Brief • 4 min Read

Good morning. In Wave 9 of The Harris Poll COVID-19 Tracker fielded April 25-26, 2020, states begin to reopen as global coronavirus cases top 3 million people.

Our team has curated key insights to help you navigate the coronavirus. Full survey results and business implications can be found at The Harris Poll COVID-19 Portal. We will continue to actively field and provide insights on a regular cadence to keep you informed of the shifts in sentiment and behaviors as the news and guidelines evolve.

Safety as a Customer Journey

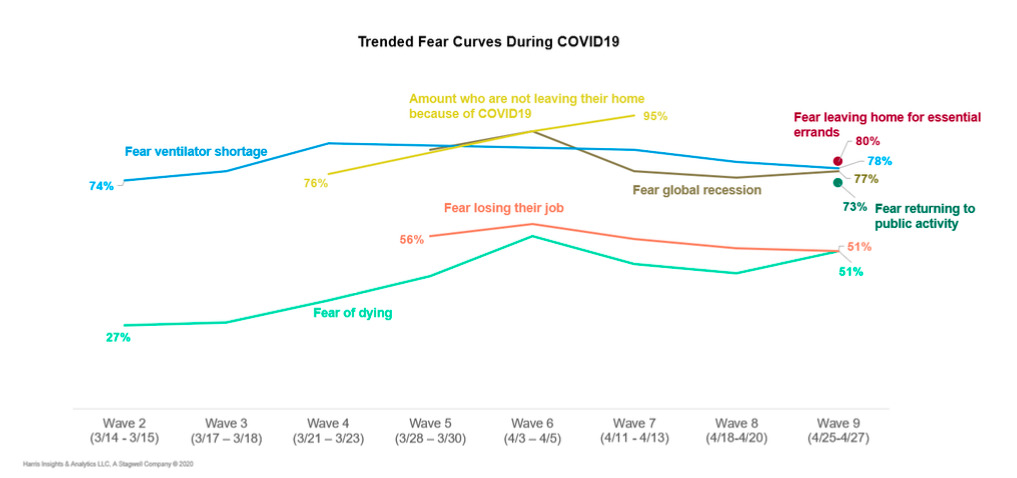

Add a fifth ‘P’ to the fundamentals of marketing: Product, Price, Promotion, Place and Purell. As this chart shows, Americans are housebound until businesses have a plan to protect them. We liken this to a customer journey that has hygiene as the basis for all commercial transactions, be it flying on a plane, going to a business conference, or shopping in a store:

- Eight in ten Americans (80%) are still concerned of their risk of being exposed to coronavirus when leaving home for errands (84% women; 76% men) and (69%) worry they’ll accidentally expose others (72% parents; 65% non-parents).

- Almost three-quarters (73%) of Americans worry about future public activities such as public transit or socializing (77% women; 70% men); or (68%) going to bars, restaurants, hairdressers, etc. Two-thirds (66%) of parents are concerned their kids will be exposed if sent back to school, causing many districts to cancel in-person classes for the remainder of the school year. Taking a flight (66%) is also a concern as is even going back to the office (63%).

- Given this, the business community remains more bearish than some lawmakers on reopening: As states push to re-open, business leaders say not so fast.

- Who’s re-thinking their safety customer journey? In the farm-to-table hygiene movement, Airbnb will make property owners wait 24 hours between guests.

- One prediction: safety will soon be ‘branded’ at its source of origin like a bottle of Evian: Australia is training veterinarians to be pet detectives to spot future pandemics.

- Dining out remains the thing Americans miss most (70% miss a lot/somewhat) but will need reassurance that it’s safe, such as reconfiguring layouts for social distancing (62%). As the NYT reports, many restaurants are trying.

- A sobering statistic: The coronavirus has killed more Americans than the Vietnam War

Takeaway: Industries whose products and services interact on the customer’s journey must work together to provide a ‘blockchain effect’ of hygiene. For instance, hotels may lose bookings if travelers think planes aren’t safe. Or, produce sellers may suffer if restaurants can’t be seen as in control of their food supply. Frenemies, enemies and adjacent partners all need to work together, sharing data and mapping journeys that reassure and provide peace of mind.

Prepping For The Test

Experts at The Rockefeller Foundation believe the U.S. needs to triple its amount of testing in the coming weeks from 1 million to 3 million a week and 30 million in the next six months. Testing is key for public confidence but unfortunately, we are not there yet: Currently, the U.S. has tested about 1.6% of the population. The public agrees: Two-thirds (66%) say proper testing in place must happen before Americans can return to work, while (80%) are concerned about shortages of testing kits for COVID-19.

