Brief • 5 min Read

In The Harris Poll Tracker (Week 120) fielded from June 10th to 12th, 2022 among 2,018 U.S. adults, we found that a cautious concern may be growing regarding the pandemic with (71%) of Americans fearing a health care shortage (+3%-pts from last week), a new variant (66%, +2%-pts), and losing their job because of the pandemic (51%, +5%-pts).

Check out our America This Week: From The Harris Poll podcast on Spotify and Apple Podcasts for data-driven discussions between our CEO John Gerzema and CSO Libby Rodney. They’ll be covering the latest trends in society, the economy, and the consumer marketplace.

As a public service, our team has curated key insights to help leaders navigate COVID-19. Full survey results, tables, and weekly summaries can be accessed for free at The Harris Poll COVID-19 Portal. We will continue to actively field on a regular cadence to track the shifts in sentiment and behaviors as the news and guidelines evolve.

Consumers Changing Eating, Shopping Habits As Inflation Pushes Up Prices: Alpha Foods-Harris Poll

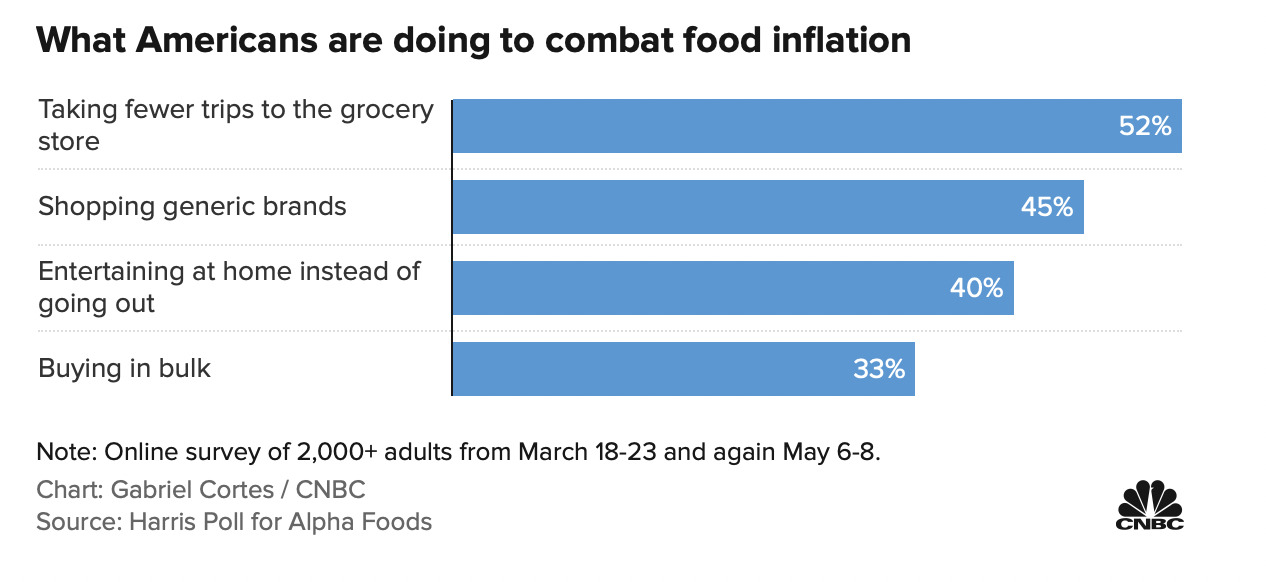

In partnership with Alpha Foods, as covered by CNBC, we found that the highest inflation in roughly 40 years is prompting people to shift their shopping habits, especially at the grocery store.

- About (90%) of Americans are concerned about food prices, and according to Harris Poll managing director Abbey Lunney, “groceries have become the No. 1 concern for Americans.”

- Americans are getting creative to combat prices: More than half (55%) say that rising meat prices have made them more curious about plant-based food and dairy options, as well as taking fewer trips (52%) and shopping for generic brands (45%).

Takeaway: Back in April, we found in partnership with Bloomberg, that Americans were recasting their relationship with money in midst of rising inflation, and this latest survey details how consumers are continuing to get increasingly creative in their purchases.

PURPOSE Under Pressure – Employees Have Spoken: Carole Cone ON PURPOSE-Allison+ Partners-Harris Poll

In our latest report, PURPOSE Under Pressure in partnership with Carole Cone ON PURPOSE and Allison+ Partners, we found that business professionals are seeking greater purpose out of their work now than in previous times.

- Almost all (91%) employees say a company’s purpose makes them feel they are in the right place as they weather ongoing challenges, such as the pandemic and economic risk.

- (88%) believe companies focused on purpose will be more successful compared with those that are not.

- (86%) say having “meaning” in their work is more important than ever before – and (84%) even say they would only work at purpose-driven companies and brands.

Takeaway: “Now more than ever, purpose is a critical corporate asset. Our findings make clear the pivotal role purpose plays in the attraction/retention ecosystem companies are navigating today,” said Wendy Salomon, managing director at The Harris Poll. “Companies are well-served to better activate purpose across functional areas and at all levels of the org chart.”

Study Highlights Differences In Perception Of Health Care Delivery By Race and Ethnicity: Healio-Harris Poll

In partnership with the American Thoracic Society International Conference, as covered by Healio, our data highlighted a health equity gap in care delivery between Black and Hispanic patients with white ones who were hospitalized with COVID-19 between May to June 2021.

- While (86%) of the patients report overall satisfaction with their healthcare delivery, Black patients were 2.5 times more likely to mention issues related to bedside manners such as health providers lacking sympathy (Black: 20% v. white: 8%).

- Black patients were also more than five times more likely than white patients to describe their healthcare team as careless (11% v. 2%, respectively).

- For Hispanic patients, they were 2.5 times more likely to describe their health team as aggressive (10% v. white: 4%).

Takeaway: These findings add to the “important growing understanding of ethnicity as its own variable,” Thomas F. Oppelt, PharmD, senior medical director of U.S. medical affairs at Gilead Sciences, told Healio. “So extra care needs to be taken to understand their perspective throughout the entire treatment paradigm.”

Electronics & Gaming: An Industry Snapshot

Check out the latest way we used our Harris Brand Platform data to report on the state of the electronics and gaming industry

- Half (49%) of younger, video game-playing consumers (18-34) play video games more now than they did before the COVID-19 pandemic.

- What do they want? (47%) of younger, video game-playing consumers are most interested in seeing partnerships between the entertainment and gaming industries – and (47%) prefer shopping with non-gaming brands that do video game partnerships.

- Take notes on Apple, Microsoft, and Sony as they lead electronic brands by brand equity scores, and Nintendo (+4.7) and SimpliSafe (+2.4) who had the highest brand equity growth between Q4 2021 and Q1 2022.

Takeaway: Electronics companies and marketers must remain on top of current trends and desires to get ahead of consumer interests and expectations – especially when it relates to their younger consumers.

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Download the Data

This survey was conducted online within the U.S. by The Harris Poll from June 10th to 12th, among a nationally representative sample of 2,018 U.S. adults.

Download

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Download the Data

This survey was conducted online within the U.S. by The Harris Poll from June 10th to 12th, among a nationally representative sample of 2,018 U.S. adults.

DownloadRelated Content