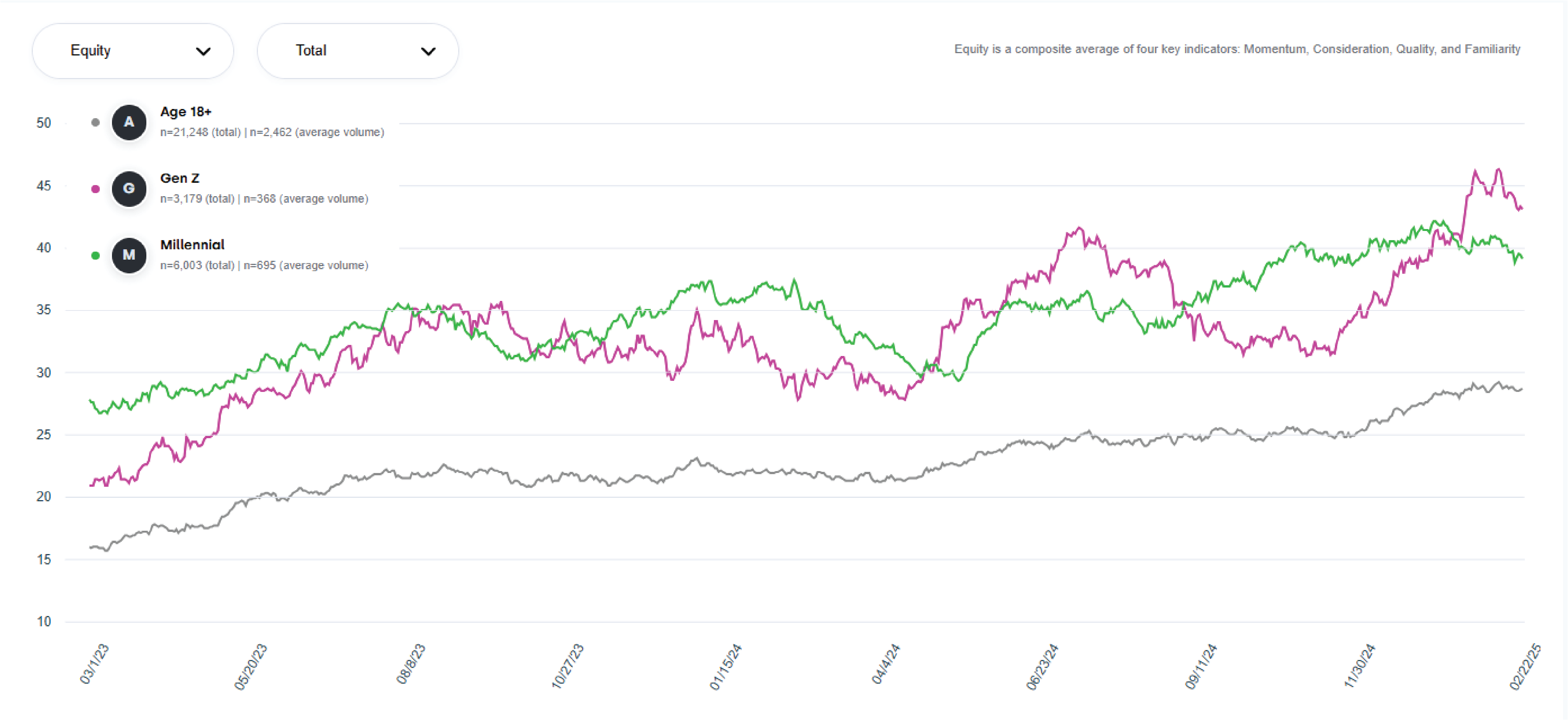

Even at its lowest point, Celsius’ brand equity was quietly climbing—a sign that consumers, especially Gen Z and Millennials, still believed in the brand.

- Gen Z brand equity surged from 20.9 to 43.9 (+110%) in two years.

- Millennials increased from 27.8 to 38.8 (+40%).

- Momentum scores spiked—an early indicator of a turnaround.