- This challenge is not a technology problem: “It’s a coordination and logistics challenge, period. And perhaps the most frustrating thing of all is that we did not have to wait for an invention or a reinvention of any of anything”, RF researchers say.

- In fact, Americans see tech as a potential savior. In our polling for Politico, (38%) of Americans said their view of the tech industry has turned “more positive” since coronavirus arrived, compared to (8% this wave) who said it’s now “more negative.” Also, (41%) believe the tech industry should help solve the outbreak, and (81%) approve of large tech firms specifically helping to trace coronavirus cases.

- And the public is willing to help: our poll found (71%) are willing to share their own location data and receive alerts about possible exposure to the virus. A public registry of COVID-19 cases is also popular: (65%) favored some kind of database that would show if their neighbors tested positive for the virus.

Takeaway: As we’ve shown over the past several waves of data, America’s pessimistic expectations about returning to restaurants, sporting events, flights and hotels collide with their desire to do so. But without testing, there’s no peace of mind to resume normal activities. As States and Federal governments haggle, business must expand testing through employee programs, funding to accelerate production, or even making approved kits and other forms of coordinated outreach. How can your company help America pass the test?

You Must Try the Dr. Jekyll Diet

It looks like the health kick is here to stay, but so is the red wine, chocolate, and Oreos: As tensions continue to rise, our fear of transmission when leaving the house is matched with growing cabin fever when sheltering at home, consumers are shopping to nurture the body and soul: a shopping cart balanced by health foods to protect immunity and indulgent foods to protect our sanity and emotional wellbeing.

- Four in ten Americans (42%) are consuming more fresh food and among them, (63%) plan on increasing or (34%) maintaining their consumption; only (3%) plan on less kale.

- And nearly 7 in 10 (66%) are eating more home-cooked meals; of them (91%) plan on increasing (51%) or eating the same number of meals (40%).

- Use of foods for fortification is a trend: A quarter are drinking more orange juice (24%), and of that group (90%) either plan on increasing (51%) or drinking the same amount (39%).

- Yet (23%) are drinking more alcohol since C19, and among them (35%) say they will drink the same or more (37%); only (28%) will drink less. Also, (42%) are eating more snack foods and of that group (38%) plan on eating the same or more (28%). Candy and soft drinks follow roughly the same pattern.

- Why is this polarized diet happening? A combination of stress and gratitude: (37%) feel overwhelmed trying to balance work at home and other needs of their family, (52%) feel grateful to be home with family, while (55%) have cabin fever.

- P.S. speaking of drinking, for your Zoom virtual happy hour try this conversation-starter: Did you know the Romans invented recycling?

Takeaway: Looking out on the remainder of the year filled with uncertainty of ‘returning to normal’, the one thing we can control is what we eat and how we live at home, consumers are shopping to create a sense of balance we lack in the outside world. As businesses think of the underlying turbulence in people’s lives today and how your brand might be the perfect counterbalance to what they’re feeling. Right now everything seems one part virtue, one part vice.

Clean House, Dirty Hair

Either their housekeeper is in quarantine or the entire family under one roof 24/7 (or both), Americans

are cleaning the house more at the expense of their own personal appearance. Uncertainty about the new normal in our future means pandemic-prepping the household over priming our looks for the grand re- opening.

- Americans are using cleaning products more than 10x/week: Surface cleaners 7x/wk and floor cleaners 3.5x/wk vs. shampoo 4x/wk vs. razors 2.5x/wk and makeup 2x/wk. And they say they plan on using more or the same amount of cleaning products (90%) surface cleaners (83%), floor cleaners (90%) and appliances like their dishwasher (85%).

- Parents are twice as likely as non-parents to keep the dishwasher running and almost nine in ten Americans (88%) are using the washer/dryer now and will use it more or the same (on avg. 3.3x/week).

And with all the home meals, (88%) say they will use their cooking appliances more or the same in the future (on avg. 8.6x/wk). - While (26%) of women and (31%) of Gen Z/Millennials are buying less makeup, (36%) of women plan on using more when they can get out of the house.

- The same goes for shampoo: (92%) plan on using more or the same and on average are using 4x/week. And thankfully (22%) say they will use more deodorant (current using average 5.8/wk; women are using more deodorant than men 6.3 vs 5.3 times per wk.)

- Shave the beard: (87%) plan on using razors or the same and on average 2.5x/wk.