Celsius Brand Equity Data – Gen Z & Millennials – 12 Week Trended Average

QuestBrand. 3/1/23-2/23/25. Base: Gen Z (pink), n=3,179. Base: Millennials (green), n=6,003. Base: General population of US adults (gray), n=21,248.

Then came February 2025.

- Celsius exceeded Q4 expectations with $332.2M in revenue (14 cents per share), marking a 25% QoQ increase from $266M in Q3.

- The stock soared 36% overnight, confirming the momentum.

- Market share climbed to 11.8%, reinforcing its No. 3 energy drink status, while full-year 2024 revenue hit a record $1.36B despite a weak Q3.

Source: OpenAI, $CELH past 5 days as of 2/24/25, 2:50pm

And now, a major power move: Celsius’ acquisition of Alani Nu, a rapidly growing energy drink beloved by Gen Z and Millennial women, which just posted the 13th-highest Brand Equity growth in AdAge/QuestBrand’s Gen Z Tracker.

The importance of Gen Z and Millennials to Celsius’ growth strategy is undeniable. In 2023, CEO John Fieldly explicitly emphasized the company’s focus on the 18-to-24 age demographic, aligning with its broader strategy to build a stronghold among younger consumers (source).

This strategic alignment underscores why Celsius was never truly at risk—despite what its stock chart suggested.

2. Track the Wrong Audience, Get the Wrong Story

Brand equity isn’t just about whether people recognize a brand—it’s about who recognizes it, who trusts its quality, who considers it, and who believes in its momentum.

Tracking the wrong target group leads to inaccurate signals. But when data is calibrated correctly, brand equity becomes a powerful tool for forecasting market success.

Old Navy: Why Audience Calibration Matters

To ensure brand equity truly reflects business impact, it’s critical to align data with a brand’s specific target audience.

For instance, Old Navy’s customers are predominantly female, with women making up approximately 90% of its base (source). Additionally, Old Navy over-indexes among females A18-44.

If Old Navy tracked brand equity across the general population, the data would be diluted—failing to capture the real consumer sentiment that influences purchase behavior.

A targeted approach—focusing on females A18-44—provides a far more accurate picture of the brand’s trajectory, ensuring marketing, messaging, and product development align with who actually drives sales.

Celsius: A Case Study in Data-Driven Growth

The same principle applies to Celsius. Instead of chasing mass appeal, they focused on health-conscious Gen Z and Millennials—a strategy that fueled its rise.

- Precision Targeting: Rather than marketing to traditional energy drink consumers—who often skew male—Celsius tapped into a younger, fitness-oriented audience looking for a “clean” alternative (source).

- Inclusive Approach: While competitors leaned into hyper-masculine messaging, Celsius embraced gender-neutral communication, positioning itself as a brand for everyone (source).

- Cultural Momentum: A TikTok-powered wave of fitness and wellness influencers reshaped Celsius into a lifestyle brand (source).

And the numbers backed it up. QuestBrand data showed Celsius’ equity among Gen Z and Millennials was rising even as its stock price fell—an early signal that demand remained strong.

For investors, it proved the dip wasn’t a death sentence. For marketers, it showed that lasting impact starts with the right target market—it’s the long game.

3. Brand Equity Moves First—The Market Follows

Markets bet on the future. Brand equity reveals it.

Because consumer perception isn’t just a reflection of today—it’s a leading indicator of what’s next.

Consider Amazon and Walmart. Amazon has long outperformed its competitor in consumer perception.

- In the past five years, Amazon maintained a commanding lead in brand equity, with an average score of 78 compared to Walmart’s 68.

- Shoppers see Amazon as more innovative, seamless, and indispensable—ranking the brand higher on Consideration and Quality.

That perception translated to market value long before revenue did.

- Amazon’s market cap surpassed Walmart’s nearly a decade ago.

- Walmart still pulled in more revenue—until February 2025, when Amazon finally overtook it.

- Investors bet on Amazon’s brand equity early. Market cap moved first, revenue followed years later.

Now, investors are making a similar bet on T-Mobile over AT&T.

For years, T-Mobile was the scrappy underdog—the budget carrier. It always led AT&T in value perception but trailed in Quality and Consideration.