- Zoom vs. Staples: (20%) plan on using fewer office supplies vs (17%) who plan on using more.

- And did you know there’s a right way to sweep a floor?

Takeaway: Which behaviors will snap back? Dislocations cause reappraisal of preferences as routines get upended. But research your categories carefully to parse today’s usage from tomorrow’s desire. And anticipate future interruptions and a consumer who is blended in and out of house more than before. Products may surge and wane based on in and out of home time spent. But in a battle of the inside vs. the outside, the house is certainly taking market share.

The Grocery Wars

As Grocery stores and food delivery services battle for the supermarket basket, both have faced supply chain disruptions that have frustrated their customers. Here’s where Americans are right now on the tug-a-war in aisle four:

- Buying groceries: (45%) of Americans are spending more on groceries than were before COVID19, esp. Parents, adults 35-49, and Urbanites. Most are spending $100/week on groceries; Most of Gen Z/Millennials are spending $125/week vs $120 35-49; $100 50-64; $100 65+.

- Spending more: (51%) of adults ages 35-49 and (48%) of 18-34 are spending more than they were before covid19 vs (40%) of 50-64 and (39%) of 65+. Also, (51%) of Urbanites are spending more than they were before covid19 vs 45% of Suburban and (36%) of Rural; (49%) of parents are spending more than they were before covid19 vs (40%) of non-parents.

- Will grocery shoppers come back? (58%) of Americans say they are more likely to buy groceries in store right now and (70%) are more likely to do so post COVID19.

- And a large number will mix in delivery and in-store pickup: (43%) say they are more likely to order online and pick up in-store now and (36%) are more likely to do so post COVID19. Also, (43%) are more likely to order groceries online through the retailer and have them delivered to their home right now and (33%) are more likely to do so post COVID19.

- Fewer see a pure online grocery future: While a considerable number (37%) are more likely to order groceries through a delivery service (e.g., Instacart, Postmates) right now and (29%) are more likely to do so post COVID19, but these numbers trail the interaction with their traditional grocer. Other Harris data shows online grocery more preferable for staples and non-perishables.

- Still, fewer are into home meal kits: (29%) are more likely to buy meal kits and having them sent to my home right now, and 25% are more likely to do so post COVID19.

Takeaway: Americans love shopping in grocery stores and they’ve done so throughout the crisis. At this moment there seems to be a combination of in-store shopping (experience/control) mixed with pick-up and/or delivery (convenience/safety). Amazon, Fresh Direct, and Instacart should be highlighting their inherent safety benefits and ask consumers in today’s age, is grocery shopping an essential task?

The COVID Reputational Rankings

Companies have the opportunity to reinvent themselves and there’s no better time than a crisis to change habits as our data shows in USA TODAY shows, with the abrupt shift in opinions on the tech industry as online services have become essential to daily life for people working and sheltering at home; positing for stakeholder capitalism that even ‘bad’ companies can become good. Is the tech industry the next hero to the rescue?

- Big Tech’s Admirable Pandemic Response: Three-fifths (59%) say the tech industry has had a good response to the pandemic trailing only (76%) healthcare (doctors/nurses/hospitals), (74%) grocery, (67%) food and beverage, and (66%) restaurants.

- TECH TO THE RESCUE: 41% think technology companies should provide solutions during the coronavirus (third only to the experts in healthcare (62%) and pharma 57%), and 81% approve of large technology companies helping to trace coronavirus cases

- Big tech is freed from the data privacy bias that used to hold their reputation

captive: 73% are comfortable sharing anonymous location data in the interest of fighting the pandemic. Four in 10 (38%) Americans say their view of the tech industry has become more positive since the start of the pandemic. - Capitalizing in a crisis is the worst thing Americans think you can do: (27%) think companies who create advertisements about COVID-19 are just doing it for publicity, and most of them feel contrived/forced. The L.A. Lakers join the long list of faux-small companies returning their SBA coronavirus loans.

Takeaway: Some industry reputational issues seemed entrenched and unmovable before the crisis. But as the pandemic shows, the public can change its mind. There’s no better time than a crisis to change habits. What can your firm do to be ‘essential’ to society? Americans are willing to bury the hatchet so come and meet them halfway.

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Download the Data

This survey was fielded online among a nationally representative sample of 2,050 U.S adults from April 25-27, 2020.

Download

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Download the Data

This survey was fielded online among a nationally representative sample of 2,050 U.S adults from April 25-27, 2020.

DownloadRelated Content