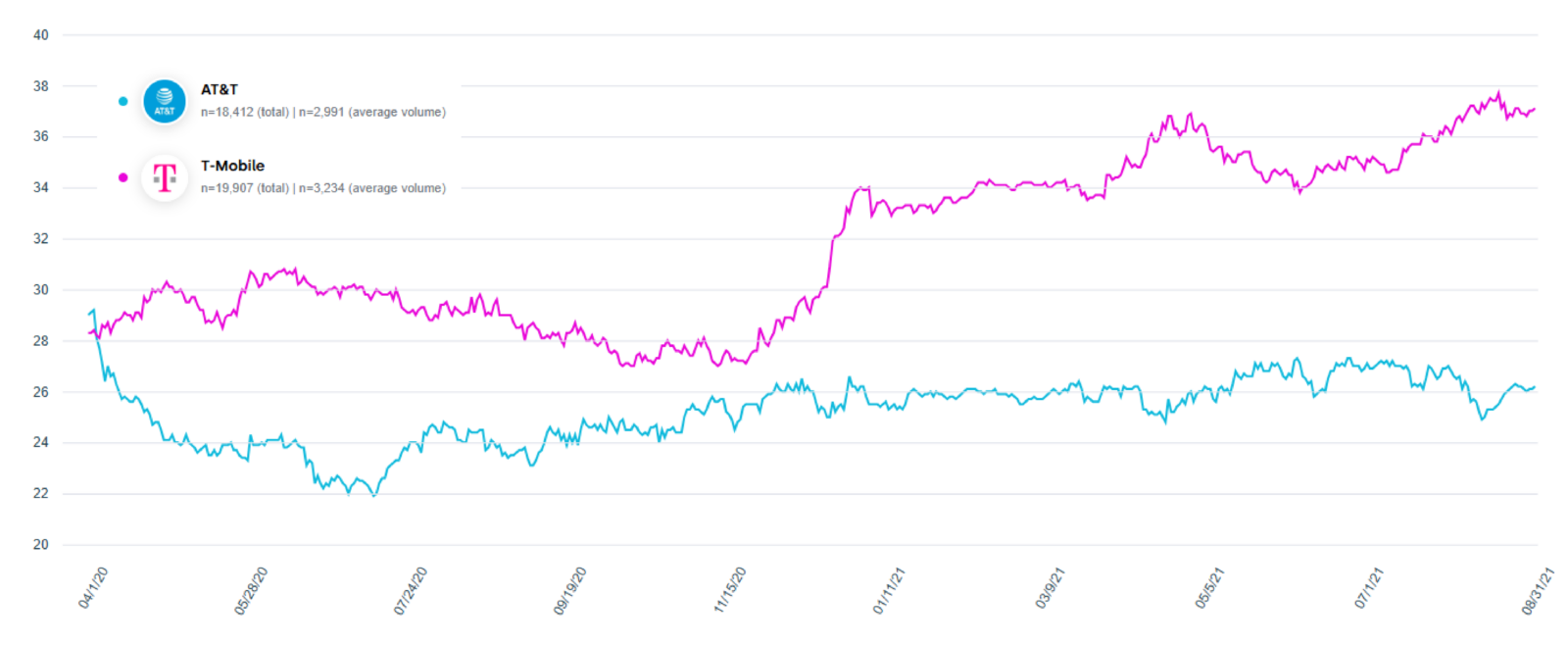

That changed in 2020.

- After its Sprint merger closed on April 1, 2020, T-Mobile’s Momentum score took off—and never looked back. Momentum reflects the percentage of respondents who agree the brand is headed in the right direction.

AT&T and T-Mobile Positive Brand Momentum – 12 Week Trended Average

QuestBrand. 4/1/20-8/31/21. Base: AT&T, n=18,412. Base: T-Mobile, n=3,234.

- Consumers no longer saw T-Mobile only as the “cheap” option—it started to close the gap in Quality and Consideration.

That shift in brand equity is now baked into market value.

- By 2023, AT&T’s stock hit a 30-year low.

- T-Mobile’s stock? Record highs—every single year since.

- Its market cap now stands at $309 billion—60% higher than AT&T’s $193 billion.

- Yet, AT&T’s Q3 2024 revenue was nearly 50% higher than T-Mobile’s.

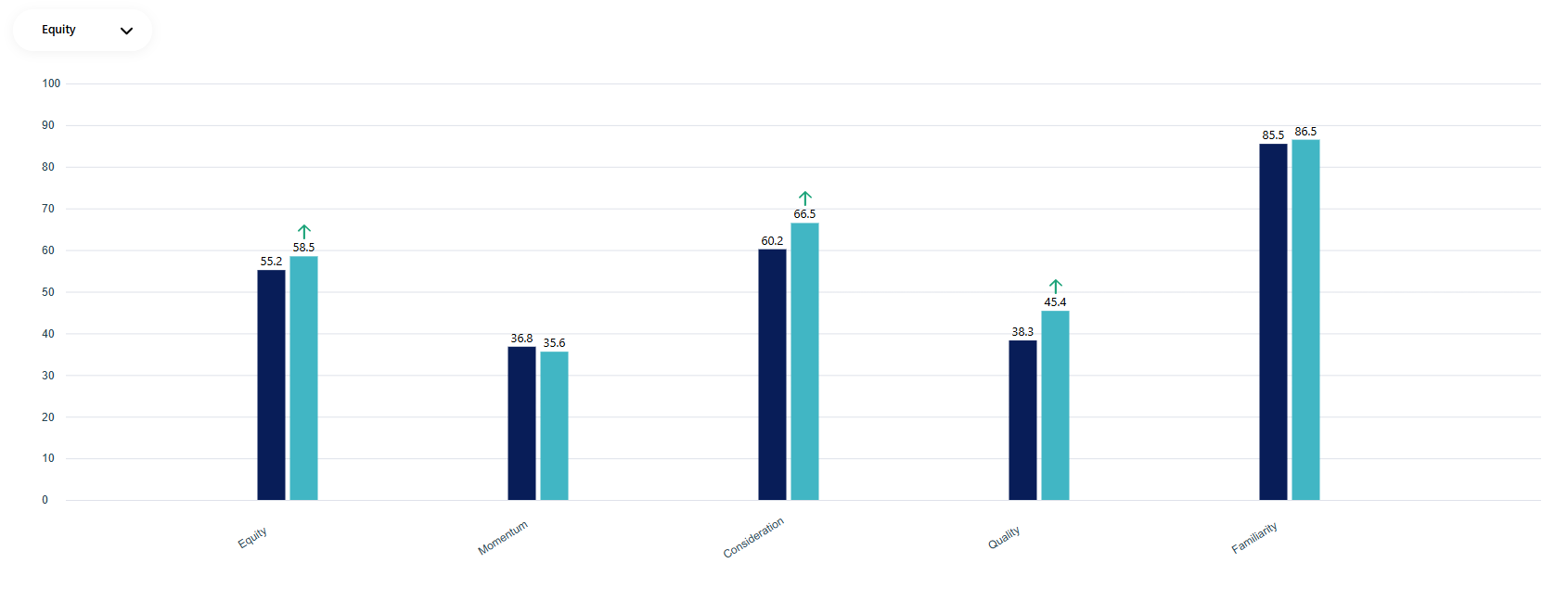

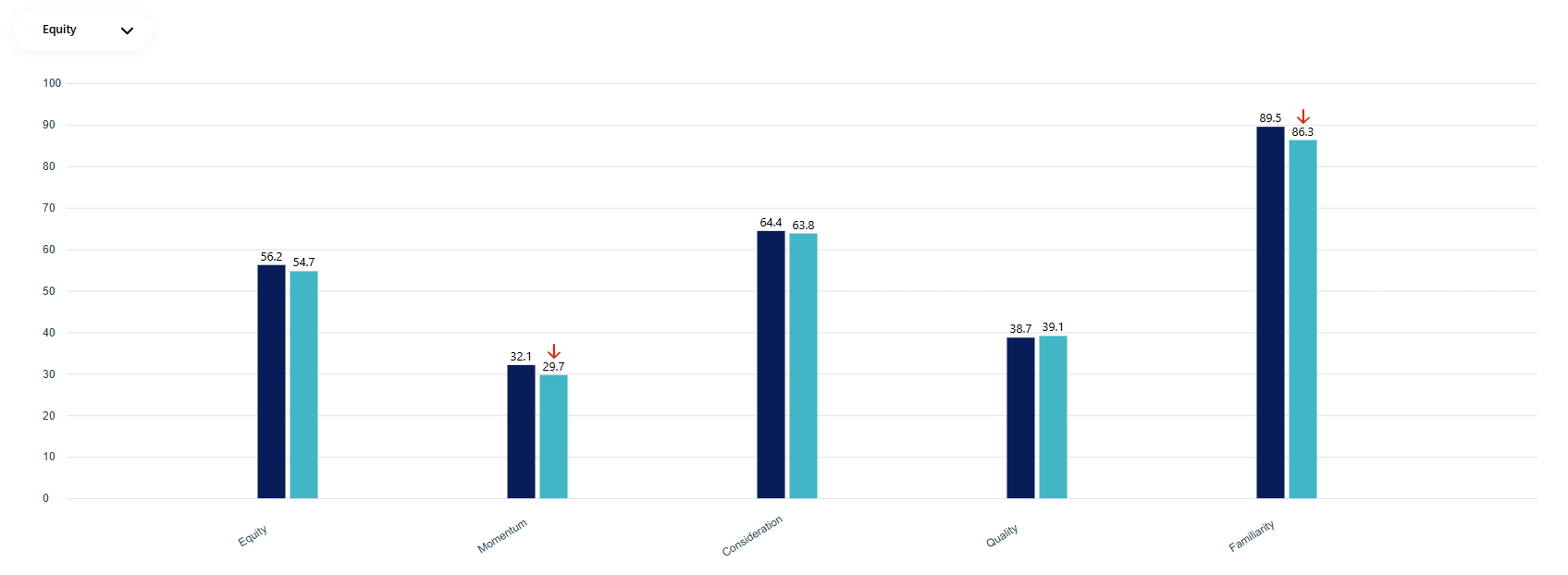

2024 v. 2020-21 Brand Equity Data – T-Mobile & AT&T (Gen Z /Millennials)

T-Mobile

QuestBrand. Base: Gen Z + Millennials. Pre: 1/1/20-12/31/21, n=11,110. Post: 1/1/24-12/31/24, n=2,744.

AT&T

QuestBrand. Base: Gen Z + Millennials. Pre: 1/1/20-12/31/21, n=9,763. Post: 1/1/24-12/31/24, n=2,486.

Past 5 Year Stock Trend (ending 2/21/25) – T-Mobile & AT&T

T-Mobile

Source: OpenAI, $TMUS past 5 years as of 2/24/25, 2:50pm

AT&T

Source: OpenAI, $T past 5 years as of 2/24/25, 2:50pm

Just like Amazon before it, T-Mobile’s brand equity pointed to where the market was headed.

Brand equity doesn’t just mirror the present—it signals the future.

4. Brand Equity Isn’t Just a Signal—It’s Your Growth Catalyst

Stock prices react to earnings. Brand equity moves before the numbers do.

When Momentum scores rise in QuestBrand, sales often follow. Celsius’ stock surge proved it in real time.

The smartest companies don’t wait for lagging indicators. They act early—doubling down on high-performing segments, launching new products, or making bold acquisitions like Celsius’ Alani Nu deal.

And it’s not just investors paying attention.

Marketers are in the same game—betting big on brand perception. But how many are measuring whether it’s actually working?

- Up to 60% of digital ad budgets vanish into inefficiencies—bad targeting, ineffective creative, or placements no one even sees (source). It’s like buying a Ferrari but ignoring the maintenance.

What’s the point of investing if you have no idea whether it’s working?

Marketing isn’t just about spending—it’s about shaping perception. If you’re not tracking how your brand is landing with consumers, you’re making million-dollar bets in the dark.

The market moves late. Consumers move first. Brand equity sees what’s coming.

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Related Content